Forensic Accounting Career Information and Education Requirements

Post on: 16 Март, 2015 No Comment

Forensic accountants require some formal education. Learn about degree programs, job duties and certification to see if this is the right career for you.

Essential Information

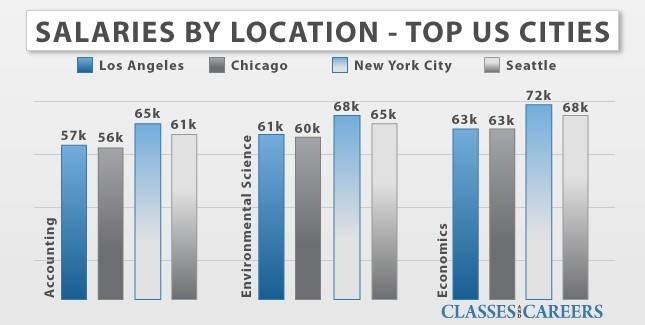

$65,080 for accountants and auditors

Source: *U.S. Bureau of Labor Statistics (BLS).

Career Information

Forensic accountants work with law enforcement officials and lawyers to determine whether illegal transactions have occurred. They investigate different crimes related to fraud, such as corporate, health care, mass marketing, hedge fund and securities fraud. Money laundering, contract disputes, embezzlement and bankruptcy are among other crimes explored.

In addition to understanding accounting techniques and financial transactions at corporate and government levels, forensic accountants must have a clear understanding as to what constitutes legal and illegal transactions. They must understand auditing in order to analyze financial, bank and credit statements. Forensic accountants also might need to understand computer technology to get into a suspect’s related digital files.

Employment of accountants and auditors is anticipated to increase 13% from the years 2012-2022, per the U.S. Bureau of Labor Statistics (www.bls.gov ). The BLS also indicated that these workers earned a median annual wage of $65,080 in May 2013.

Education Requirements

Like all accountants, forensic accountants are required to hold a bachelor’s degree in accounting or a related subject. The curriculum often consists of classes in business administration, finance, marketing, economics and statistics. Graduates who earn a graduate certificate or master’s degree in forensic accounting can increase their employment and salary potential. Students who didn’t major in accounting as undergraduates can also benefit from advanced education in the subject.

Certification

Forensic accountants generally are required to have their CPA certification. Graduates must complete a certain number of semester hours beyond a bachelor’s degree. In most states, the required number is 30 semester hours. Some schools offer a combined 5-year program for those looking to become CPAs.

A forensic accountant can also become a Certified Fraud Examiner or Certified Forensic Accountant. Two years of experience is necessary to take the applicable exams.