Financing Strategies for Your Startup

Post on: 2 Июль, 2015 No Comment

Raising money for a startup has never been easy. But there is some good news: here are the two best bets for finding the money needed to launch a company

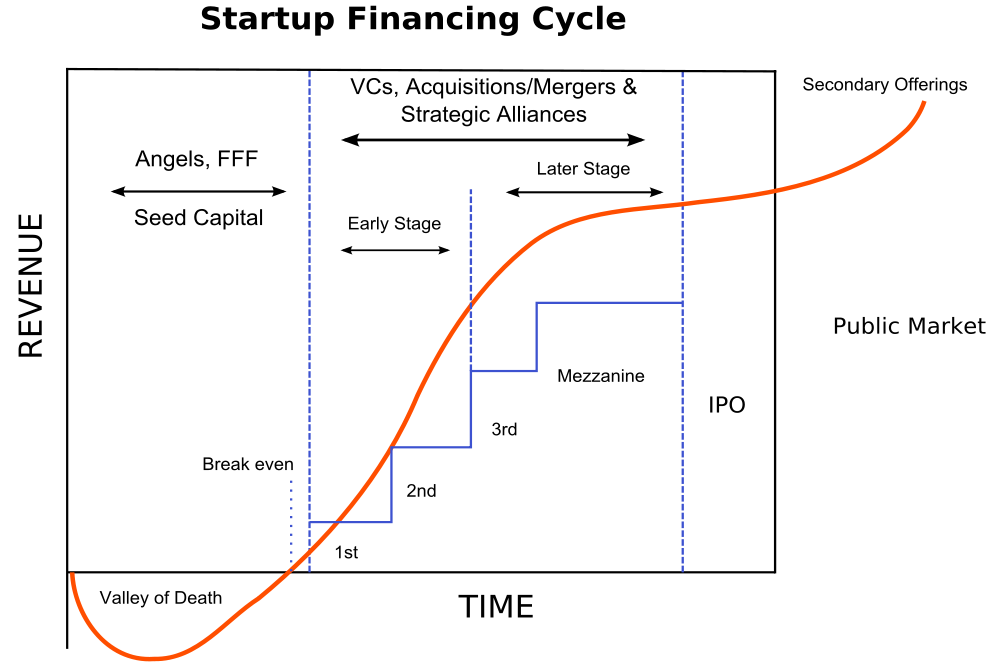

But, he adds, angels are even keener on people who already have built a successful business. Angels are most likely to consider investing in your startup if its in a leading-edge sector, says Sparaga, such as software, the Internet, biotech or clean energy. But sometimes theyll invest in someone whos approaching an old business in an innovative way, he says.

In that case, its the business model that interests them, not a technology. Aside from angels, who else is the most likely to help finance your startup? Its a short list. The Canada Small Business Financing Program (CSBFP) can make it easier to obtain a bank term loan by allowing lenders to share the risk with Ottawa. But the program is designed to finance hard assets such as land and equipmentnot inventory, working capital or soft assets such as the skilled talent and intellectual property that are at the heart of most startups today.

The Business Development Bank of Canada provides some seed financing, but its geared toward export-oriented technology companies. And outside of the CSBFP, banks are in the business of providing lower-cost money, not high-risk startup capital, unless you offer solid collateral such as a hefty purchase order from a highly creditworthy client orgulp!your own home. There is one budding option that could become an important, even transformative, source of startup financing. But not just yet.

Crowdfunding allows entrepreneurs to harness the power of social media to gather small sums from each of a large number of peopleand without having to file a prospectus with securities regulators. The U.S. House of Representatives has just passed a bill thats now before the Senate to permit firms to raise up to US$1 million per year by selling equity through crowdfunding sites, or up to US$2 million if they provide audited financial statements.

In Canada, provincial laws permit crowdfunding sites to offer investors rewards of products and services, such as copies of artistic works or fun experiences, but not to sell equity. Our legislatures have not yet turned their minds to crowdfunding, says Wise. However, this past January, the CATAAlliance, an Ottawa-based high-tech industry association, kicked off a campaign urging provincial securities regulators to adopt an approach akin to that in the U.S. legislation.

Fortunately, one financing source thats as old as capitalism itselffriends and familyhas, in the past few years, become a more promising option. Sparaga points out that because Canada hasnt felt the full effects of the economic upheaval in the U.S. friends and family here still have money to invest.And, says Simpson, ultralow interest rates have made people more receptive to investments with the potential for a decent return.

As well, says Wise, With the 2008 debt crisis, mutual funds lost so much value that many investors lost faith in them. [People are] more open to a bigger variety of options, including investing in startups. Another factor that has made it easier to obtain financing from friends and family is the falling cost of launching a business.

The Ewing Marion Kauffman Foundation, a Kansas City, Mo.-based body that promotes entrepreneurship, estimates that, stateside, it costs just US$31,000 to start the average firm. This rises to still fairly modest averages of US$82,000 for construction companies, US$98,000 for retailers and US$175,000 for manufacturers. Wise says even many non-tech firms have become cheaper to launch. Key reasons include access to free or cheap online business tools, endless price-cutting by suppliers facing ever-tougher competition and the economys shift away from capital-intensive activities.

The drop in startup costs is most dramatic within the digital realm. Thanks to trends such as the vast economies of scale that the Web has made possible and almost free server time for developers, you can launch, say, a software firm for a small fraction of what it would have cost a decade ago. It takes only $25,000 to $50,000 to build a proof of concept for software, says Wise. A sum of that size is far easier to raise from friends and family than $250,000 would be, he says: Because the amount needed for a startup has shrunk, the number of people who can fulfil that need has become much higher.