Focus Islamic finance

Post on: 16 Март, 2015 No Comment

Islamic finance

Add this article to your reading list by clicking this button

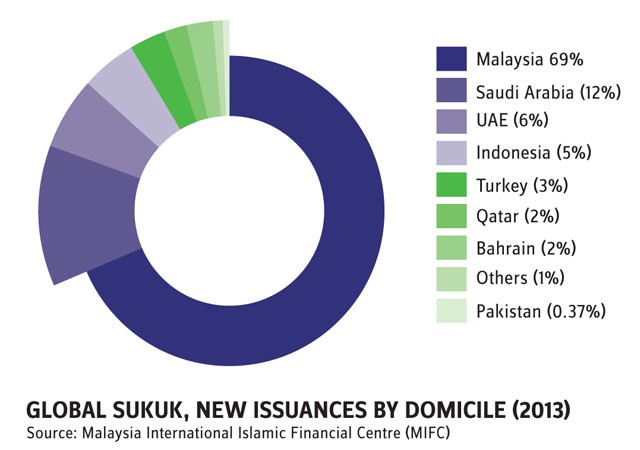

THE global market for Islamic finance at the end of last year was worth around $1.3 trillion, according to the UK Islamic Finance Secretariat, part of the CityUK lobby group. The total value of sharia -compliant assets has grown by 150% since 2006. Globally, banks hold over 90% of Islamic assets, and together with funds are big investors in sukuk. a type of bond. According to the latest quarterly report from Zawya, a business information firm, global sukuk issuance in the first quarter of this year was $43.3 billion, almost half the total for the whole of 2011. The withdrawal of European banks lending to the Gulf Co-operation Council (GCC) region is thought to have contributed to this rise. Total issuance could reach $126 billion this year, continuing the growth trend (aside from a brief decline in 2008 associated with the global economic slowdown). Malaysia, which dominates the global sukuk issuance market, is over 60% Muslim, and Islamic banking assets make up around a quarter of the countrys total. Globally, perhaps 12% of Muslims use Islamic financial products, but with other countries (predominately Muslim or with large Muslim populations) expressing interest in increasing services, the market seems likely to continue to grow.

Previous

Readers’ comments

No need, essentially Islamic finance is the same* as Western finance except it uses contrived legal loopholes to avoid breaking sharia law (eg an Islamic mortgage somehow makes you pay rent linked to the base rate instead of interest as usury is banned but leaves you with the same repayment and default considerations).

In other words, much like Halal meat (which is unregulated and often reverts to animal cruelty) it is hypocritical. It is having your cake and eating it. It is hypocritical because you get the same thing as a western mortgage for example but without the guilty conscience.

The closest comparison I can think of is when the Venetians managed to find legal loophole methods of lending money to people centuries ago which neatly side stepped the biblical ban on usury (as it was interpreted at the time).

*I am putting the ethical investment argument aside for now, we can assume for comparison that I am comparing it to a relatively ethical set of Western finances.

Connect The Dots Apr 10th 2012 23:53 GMT