Forex Charts

Post on: 17 Май, 2015 No Comment

Forex Charts

Important: This page is part of archived content and may be outdated.

Similar to other forms of trading, forex traders which prefer technical trading use forex charts to identify patterns or accumulate information about the movements of the forex market and the fluctuations currencies present. Forex charts are used as a visual aid to traders which research and study market moods and correlate facts and figures in order for them to be able to generate their own trading strategy, a strategy which can be cultivated based upon the derivatives extracted from research and the attempt to generate personal forex signals. At the majority of forex platforms including the Metatrader trading terminal there are 3 main type of forex trading charts that will be offered to the user in order for him to be able to research and analyze the forex market.

The predominant type of charts used in forex trading are

- Line Charts

- Bar Charts

- Candlestick Charts

Line Forex Trading Charts

Line forex trading charts charts are the simplest form of forex charts and they don’t really give the trader a clear outlook with one glance as in reality they only exhibit a line from one closing price to the next closing price which in a whole shows the general mood of the particular currency pair over a give period of time.

Bar Forex Trading Charts

Bar forex trading charts are a more advanced type of a forex chart as they reveal slightly more information than normal line charts. Bar charts reflect closing prices and simultaneously reflect opening prices with both high and low indications. In each bar the lowest point of the line indicates the lowest traded price for a given currency pair during a given period while the highest point of the line indicates the highest traded price of a given currency pair during a given time.

Additionally each vertical line comes together with 2 horizontal hashes with the horizontal hash to the left reflecting the opening price of a currency pair at a given time and the horizontal hash at the right side reflecting the closing price of the currency pair at a given time. Please note that due to the characteristics offered by bar charts, you might find traders often referring to bar charts as as OHLC charts acronyms for OPEN, HIGH, LOW, CLOSE which are in reality the basic characteristics of bar charts themselves.

Candlestick Forex Charts

The third form of forex charts which are the most revealing in terms of information are forex candlestick charts. They are a basic combo of a line chart and a bar chart and have origins back to Japan. Forex candlestick charts provide an overview of high, open, low and close prices of forex trading prices and are known to be the easiest form of charts to read and comprehend. In their basic form candlestick charts add up from the “body” and a wick referred to as the “real body” in technical analysis.

The body defines the area between the open and the close of a trade session with any minor shadows above that level often referred to as simply “shadows” and they reflect price excursions. The wick of the candle at its highest level illustrates the highest traded price of a currency pair during a give time and respectively the lowest part of the wick reflects the lowest traded price of a currency pair during a give time.

When a pair opens higher than what it closes the body of the candle in forex trading is green where in the case that it opens lower than what it opened it is red. Please note that coloring can vary between various forms of trading as the original form of candlestick charts has the body filled and unfilled and not red and green respectively. Although forex charts are offered in various types from the majority of trading platforms including the Metatrader (MT4), the majority of both beginner and experienced traders tend to prefer candlestick charts as they offer more information at one glance and they are simply easier to read and more revealing.

Candlestick charts are a major visual aid for decision making in stock trading, forex trading, commodity trading and options trading. Other variations of candle stick charts are Heikin-Ashi (Japanese for average bar) candlestick charts are a weighted version of candlestick charts. Although more experienced traders tend to like Heikin Ashi forex charts better as they are easier to read they can tend to be misleading and confusing for new or beginner traders as they don’t necessarily synchronize with the real open and close price. Unlike regular forex candlestick charts, Heiken-ashi do not present open, high, low and close positions but instead they present values of each candlestick based on the forces exerted in the market and reflect the movement in a forex chart .

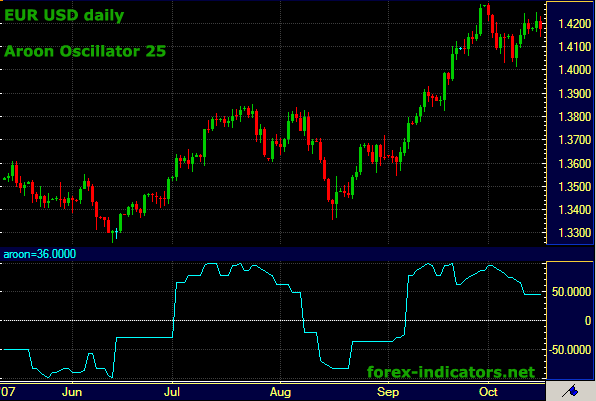

Live Forex Charts

All types of forex trading charts mentioned above are available as live forex charts within the Metatrader (MT4) platform for all currency pairs offered for trading. After you have registered a free demo or real money trading account you will have full and unlimited access to the live forex charting offered inside and will have the opportunity to monitor, evaluate and take notes of trends of the currency pair you wish to trade. Automated options are offered for switching between types of forex charts and going back in time in order to be able to draw your conclusions and shape your technical trading strategy.