Four Factors to Consider When Investing in the Corporate Bond Market

Post on: 9 Июль, 2015 No Comment

Four Factors to Consider When Investing in the Corporate Bond Market

The corporate fixed income market makes up a large part of the total fixed income market andbecause of its attractive yields, marketability, and diversityshould be considered for portfolios needing fixed income investments. Currently, there are over 7,000 corporate issues in the combined Merrill Lynch Investment Grade Index (COAO) and the US High Yield Master ll Index (HOAO), with over 4,000 rated between B and BBBthe range of bonds that, according to our investment approach, can provide balance in a portfolio to help meet clients income needs while preserving their capital.

But with this many options available, how do you decide what bonds are best for you? Each option involves a trade-off between risk and reward, and what you ultimately decide should align with your individual goals and overarching portfolio objectives. Before jumping into corporate bonds, investors should evaluate their options based on four primary factors.

Credit Quality

Both Standard & Poors and Moodys use a similar bond rating scale (D to AAA for the former and D to Aaa for the latter), which reflects an evaluation of a companys risk of default based on its overall financial condition. Typically, the higher-rated bonds have lower risk and lower returns.

The decision of where to invest is heavily dependent on your personal financial goals, the amount of risk thats right for you, and your income needs. As an example of a prudent approach, weve highlighted one fixed income allocation below in the credit category chart that includes roughly 70 percent investment-grade bonds (those rated over BBB-) and 30 percent high-yield bonds (BBB+).

Interest Rates

During the debt crisis of 2008, one Standard & Poors A-rated (or investment grade) bond may have had a yield of 6.5 percent on a five-year note. But today that same A-rated bond may have a yield of only 1.57 percent. For a bond such as this, the credit rating remains the same, yet there is an interest rate decline of 4.93 percent because of market changes. On the other hand, high-yield bonds, which tend to be rated in the B range, often maintain interest rates around 5 percent, and they currently provide more income and credit risk than the investment-grade bonds with higher credit ratings. This increased credit risk on high-yield bonds requires a cautious approach before being adding to a portfolio.

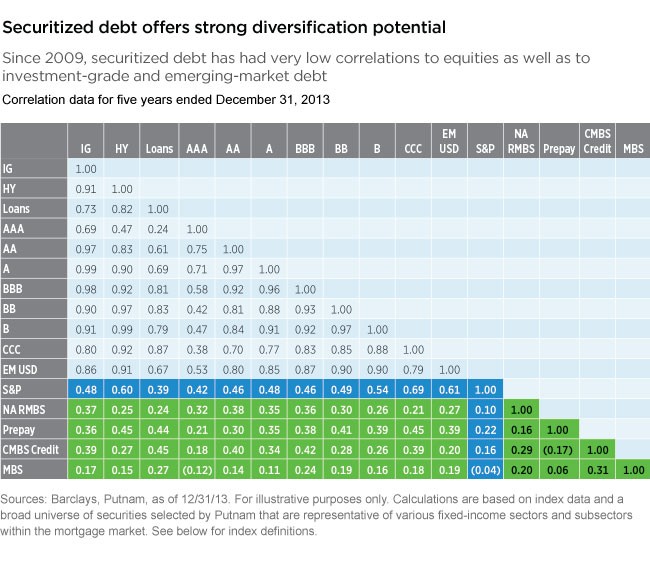

Diversification

Diversification is a common phrase and approach to investing that many investors adhere to. And while you may think that just adding bonds to your investment portfolio will be sufficient, we believe its important to seek diversification in the bonds you purchase.

For starters, you might consider choosing corporate bonds from several industries, such as banking and finance, consumer goods, services, manufacturing, energy, telecom, health care, and utilities. A mix of these can help protect your assets from an unpredictable downturn that may hit a particular industry. This is especially important with bonds, since the goal of this part of your portfolio is maintaining your current and future income streams.

Another way to achieve diversification with your corporate bonds is to choose a range with laddered maturities. A nice range may have maturity dates ranging from 2014 to 2023, as weve shown in the maturity schedule chart below. This would equal an average maturity of six years and three months per bond with an average duration of just over five years.

The timing of these maturities is especially important when considering your goals. Are you planning a new business acquisition in your five-year plan? Will you need cash flow in 10 years to ensure a smooth transition to retirement? Taking your personal goals into consideration is imperative when planning out your strategy.

Position Sizing

Position sizing is the amount of money that should be allocated to each bond compared to the whole portfolio. Depending on the type of portfolio you have, bonds representing between 2 and 5 percent of the whole may be sensible in helping to meet your goals.

As an example, in a corporate bond portfolio of $1 million with a 70/30 split between investment-grade and high-yield bonds, each of your investment-grade bonds could be worth between $40,000 and $50,000, and those below investment grade could be allocated at $20,000 each.

In a laddered portfolio of individual bonds, credit risk needs to be managed, and position sizing helps limit this risk.

The Bottom Line

In this fixed income market, investors have no choice but to take on some level of risk to obtain a moderate level of return. We generally favor credit risk over duration risk, and we implement controls and strategies in an effort to mitigate these risks for our clients.

Using the risk controls described above, we may create a portfolio similar to the one above, using 70 percent investment-grade bonds and 30 percent high-yield bonds to achieve an average credit rating in the BBB range. Our goal with this type of portfolio would be to achieve a yield range of approximately 4.6 percent and an average yield to maturity of approximately 3.5 percent.

Were Here to Help

If youd like more information about corporate bonds or to discuss your strategy, contact your Moss Adams wealth advisor.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and it should not be assumed that future performance of any specific investment or investment strategy (including the investments or investment strategies recommended or undertaken by Moss Adams Wealth Advisors) will be profitable. Past performance is not guarantee of future results. Diversification neither guarantees a profit nor prevents a loss. Bond investors should carefully consider risks such as interest rate risk, credit risk, securities lending, repurchase, and reverse repurchase transaction risk. Greater risk is inherent in portfolios that invest primarily in high yield bonds. They are subject to additional risks, such as limited liquidity and increased volatility. A copy of the current written disclosure statement discussing our advisory services and fees is also available upon request.

Take This Article to Go

Articles, videos, and other Moss Adams resources are also available on your mobile device. Get the free app for iOS and Android: www.mossadams.com/app

The material appearing in this communication is for informational purposes only and should not be construed as legal, accounting, or tax advice or opinion provided by Moss Adams LLP. This information is not intended to create, and receipt does not constitute, a legal relationship, including, but not limited to, an accountant-client relationship. Although these materials have been prepared by professionals, the user should not substitute these materials for professional services, and should seek advice from an independent advisor before acting on any information presented. Moss Adams LLP assumes no obligation to provide notification of changes in tax laws or other factors that could affect the information provided.