Five years after the financial crisis investment banks today

Post on: 7 Август, 2015 No Comment

A bulge bracket investment bank

7 minute read

Investment banks have changed enormously in the past five years. When Lehman Brothers went bankrupt in autumn 2008, they stood at the lowest point of the worst crisis in their history since the Wall Street Crash. But the industry is now well-advanced on a process of recovery and evolution, and its institutions are much stronger as a result.

To mark this anniversary, we asked Morgan Stanley’s Huw van Steenis, Managing Director in Equity Research to talk us through how investment banks have changed and why, and how they operate today.

The Lehman Brothers bankruptcy

On 15 September 2008, Lehman Brothers, then one of the world’s largest investment banks, declared itself bankrupt. This high-profile collapse is now seen as a symbolic turning point. Problems in the economy and financial markets had become apparent already, but the fall of Lehman Brothers is arguably when their severity and their potential effects on the real economy were first recognised.

What are the key ways that investment banks and the investment banking world have changed over the past five years?

During the fifteen years before 2007 we went through a bizarrely benign period of global economic history. The globalisation of the world economy drove down prices and improved GDP growth. We also saw an IT revolution that transformed productivity.

But the market became overly complacent in this benign world, and one of the basic principles of banking was frequently overlooked: that lending money is a risky activity so banks need to be diversified and have stringent controls. Many banks placed too much on a narrow set of bets and underestimated how big the risks were.

The investment banking industry has now changed in a number of ways as a result of the financial crisis these conditions led to.

Return to core businesses: First, banks have gone back to basics, thinking about what they’re good at and what they’re not so good at, what business areas they should be in and what business areas they shouldn’t be in. It’s been a painful process, but one that’s actually cathartic. It’s led to a renewed focus on giving financial advice, lending money and facilitating trading, and a step away from activities like repackaging and reselling loans, or putting a lot of capital into private equity and hedge funds.

Huw’s advice for a career in banking today — and in the future

Always quiz potential employers carefully: Try to establish how committed they are to the part of the business you’re interested in. You want to make sure you’re joining a bank, and an area within that bank, that has momentum and growth potential.

Keep reinventing yourself: Banking will always have cycles of change, so you need to keep adapting too.

Better regulation: Regulation has been rethought to make the banking system sounder and safer. Banks have been asked to hold more capital and more liquid assets. They’ve also been asked to be more thoughtful and rigorous in their risk management and stress testing — for example, by recording losses made in their accounting systems as soon as possible so that these accounts accurately reflect the bank’s financial position.

Global restructuring: Banks have been rethinking the structure of their businesses across the world. The banking industry went through a period of tremendous globalisation, and we’re now going through what I believe is a decade of balkanisation. Policymakers are looking to protect their countries’ best interests and are putting up regulatory walls, restricting the free flow of capital across borders. The banks are working out ways to respond to this change.

How has Morgan Stanley changed?

Rebalanced business: We now do much more wealth management — that is, advising individuals on their investments. One of the consequences of the financial crisis was that Morgan Stanley had the opportunity to buy Citigroup’s US wealth management business, Smith Barney. The integration of this business with Morgan Stanley’s existing wealth management business means the bank now has one of the world’s leading wealth businesses in this field, and the biggest in the US. Developing this area means that Morgan Stanley’s business as a whole is more diverse and balanced, which makes it stronger.

Changes to funding structure: Morgan Stanley, like the banking industry as a whole, has delevered. That means we hold significantly more capital and have reduced our usage of short-term funding, meaning we’re much more resilient to extreme shocks.

Clients first: Morgan Stanley has always put clients and their businesses first, but in market conditions as extraordinary as those we saw immediately before the financial crisis, there was also some focus on investing and trading with the firm’s own assets. But Morgan Stanley has now doubled its commitment to its clients, which has paid off. For instance in the business I work in, Equities (shares), in the last quarter we’ve gone from being third globally to first globally, by reported revenues.

Has Morgan Stanley’s client base changed since the financial crisis?

In the extraordinary market we had running up to 2007, investment banks could focus on a narrow base of clients and still make money. In the environment we’re in today, however, you need to have a broad client base, both in terms of geography and industry. This actually plays to one of Morgan Stanley’s historic strengths: the fact that we work with a very broad range of clients all around the world.

Geographical client trends: Some globally-operating emerging market companies have risen significantly over the past five years, and we’re working more and more with these. The proportion of M&A which is between different continents has grown to a new high. Clients in countries with stronger economies will generally be more profitable for us than ones in countries with weaker economies so, for instance, in very general terms the US is currently a better environment for us to do business in today than Europe. But there are good opportunities for us to help clients in weaker economies too — for example, with restructuring their businesses, or with raising capital to strengthen their balance sheets.

Industry client trends: We’ve done a lot of work for financial institution clients in the last five years. The process of balance sheet strengthening by raising capital and disposing of non-core assets that banks and other financial institutions have needed to go through has brought us an extraordinary amount of business.

Which parts of Morgan Stanley’s business have been the most active since the financial crisis?

The trading side of our business has probably been busier than the investment banking side, where we advise on acquisition deals and raising capital through the markets, because only the brave embark on these processes in uncertain economic times.

Investment banking trends: M&A and IPOs have started to pick up again over the past year. As the world gets through the economic repair process, investors will be prepared to commit more money to acquisitions and chief executives will be prepared to look for growth again. This means they’ll move from a battening down the hatches mood to looking forward.

Trading trends: Foreign exchange trading has come to account for a larger proportion of banks’ earnings since the financial crisis because of macroeconomic uncertainty. Investors are speculating on whether the US economy really is improving faster than European ones and on the impact of extraordinary monetary policy experiments in Europe and Japan. Trading in equities has shrunk because of the effect of the ongoing economic difficulties on the corporate world. But we’re now seeing a pronounced increase in equity trading as the recovery in the US and western economies comes through and investor confidence improves.

Why Huw thinks now is a good time to join an investment bank

Growth: After five difficult years, revenues are picking up — so headcounts are increasing.

Complex work: The challenges for banks arising out of the financial crisis and the subsequent changes in the industry mean that there are currently many really good graduate jobs in investment banking with lots of interesting issues to get your teeth into.

Engagement with clients: Investment banking is becoming more client-focused and giving good advice is prized more than ever.

What advantages do global investment banks like Morgan Stanley have in the current economic climate over localised banks or boutique investment banks?

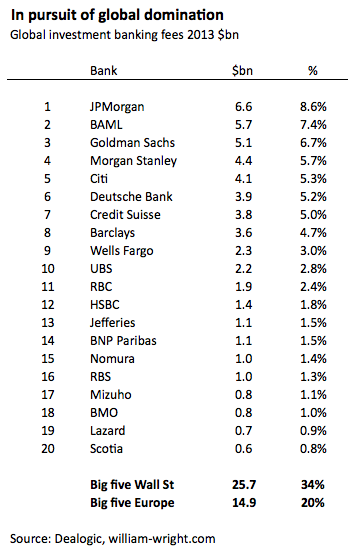

Many of the world’s largest companies and investors want global advice from a bank with a global network, which we can provide. In addition, the tremendous changes the banking industry is currently going through, particularly increased regulatory demands and the fact that banking activities are increasingly reliant on technology, mean that banks’ fixed costs are higher than they once were. When fixed costs get higher, the largest businesses in an industry, like Morgan Stanley, are at an advantage.

Localised banks: European companies, because of weaknesses in Europe’s banks, are looking less at borrowing from these when they want to raise money and more towards the global bond markets. Because of our expertise in capital markets across the world, this shift has been a very significant positive trend for us and other global investment banks.

Boutique banks: The range of advisers we can provide clients with has been a big advantage for us over boutique banks. In the current environment where raising funding can be difficult, chief executive officers and chief financial officers want to have a broad discussion about their whole capital structure. What’s the best way to strengthen their balance sheet? Where can they get funding at the best price? We can advise effectively across the full spectrum of their options, unlike most boutique banks.