Fixing a SmallBiz 401(k) Plan

Post on: 25 Май, 2015 No Comment

Email this article

Comments *

A while back, I came to the realization that our small company’s 401(k) plan was silently robbing our employees of their retirement funds. Our plan, administered via our payroll company and a big-name Wall Street entity, had been selected a few years earlier by our former CFO. I believe she largely based her selection of 401(k) providers on brand awareness and ease of implementation. The plan was filled with exclusively high-fee, managed funds. On average, these fees took about 1.5% to 2% of our employees’ retirement savings every year. Additional plan-management fees ate even deeper into retirement savings.

Why are high fees and managed funds such a big deal? First, it must be recognized that managed funds, as a whole, underperform the market. But let’s just assume for the sake of calculation that they could match market returns. Take a perfectly disciplined employee who invests 10% of his or her income in a 401(k) with a 4% employer match, and who starts at age 24 and continues to age 65, without ever taking a break, losing a job, getting sick, getting a divorce, or needing a loan from the plan. The investment returns average 7% per year, and inflation averages 3%. The employee starts out making $25,000 per year and yearly receives raises of 4%.

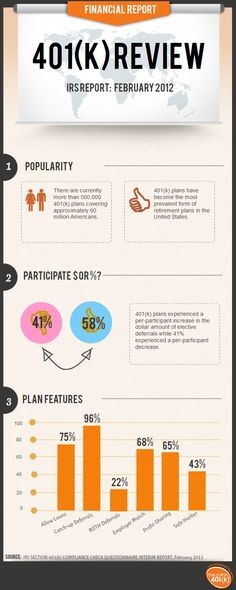

What does this look like after a lifetime of savings? (Note that plan fees can be as low as hundredths of a percent of plan assets. For purposes of the graphic below, I’ve rounded that down to “no fees,” comparing the returns on a no-fee plan to returns on a plan with fees that are 2% of plan assets.)

Recommended Stories:

After 42 years of saving diligently, nearly 36% of this employee’s retirement savings has vanished due to an additional 2% in fees. And many small-business 401(k) plans charge even more than that. The difference between high fees and minimal fees may be the difference between a modestly comfortable retirement and one that is financially insecure.

A New Direction

When I realized how much the financial-services industry was taking from our employees, I contacted the payroll-services firm that had facilitated our 401(k). I said I was displeased with our fund selections and that I would like to pick a 401(k) with low-cost index funds and exchange-traded funds as options. I was told that because our company had fewer than 50 employees, the assets in our 401(k) plan were relatively meager, and what I wanted was just not possible. “Maybe someday when you are big enough,” they told me. Perhaps that was supposed to make me feel that their weak fund options and high fees were my fault for not being a more successful businessman.

I was determined to find other solutions, but in meetings with several financial advisers, I was told the same thing: high fees are just part of the equation, and the smaller your company is, the more fees you pay. Calls to several different 401(k) providers went unanswered, presumably because we were too small. I fumed in impotent anger. Congress has created a savings tool that is rapidly becoming the sole viable retirement vehicle for a large percentage of the population, yet nobody seems to care that many of these plans deliver weak results, dooming participants to a marginal retirement.

A Ray of Hope

After months of trying unsuccessfully to find solutions, I had largely lost hope. For this and other reasons, we decided to start looking at other payroll-services companies. About the time we started bringing in other folks to pitch payroll services, I was informed (surprise!) that our existing payroll company did indeed have additional 401(k) options, and if I’d like to select from a list of a few hundred different funds, it would be happy to put those into our 401(k). I went through the list and found a number of Vanguard funds that were exactly what I had been looking for from the start. I set up a meeting to discuss moving forward with this change.

The payroll company arrived in my offices with a team of three financial advisers in tow. I explained, as I already had umpteen times, that I wanted to pick low-fee index funds. They patiently explained that the funds I wanted had very low fee and commission structures, and that I’d need to pick different funds in order to pay for their financial advisory services. I informed them that I would not be hiring these financial advisers or picking those high-fee funds. Again I had hit a brick wall.

The payroll company claimed that unless I hired their financial advisers, I would be in breach of our fiduciary responsibilities. I countered that I would instead find an adviser on my own and pay him an hourly rate for his services, as opposed to a percentage of plan assets paid by the employees.

The payroll company said I’d hear back from them in 60 to 90 days. We thought we were waiting for them to tell us whether we could go forward with our plans. But we never did hear back from them. And one day, without warning, all of our 401(k) assets were transferred from the existing fund selections to a single Vanguard S&P Index Fund. And instead of the old fund options, we had 10 new ones that I had selected.

Our Financial Adviser

On its face, that seemed a good thing, because it was what we wanted. But because we hadn’t been told whether the payroll company was planning to grant our request, we hadn’t hired a financial adviser at the time we found that the old plan was closed out. So we were technically in breach of fiduciary responsibilities, even though it was the payroll company’s fault.

But while I was required to hire a financial adviser, in general I’m not a fan of them. When it comes to allocating a participant’s assets in a 401(k) plan, the financial adviser looks at the person’s age and “risk tolerance” and recommends a weighting of assets that is supposedly appropriate for those two factors. I doubt more than 15 minutes go into planning those allocations. They can use the same allocations for decades to come. It’s pretty easy work, and it isn’t worth much to me. Young and brash = more stocks, less bonds. Old and conservative = less stocks, more bonds.

I found the website of the National Association of Personal Financial Advisors, which purports to be “Truly Comprehensive, Strictly Fee-Only.” I searched for financial planners within a few miles of our office and came up with a list of about 20. Most refused to work with us due to the fiduciary responsibilities of working with 401(k) plans. Another said it would charge us 0.6% of the plan assets yearly, which they assured me was standard. It seemed that “strictly fee-only” didn’t mean what I assumed it did. One quoted a price of $1,000 per employee per year. That would be $20,000 per year for the adviser to come into our office and give the staff a 30-minute presentation.

One lesson, in the end, is that perseverance pays off. After seemingly endless searching, we did finally find someone willing to work under our terms. He gets paid hourly for meeting with employees and planning their allocation of funds. If they need help in the future, he’s on call for questions. The prices are reasonable and, in practice, employees rarely consult him. I don’t remember the last time I saw an invoice from him.

Sweetening the Pot

So now our small company has a 401(k) plan with a good selection of low-cost index funds and very low plan fees. While it makes me happy to have achieved that, one must also realize that for many employees, even the best 401(k) may fall short of their retirement goals.

My next step was maxing out our employer matching funds to the plan, to encourage more employees to participate and save more money. It doesn’t cost that much to increase matching funds to a level where we are offering substantially better retirement benefits than our competition. The costs are certainly outweighed by better employee retention. We are a service business, and the loss of key employees puts our clients and earnings at risk. I’m proud to say that we have lost only one full-time employee in the past two years, and while our 401(k) plan may be only a small part of the reason, every bit helps. Proving to employees that you value their financial future is good business.

Advice to Small-Business Owners

I know you have a million other things to do, and a 401(k) is usually not high on your list. You’ll probably do what I did, at first: delegate the project to someone else in your organization, who will give the business to the company that promises to make it a “one-stop solution” bundled with other services, with surprisingly well-hidden fees. But it is you who must take charge of this process. You and your employees are going to pay a huge price if you seek the easy way out. Find out what hidden fees you are paying, and aggressively eliminate them. You don’t have to be a big company to do that. You just have to be extremely persistent.

Will Akerlof is president of Liquid Advertising.