Four in 10 investors believe ‘say on pay’ vote has no influence

Post on: 4 Июль, 2015 No Comment

EricGarcia

Bloomberg News

Many shareholders are dissatisfied with disclosures about CEO pay, a Stanford study finds.

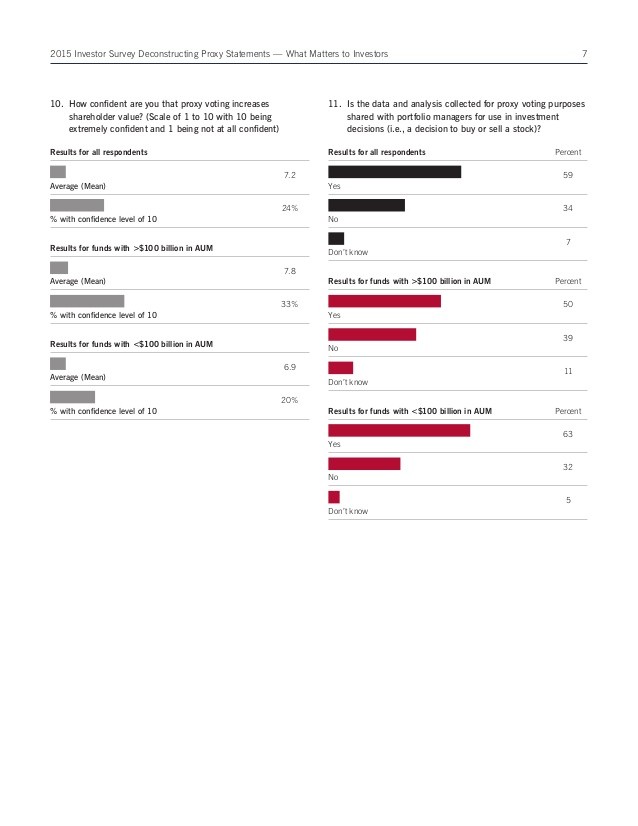

WASHINGTON (MarketWatch) — More than four in 10 institutional investors say their “say on pay” vote doesn’t end up influencing how company executives are paid, according to a new study from Stanford Graduate School of Business.

Perhaps equally worrisome for small investors, who rely on money managers to represent their interests, just one in four of those professionals said they understand the way executives will receive payouts under long-term performance plans.

The findings come after the Securities and Exchange Commission in 2011 began requiring nonbinding shareholders vote on executive compensation at least once every three years, under the Dodd-Frank financial reform law.

While shareholders can’t force a change, some votes have had an effect. At Oracle Corp. ORCL, +1.83% where such pay votes have gone against the company for three straight years, stock awards were reduced for some top executives. including then-Chief Executive Larry Ellison, after the second vote.

The Stanford study, of 64 asset managers and owners with a combined $17 trillion in assets, found broad dissatisfaction among investors regarding executive pay and how it is disclosed. Only 21% believe CEO pay at companies whose shares they own are tied to performance, despite claims to the contrary by companies.

And investors appeared to be pleading for clear English in proxy statements. Nearly half say they are too difficult to understand, and 55% complain they are too long. Not that they read all of them anyway: the investors admit to reading only 32% of a typical proxy statement, on average.

There were also some apparent contradictions in the survey. Fewer than four in 10 said those statements clearly and effectively disclose executive compensation, and nearly two-thirds described the relationship between risk and compensation as “not at all” clear. Yet 54% said proxy statements allow them to make informed votes on executive pay.

The study was done by the Corporate Governance Research Initiative at Stanford together with RR Donnelley, a strategic communications company, and Equilar, which provides information on executive compensation.

Ron Schneider, director of corporate governance at RR Donnelley, said the survey is a way for companies to listen to investors.

“This was meant to be an engagement-by-survey,’ Schneider said. “It’s not a replacement for companies talking directly.”

Investors have long grumbled about executive pay, and this study found only 21% of those surveyed consider CEO compensation at companies in their portfolios is appropriate in size and structure.

Meanwhile, another study, released last year, showed that “say on pay” votes only alter the structure of CEO pay. When a CEO’s pay is up for a vote, salary tends to go down and stock options tend to increase, according to the study by professors at the University of Illinois-Urbana Champaign and the University of Missouri at Columbia.