FinFX Review

Post on: 30 Апрель, 2015 No Comment

FinFX A True ECN/DMA Broker

FinFx Trading Oy is the largest Finnish ECN/DMA currency and commodities broker specializing in online trading services for international clients. One of our top priorities is the safety of customer funds: therefore FinFX is audited by PricewaterhouseCoopers (PwC).

FinFx Trading Oy.

Regulation and Info

FinFX has gained significant status in the international forex markets since 2010 and is growing steadily. Every day new traders open accounts with FinFX and start investing in the currency market. In 2013, FinFX was chosen as the Best FX Broker in Northern Europe by World Finance.

FinFX uses a STP-model and provides its customers with real-time market and price feeds from prime banks as well as the award-winning MetaTrader 4 platform. FinFX also provides the MetaTrader 4 Mobile application, which enables traders to follow the market and benefit from their iOS and Android-based devices that include iPhone, iPad, iPod touch as well as Android-phones and Android tablets. FinFX provides up to 1:200 leverage for currency and commodities trading, offering even small traders a good profit potential.

The Nitty Gritty!

The customer base consists of thousands of private customers and companies from more than one hundred countries. Trades are transmitted swiftly and reliably to the worlds largest banks. The direct relationships with the prime banks allow FinFX to provide clients with competitive market prices and deep liquidity.

Benefits include raw spreads from 0.0 pips, true ECN/DMA environment, flexible leverage up to 1:200, a variety of order types for all styles of trading, scalping allowed absolutely no restrictions, EAs enjoy the best possible conditions, prices quoted to 5 decimal places, hedging allowed, FIFO rule not applicable, open and fund a trading account in your choice of currency: EUR / USD / CHF / GBP, various deposit and withdrawal options such as bank wire transfer, credit/debit card, Skrill (Moneybookers), unmatched client support 24/5, multi-lingual support English, German, Russian, Finnish and Spanish with complete transparency from A to Z

PAMM Accounts

The Percent Allocation Management Module (PAMM) allows money managers to trade in an unlimited number of individual and institutional managed accounts simultaneously from a single MT4 account operations. The PAMM has nothing to do with the trade copier software, as it is designed to adjust the risks of all customers, regardless of the amount of the deposit. The managers performance results (profit and loss trades) are distributed among the managed accounts. Managed account client is virtually connected to the main administrator account money in a way that all operations performed by the Manager are reflected proportionally in the client accounts. The balance of the PAMM account virtual Maestro is the sum total of all customer deposits. To ensure the safety of investors, the customer deposit is kept physically on their own with FinFX opened its doors under the personal name and no access to the money manager. The investor becomes the only one who is able to make deposits / withdrawals managed account

Review FinFX PAMM benefits

- Dedicated MAM server in New York with very low latency to our liquidity providers

- Managing is done from one MetaTrader 4 account

- Convenient backoffice tool to monitor clients

- PAMM account base currency: USD, EUR, CHF or GBP

- Minimum deposit per client account – 2000 USD/EUR/CHF/GBP

- Performance (incentive) fee calculation report is available on a monthly basis

- No-slippage True Limit Orders available in ECN environment

- Withdrawal from commission account is possible at any time

- VPS service for no-latency trading is available free of charge

- Customized compensation plan can be applied

- Volume-based commission split between 2 partners possible

- Demo PAMM is available for testing

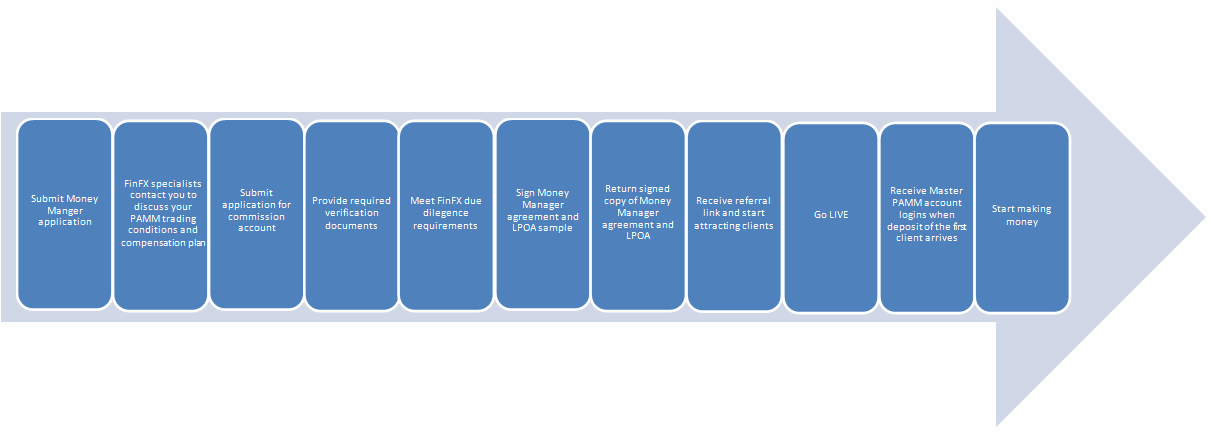

The client opens a managed account with FinFX via the Money Managers unique referral link and authorizes the Money Manager by signing a Limited Power of Attorney (LPOA). Once the client has proceeded with the funding, the managed account can be attached to the PAMM Master account. The Money Manager becomes able to trade on behalf of the client. To address the special needs of professional managers, FinFX is pleased to offer a number of different ways the Money Manager can benefit from managing client accounts:

- Clients managed account may become subject to a performance (incentive) fee which is calculated on the High Watermark basis.

- Clients managed account may become subject to a management fee, which means that a guaranteed fixed amount is deducted from the managed account, regardless of how well the performance goes.

- Clients managed account may become subject to a one-time fee (deposit fee) to be charged from every client deposit.

- Instantly paid volume-based commission system in the form of spread mark-up (spread widening) to the benefit of the Money Manager can be applied in addition to the above mentioned remuneration programs.

The managed account can be closed at any time, funds may be withdrawn by the customer once all open positions are closed. Investors have instant read-only access to their own accounts managed without the ability to place trades yourself. After each month, the Back office department at FinFX contacts the money manager with a special report showing PAMM general behavior and performance of each individual managed account. There are five days to review the report and give its approval. Once approval is received FinFX proceed with payment of fees.

FinFX PAMM is recommended by MT4PAMM.

Trading CFDs involves high risk of loss.