Foreign Currency Hedging Strategies

Post on: 23 Апрель, 2015 No Comment

Other People Are Reading

Diversification

Financial diversification is a strategy that enables you to turn a a profit across various economic scenarios. Risk is reduced, because losses associated with one profit source are unable to dominate your total returns. Diversification as a foreign currency hedging strategy relates to assembling a portfolio of multiple currency reserves, establishing international businesses and buying global stocks and bonds.

For example, private individuals may diversify with U.S. dollars, Japanese yen and Russian rubles for their foreign exchange reserves, as a currency hedge. Because of energy costs, the U.S. dollar and Japanese yen generally maintain an inverse relationship to the Russian ruble. The resource-rich Russian economy and ruble actually benefit from high energy prices. Alternatively, Japan and the United States are energy importers, whose economies suffer from inflation and weak exchange rates when raw material prices advance.

Beyond building diverse currency reserves, larger businesses may establish presences in Japan, the United States and Russia to hedge economic risks associated with each country. Smaller investors, however, may purchase global mutual funds and multi-national stocks to manage foreign exchange risks. Coca-Cola is one stock that maintains a diverse, international profit base.

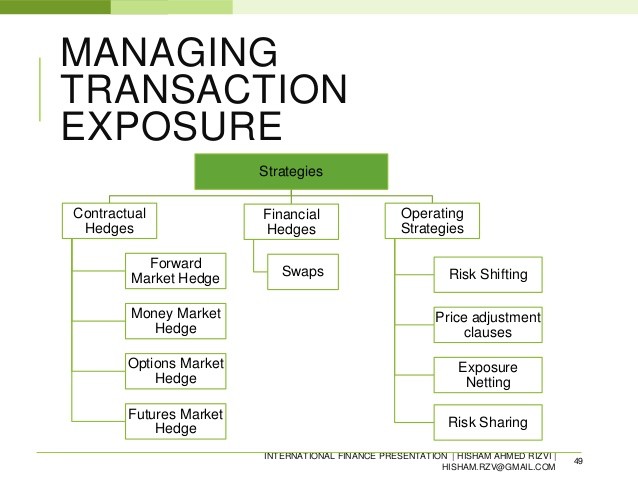

Currency Derivatives

Currency derivatives allow trading partners to establish predetermined exchange rates for set periods, which effectively hedges against foreign exchange risk. Currency derivatives include options, futures and forwards contracts. Options and futures are liquid contracts that trade on organized exchanges, such as the Chicago Mercantile Exchange. Liquidity describes the ease in which any asset may be sold for cash. Traders pay premium costs to acquire options, which grant rights to accept or reject foreign exchange at set rates. Futures contracts, however, are binding agreements that force traders to buy and sell currency at predetermined exchange rates.

Forward contracts are customized agreements between two parties that negotiate exchange rates at later points in time. Because of their customization, forwards are not liquid, and do not trade on organized financial exchanges. Parties that enter into forward contract agreements should verify that their trading partner is financially solvent, and able to deliver or purchase currency.