Five things investors need to know about fixed income in 2014

Post on: 4 Май, 2015 No Comment

There will be those who feel compelled to hold fixed income in 2014, despite the very many signs that it might be a rough year for the asset class. This is not purely for masochistic reasons, investors may be reliant on the income, they may believe that economic growth will disappoint, or they may believe that it is important for portfolio diversification purposes. What do investors need to know about fixed income in 2014? Cherry Reynard reports

1) Interest rates do not have to rise for bond prices to fall

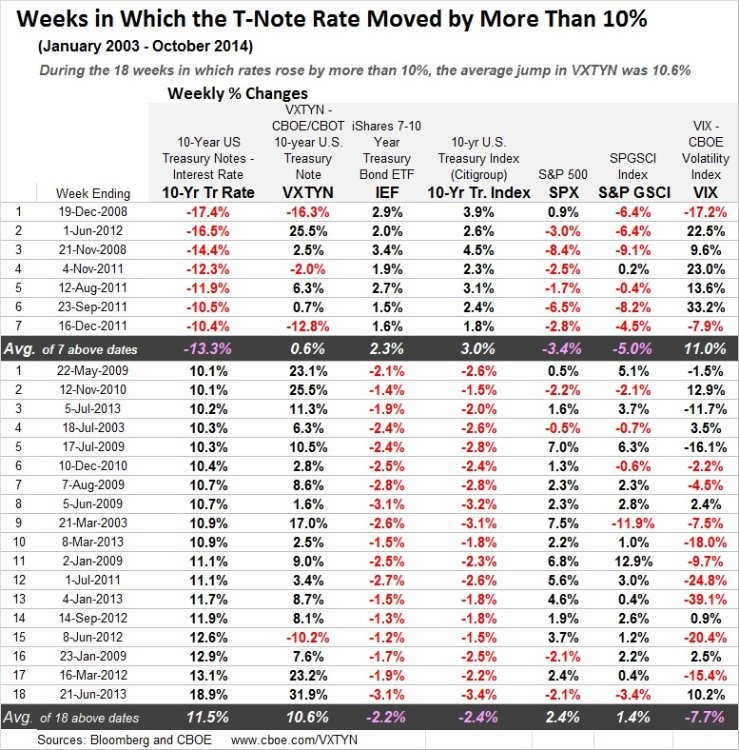

It is enough that investors start to expect an interest rate rise sooner than is currently priced into markets. This means that while policymakers may conclude that interest rates should stay on hold, if economic growth accelerates bond prices could still fall. Interest rate rises still look some way off perhaps as much as two years in most major developed economies but government bond yields could still rise in the intervening period.

2).but not all fixed income falls in a climate of rising interest rates

For those who want to retain bond holdings even as interest rates are likely to rise, there are parts of the market that dance to a different tune. For example, convertible bonds can offer defensive qualities at times of falling equity markets, but can also participate in a stock market rally.

Convertible bonds act like a conventional bond, but offer the option of converting to shares at a pre-set price. As such, their price will be influenced by the price of those shares, because the option to convert becomes more valuable as the share price rises. A number of companies have launched dedicated convertibles funds, including JP Morgan (an investment trust), UBS, M&G and Aviva Investors. Equally, investors could explore floating rate notes. This is a small and relatively illiquid market, but there are a number of dedicated funds, such as the TwentyFour Income fund. As the name suggests, the income on a floating rate note floats with prevailing interest rates. This means that they can go up as interest rates rise.

3) Despite last years falls, fixed income remains historically expensive

The yield on the 10-year gilt moved from 1.85% at the start of last year to 3.04% at the end. It may have felt painful at the time, particularly for a safe haven asset, but on historic measures gilts still look relatively expensive. They still only yield marginally more than inflation 2.87% compared to 2.1%. The reality is that the upside remains limited, while the downside remains high. There is only likely to be an improvement in gilt prices if growth disappoints, and even then, only by 1-1.5%, while the downside if growth accelerates is significant.

Few of the major fund selectors have any allocation to government bonds. For example, David Hambidge, head of multi-asset at Premier Asset Management holds nothing in the asset class and avoided it throughout 2013. John Chatfeild-Roberts, chief investment officer and head of the Merlin funds of funds team at Jupiter Investment Management says: We are not keen on developed market government debt. There is an awful lot of it and it is not particularly attractive.

4) Corporate bonds look better than most other areas

At least with corporate bonds investors are still receiving a decent income, even if they may be largely flat on their capital returns (which is unlikely to trouble a long-term income-seeker). Chatfeild-Roberts says that the corporate bond for a good company, held to redemption is still a sound investment. Equally, high yield bonds are still benefiting from the relatively low default rate. Investors have an increasing range of options of funds specialising in shorter-maturity corporate bonds. Groups such as RLAM and Standard Life have recently launched funds, while groups such as Smith & Williamson have existing, well-established funds. The advantage of shorter-maturity bonds is that they have less interest rate risk. However, managers such as Fraser Lundie, co-head of credit at Hermes Fund Managers, says that short-dated bonds are now an increasingly crowded trade and investors may be better off in a bond fund that can use derivatives to hedge out interest rate risk. Nevertheless, fixed income investors still have options.

5) Fixed income has a place in well balanced portfolios

The economic recovery is not assured. Economic growth statistics continue to wobble, as demonstrated by the latest US employment statistics as Forbes reports. In this environment, fixed income may begin to look cheap once again. Equally, the fixed income market still has plenty of support. Investors need income and there are plenty of supportive buyers entering the market as yields rise. For example, pension investors have just started buying long-term gilts once again.

Then there are sound portfolio diversification reasons to hold fixed income. It is good to have a number of different income sources, to spread risk across different asset classes. It may not be the best year for fixed income, but it doesnt mean investors should avoid it completely.