Forex Trading Daily Outlook

Post on: 9 Июнь, 2015 No Comment

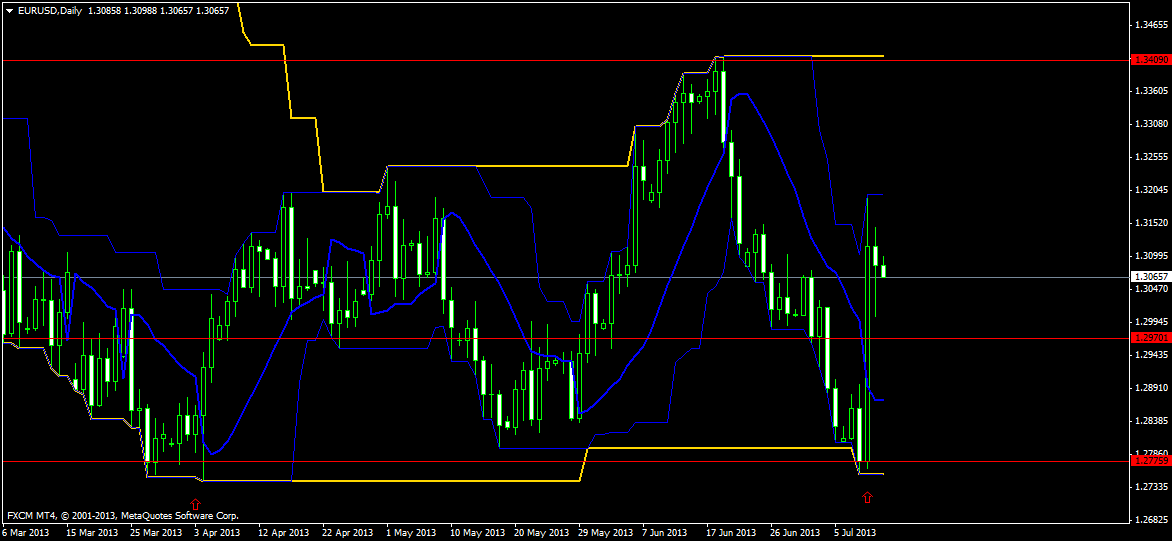

The euro (EUR) dropped sharply against the US dollar (USD) before recovering somewhat. The pair touched a six month low at 1.2750 before correcting slightly to 1.2790. The single currency is seen tumbling almost daily the past two weeks as investors are looking at which will be the next Eurozone country to be Cyprussed. The list is long, starting with Slovenia, which has an overblown financial sector relative to GDP to Spain, whose banks have already been bailed out; but for how long? As a hit to depositors is seen as the norm by European policy makers, keep an eye out for any slow growth, high debt country which could be next in line.

Gold (XAU) gained inversely against the fall of major currencies including the US dollar (USD) and the euro (EUR). The precious metal touched 1607 before correcting to 1604.

The US 500 (SPI) has shown signs of fatigue as the index moved lower, touching 1549. From a technical standpoint, the largest US stock index looks to be within a pennant formation which may push it to higher highs in the coming days.

Weekly option volatilities for the EURUSD picked up at 10.35 from 9.25 yesterday. This shows that markets’ fears re-emerge and push options’ premiums higher.

Stay in tune throughout the day with foreign exchange bullets !

Movers & Shakers

The British Pound (GBP) has been gaining ground versus the US dollar (USD) moving from 1.5090 to 1.5150 in latest trading. The sterling has lost substantial ground since monetary expansion was incorporated into sterling pricing. However as money leaves troubled Eurozone economies in search of safe havens to park their cash, the sterling looks like the attractive destination. Look out for a reversal in the trend.

Outlook

EURUSD Pivot Point 1.2830 with a preference to go SHORT at 1.2830.

Sentiment is 41% of deals to buy EUR

USDJPY Pivot Point 94.50 with a preference to go SHORT at 94.50.

Sentiment is 42% of deals to buy USD

GBPUSD Pivot Point 1.5090 with a preference to go SHORT at 1.5090.

Sentiment is 63% of deals to buy GBP

AUDUSD Pivot Point 1.0465 with a preference to go SHORT at 1.0465.

Sentiment is 59% of deals to buy AUD

UK 100 Pivot Point 6270 with a preference to go LONG at 6270.

Calendar

EUR – German Unemployment Change at 08:45(GMT) Forecast -2K

CAD – Canadian GDP m/m at 12:30(GMT) Forecast 0.1%

USD – US Unemployment Claims at 12:30(GMT) Forecast 340K

SPECIAL NOTE

Opening and Closing times of Products for Good Friday and Easter Monday 29 th March 2013 – 1 st April (Times in GMT)

FOREX — Regular Trading

GOLD — Thursday 22:00 (Close) & Sunday 22:15 (Re-Open)

SILVER — Thursday 22:00 (Close) & Sunday 22:15 (Re-Open)

US500 — Thursday 20:15 (Close) & Sunday 22:00 (Re-Open)