Forex Trading Based On News Releases

Post on: 8 Август, 2015 No Comment

The Forex market is open from 5 pm EST Sunday thru 4 pm EST Friday. Every hour of the day during this time period, spanning the entire planet, currency traders are busy trying to anticipate future currency movements in order to make a profit. By correctly anticipating how exchange rates will fluctuate between the major currencies, investors can make unlimited profits. However, anticipating the movement of those exchange rates is the tricky part but many Forex traders insist that profits can be made by correctly guessing how news releases will affect short-term rates.

Forex retail traders tend to have a slight advantage over the larger hedge funds and big investors when it comes to reacting to the effect of news releases upon exchange rates. This is because they can trade faster than their larger counterparts, and take advantage of the difference between current exchange rates and what they settle to once the news filters through the market. The market can adjust within minutes, which is why the retail Forex trader must have stops and targets in place before beginning a trade. Forex traders hoping to profit from news releases are looking at transactions lasting a few hours to even 20 or 30 minutes in duration.

The U.S. dollar is used to back or finance nearly 90% of currency transactions on the Forex market. What this means for Forex traders is that U.S. government releases of key economic data will tend to have a larger effect upon exchange rates than the data of other nations. However, there are times when the economic data from another nation (or an economic bloc like the Euro Zone ) will have a more significant effect upon exchange rates than information released from the U.S. government. Nevertheless, in most cases, the fundamental data released from the U.S. has a more dramatic effect upon rates than data released from the other major currency nations.

There are presently 8 major currencies traded on the Forex market:

There are at least 16 derivatives using the major currencies giving investors a number of options to choose from. The nations which are represented by these currencies all release economic data at regularly scheduled intervals, and there is almost always news coming out every day that will have a short term effect upon exchange rates. The key for Forex traders hoping to capitalize and make a quick profit is to realize how significant the nation that is releasing the data is and whether it will have an impact upon exchange rates in the short term. The investor must also decide how significant the economic data is and its potential impact upon rate movement. There are nine basic sets of data to look for and each will be released at a regularly scheduled time:

- Interest Rate Decisions by Central Banks/Financial Policy Makers

- Gross Domestic Product (GDP) rates

- Retail Sales

- Inflation (Consumer Price and Producer Price)

- Unemployment

- Trade Balance (Surplus or Deficit)

- Business Confidence/Outlook Surveys

- Consumer Confidence Surveys

- Manufacturing Confidence/Outlook Surveys

Not all of these figures will have the same effect upon currency rates, but the current outlook of the market plays a key factor in how news releases will affect exchange rates. If the U.S. economy was in a recession and the market was expecting the economy to expand, the newest GDP figures would probably play a bigger role on exchange rates than unemployment figures (this is because it is common in many recoveries for GDP to expand before unemployment rates begin to drop).

In the past two years, news releases on U.S. unemployment statistics and interest rate decisions by the Fed have been the top two indicators of exchange rate movement on both the 20-minute and daily charts. Interest rate decisions and inflation have figured larger in more recent exchange rate movements as the market attempts to guess whether the rates will continue to rise and cool the economy to the point of a recession.

Not only does a retail Forex trader need to know which statistics are most relevant to the exchange rates, he/she also needs to know when all key information is made available. One of the principle advantages to smaller traders in the currency markets is the fact that all relevant financial information is basically made available to all players at the same time. For smaller traders looking to capitalize on short term fluctuations based upon news releases, this is good news.

Even if a small trader and a major conglomerate investing billions of dollars receive the economic news at the exact same time, the smaller trader can make a deal and get out before the larger trader can conduct a transaction. Remember, since some Forex trades only last for a few minutes, knowing when key information becomes available is critical to maximizing profits. The quicker an investor can buy in at current market price, the better the profits will be when they sell out before the market fully adjusts to the newly released data. In the Forex world, timing is everything.

Because U.S. economic data tends to have a larger impact upon rates than most other news, be sure to know that all fundamentals relating to the USD tend to be released between 8 and 10 a.m. EST. If you have a position in the EUR/USD, then you will also be interested in sticking around and listening for data coming out of France, Germany, and

Switzerland (these are member nations with EURO currency so their economic data will influence exchange rates). Information from these nations will be released between 2 and 6 a.m. EST. Because the Forex market trades 24-hours per day, investors can take advantage of information as soon as it becomes available.

In fact, a recent study concluded that the top news releases for the U.S. economy had an average pip reaction in excess of 50 in the EUR/USD within the first twenty minutes during 2004. Almost all releases had some significant pip reaction and some exceeded 100.

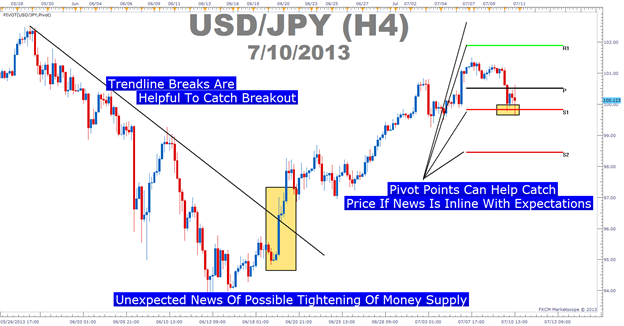

To really make profits from news releases, traders must be able to identify periods of consolidation. A period of consolidation occurs when the market is awaiting the release of some key economic data, and the trading range will tend to tighten up (20-30 pips), usually occurring when the rate nears a support or resistance level. The market will tighten up in anticipation of the release of the new number or information. The Forex trader hoping to profit from the news release will hope that the number triggers a breakout. Investors will ride the breakout until the momentum stops. However, if an investor fails to have stops in place before making investments, the trend could reverse and all those profits could quickly turn into losses.

One way to reduce risks while trading on the Forex is to buy SPOT options that have barrier levels already in place. The One-Touch Spot option will payout if the exchange rates merely rise to a certain level before the expiration date they do not have to settle there just reach it. There is also the No-Touch SPOT option where an investor will receive a payout if the currency rates never reach a certain level before the expiration date. These SPOT options limit risk to the premium paid but offer limited payouts as well. However, for those traders looking to limit risk while having the chance for unlimited profits, there are SPOT options that investors can write themselves (set strike price and expiration date) and receive the associated premium. For the buyer, once the premium is paid, the investor has an opportunity for unlimited profits but has limited his/her risk to the cost of the option. The use of SPOT options can be a great way for those trading on news releases to maintain maximum profit potential but limit their losses should they incorrectly guess as to how the news will affect exchange rates.