Foreign Direct Investment Involving UK Companies 2012 (MA4)

Post on: 16 Март, 2015 No Comment

Contents

Key Findings

- Net investment flows into the UK (inward investment) increased in 2012 to £35.4 billion (current prices), from £28.9 billion in 2011. However, both of these estimates are well below flows of net investment into the UK seen between 2005 and 2007.

- The net flow of direct investment abroad by UK companies (outward investment) decreased from £60.1 billion in 2011 to £26.5 billion in 2012, a fall of £33.6 billion.

- Net investment flows (outward investment) to Europe declined sharply in 2012 compared with 2011, falling from a net investment of £27.3 billion in 2011 to a net disinvestment of £0.7 billion in 2012.

- Most sectors involved in net investment abroad (outward investment) saw a decline in 2012, most notably within the services sector, falling from an investment of £42.2 billion in 2011 to an investment of £0.03 billion in 2012. This decline was mainly in the information and communication, financial services and the electricity, gas, water and waste industries.

- The net position of direct investment abroad by UK companies stood at £1,088 billion (£1.1 trillion) by the end of 2012 (current prices). This was similar to levels reported at the end of 2011 and 2008. The net position of direct investment in the UK by overseas companies at the end of 2012 was estimated at £936 billion, an increase on the value reported at the end of 2011 (£793 billion).

- Net earnings from direct investment by UK companies’ abroad (outward earnings) amounted to £80.2 billion in 2012. This was a decrease of £19.8 billion on the amount earned in 2011 and a return to similar levels seen in 2010. Net earnings from FDI in the UK (inward earnings) decreased slightly in 2012 to £42.7 billion (current prices), a decrease of £1.7 billion on the amount reported in 2011.

Overview

This Statistical Bulletin provides data on Foreign Direct Investment (FDI) flows, positions and earnings involving UK companies. The investment figures are published on a net basis, that is, they consist of investments minus disinvestments. Investments can include acquisitions of assets or shares and disinvestments can include the disposal of assets or shares.

A summary of these results, by geography, was initially released as an Office for National Statistics (ONS) statistical bulletin for Foreign Direct Investment involving UK companies 2012 on 5 December 2013. This release provides additional information on component and industrial breakdowns.

The FDI estimates are analysed and produced to measure investment data for:

The UK’s FDI statistics are produced according to the agreed international standards set out in the third edition of the Organisation for Economic Co-operation and Developments (OECD) Benchmark Definition of FDI (BD3 ) and the fifth edition of the International Monetary Fund (IMF) Balance of Payments Manual (BPM5 ).

The OECD and IMF have recently released new versions of their manuals concerning FDI statistics (BD4 and BPM6 ). These revised manuals reflect the changes that have occurred in international finance since the previous updates. Along with other countries, the UK is currently working to implement these changes.

For more detail on these changes see the guidance and methodology section of the ONS website.

FDI estimates are essential for measuring the UK’s Balance of Payments. FDI earnings figures feed into the Balance of Payments current account, FDI flows form an integral part of the financial account and FDI positions supply direct investment data to the International Investment Position (IIP) account.

Within the UK, FDI estimates are used by a large number of government departments for briefing and policy formation purposes, including HMRC, Cabinet Office, HM Treasury, UK Trade and Investment, the Bank of England, the Department for Business, Innovation and Skills and the Department for International Development.

UK FDI figures are also extensively used for policy, analysis and negotiations by international organisations, including Eurostat, United Nations Conference on Trade and Development (UNCTAD), OECD and IMF, as well as a number of foreign embassies. More widely the FDI estimates are utilised by commercial companies, academics and independent researchers.

User Engagement

We are constantly aiming to improve this release and its associated commentary. We would welcome any feedback you might have and would be particularly interested in knowing how you make use of these data to inform our work. Please contact us via email: fdi@ons.gsi.gov.uk or telephone Ciara Williams on +44 (0)1633 456455.

Summary

FDI net investment flows (Table 1.1)

The net flow of direct investment abroad by UK companies (outward investment) decreased from £60.1 billion in 2011 to £26.5 billion in 2012, a fall of £33.6 billion (current prices). This was a return to similar levels of net outward flows seen in 2009 and 2010 and continues to remain substantially lower than the peaks observed in 2000 and 2007 of £154.2 billion and £159.1 billion respectively.

Net investment flows into the UK (inward investment) increased in 2012 to £35.4 billion, a similar amount to 2010. However, both of these figures are well below flows of net investment into the UK seen between 2005 and 2007.

FDI net International Investment Positions (IIP) (Table 1.2)

The net position of direct investment abroad by UK companies stood at £1,088 billion (£1.1 trillion) by the end of 2012 (current prices). This was similar to levels reported at the end of 2011 and 2008.

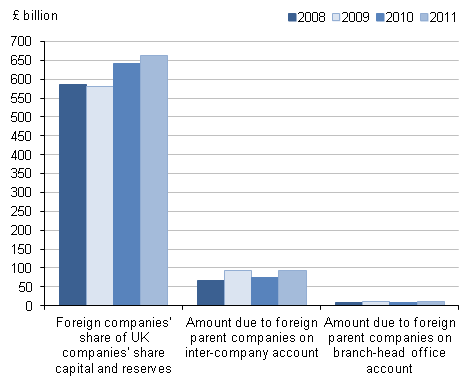

Outward FDI net positions seem to have recovered from the reduction at the end of 2009 following the 2008/2009 economic downturn. The net position of direct investment in the UK by overseas companies at the end of 2012 was estimated at £936 billion, an increase on the value reported at the end of 2011 (£793 billion). This has been primarily driven by a decreased level of inter-company borrowing and sustained income yields.

FDI net investment earnings (Table 1.3)

Net earnings from direct investment by UK companies’ abroad (outward earnings) amounted to £80.2 billion in 2012. This was a decrease of £19.8 billion on the amount earned in 2011 and a return to similar levels seen in 2010. Although there was a decline in the value of UK earnings abroad in 2012, figures still continue to be above those recorded in 2008 and 2009, when the effects of deteriorating economic conditions became visible in the UK FDI data.

Net earnings from FDI in the UK (inward earnings) decreased slightly in 2012 to £42.7 billion (current prices), a decrease of £1.7 billion on the amount reported in 2011. However, UK inward net earnings have continued to recover from the large fall seen in 2008. Net earnings in 2012 remained broadly similar to the value recorded in 2007 and 2011.

FDI by geography and industry

The overall trends above are partly reflected in the destinations of net investment abroad by UK companies. For example, net investment to Europe declined sharply in 2012 compared with 2011, likely owing in part to relatively subdued economic conditions. On the other hand, net investment into the UK by overseas companies increased from all regions except Africa and Australasia & Oceania.

In contrast to 2011, most sectors involved in net investment abroad saw a decline in 2012, most notably within the information and communication, financial services and the electricity, gas, water and waste industries. These decreases originated from Europe, the Americas and Asia.

However, despite an overall increase in net investment into the UK during 2012, decreases in net investments were seen in half of the industries, particularly in the mining and quarrying industry from Europe.

How our statistics compare with external sources

The UK experienced mixed economic conditions in 2012 as annual GDP growth slowed from 1.7% in 2010, to 1.1% in 2011 and to 0.3% in 2012.

However, the UK remains one of the most active countries for outward and inward FDI in the world. The latest OECD figures suggest that 4.6% of total world inward FDI was to the UK in 2012, whereas 5.8% of total world outward FDI was from the UK.

The trends in these flows suggest that FDI inflows to the UK have been increasing since 2010, while the value of FDI outflows fell in 2012 from 2011, yet remained higher than the 2009 and 2010 levels.

Global economic activity continued to slow in 2012. The latest International Monetary Fund (IMF) data estimated that world GDP grew by 3.2% in 2012 after growing by 3.9% in 2011 and by 5.2% in 2010. However, unlike those previous years, the slowing rate of economic activity is more widely spread around the world.

The advanced economies grew by 1.5% in 2012, compared with growth of 1.7% in 2011. This is partly reflecting the continuing economic adjustments in some developed economies following the 2008/09 economic downturn. However, growth in the rest of the world also slowed to 4.9% compared with 6.2% in 2011. The IMF found that a number of emerging markets may be coming off cyclical peaks which would make it harder to sustain the growth rates of previous years.

Rate of Return analysis

One useful indicator related to direct investment earnings is the rate of return. The rate of return is calculated as earnings divided by positions.

Overall, the implied rate of return for outward direct investment abroad by UK companies was 7% in 2012, a decrease on 2011 (9%) and still lower than 2007 (10%).

Foreign companies investing in the UK saw slightly less prosperity on their investments in the UK in 2012. The implied rate of return for inward investment into the UK decreased to 5% in 2012 from 6% in 2011 and was still lower than the value reported in 2007 (7%).