Fact Sheet Target Date Retirement Funds Tips for ERISA Plan Fiduciaries

Post on: 11 Апрель, 2015 No Comment

Target Date Retirement Funds — Tips for ERISA Plan Fiduciaries

U.S. Department of Labor

Employee Benefits Security Administration

February 2013

Target date retirement funds (also called target date funds or TDFs) have become an increasingly popular investment option in 401(k) plans and similar employee-directed retirement plans. The U.S. Department of Labors Employee Benefits Security Administration (EBSA) prepared the following general guidance to assist plan fiduciaries in selecting and monitoring TDFs and other investment options in 401(k) and similar participant-directed individual account plans. Employers and other plan fiduciaries can learn more about their fiduciary responsibilities under the Employee Retirement Income Security Act of 1974 (ERISA) by visiting EBSAs Compliance Assistance page.

Target Date Fund Basics

With the growth of 401(k) and other individual account retirement plans, many more participants are responsible for investing their retirement savings. Target date retirement funds, or TDFs, can be attractive investment options for employees who do not want to actively manage their retirement savings. TDFs automatically rebalance to become more conservative as an employee gets closer to retirement. The target date refers to a target retirement date, and often is part of the name of the fund. For example, you might see TDFs with names like Portfolio 2030, Retirement Fund 2030, or Target 2030 that are designed for individuals who intend to retire during or near the year 2030. Because of these features, many plan sponsors decide to use TDFs as their plans qualified default investment alternative (QDIA) under Department of Labor regulations. A QDIA is a default investment option chosen by a plan fiduciary for participants who fail to make an election regarding investment of their account balances. (1 )

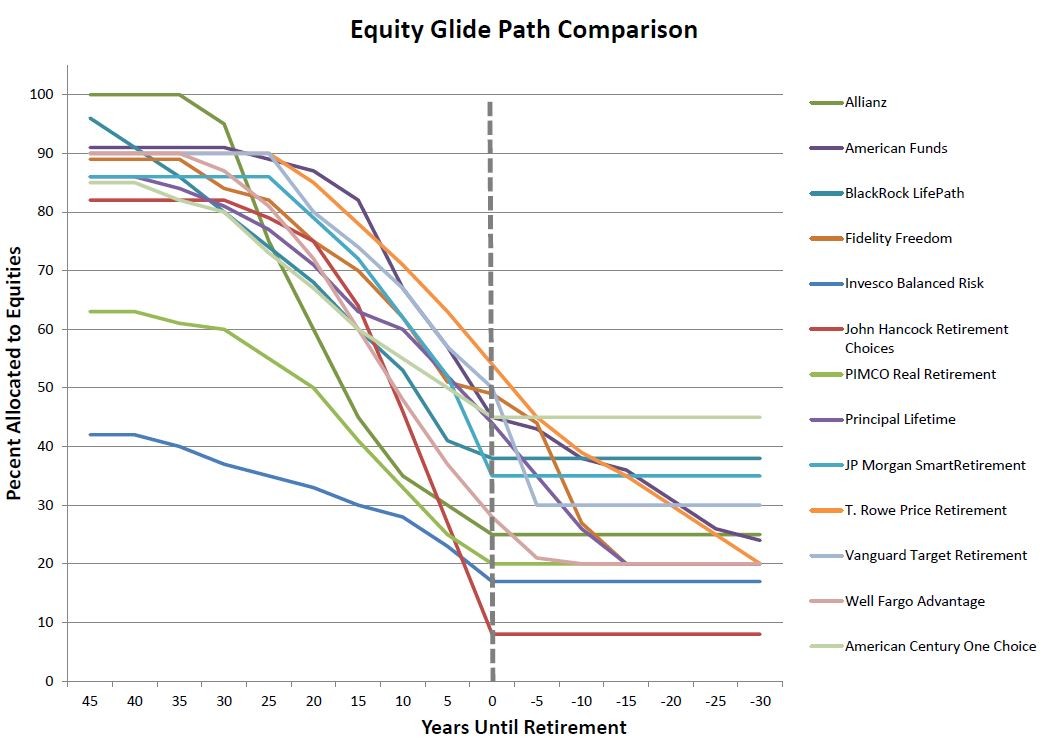

TDFs offer a long-term investment strategy based on holding a mix of stocks, bonds and other investments (this mix is called an asset allocation) that automatically changes over time as the participant ages. A TDFs initial asset allocation, when the target date is a number of years away, usually consists mostly of stocks or equity investments, which often have greater potential for higher returns but also can be more volatile and carry greater investment risk. As the target retirement date approaches (and often continuing after the target date), the funds asset allocation shifts to include a higher proportion of more conservative investments, like bonds and cash instruments, which generally are less volatile and carry less investment risk than stocks. The shift in the asset allocation over time is called the TDFs glide path. It is important to know whether a target date fund’s glide path uses a “to retirement” or a “through retirement” approach. A “to” approach reduces the TDF’s equity exposure over time to its most conservative point at the target date. A “through” approach reduces equity exposure through the target date so it does not reach its most conservative point until years later.

Within this general framework, however, there are considerable differences among TDFs offered by different providers, even among TDFs with the same target date. For example, TDFs may have different investment strategies, glide paths, and investment-related fees. Because these differences can significantly affect the way a TDF performs, it is important that fiduciaries understand these differences when selecting a TDF as an investment option for their plan.

What to Remember When Choosing Target Date Funds

- Establish a process for comparing and selecting TDFs. In general, plan fiduciaries should engage in an objective process to obtain information that will enable them to evaluate the prudence of any investment option made available under the plan. For example, in selecting a TDF you should consider prospectus information, such as information about performance (investment returns) and investment fees and expenses. You should consider how well the TDFs characteristics align with eligible employees ages and likely retirement dates. It also may be helpful for plan fiduciaries to discuss with their prospective TDF providers the possible significance of other characteristics of the participant population, such as participation in a traditional defined benefit pension plan offered by the employer, salary levels, turnover rates, contribution rates and withdrawal patterns.

- Establish a process for the periodic review of selected TDFs. Plan fiduciaries are required to periodically review the plans investment options to ensure that they should continue to be offered. At a minimum, the review process should include examining whether there have been any significant changes in the information fiduciaries considered when the option was selected or last reviewed. For instance, if a TDFs investment strategy or management team changes significantly, or if the funds manager is not effectively carrying out the funds stated investment strategy, then it may be necessary to consider replacing the fund. Similarly, if your plans objectives in offering a TDF change, you should consider replacing the fund.

- Understand the funds investments the allocation in different asset classes (stocks, bonds, cash), individual investments, and how these will change over time. Have you looked at the funds prospectus or offering materials? Do you understand the principal strategies and risks of the fund, or of any underlying asset classes or investments that may be held by the TDF? Make sure you understand the funds glide path, including when the fund will reach its most conservative asset allocation and whether that will occur at or after the target date. Some funds keep a sizeable investment in more volatile assets, like stocks, even as they pass their target retirement dates. Since these funds continue to invest in stock, your employees retirement savings may continue to have some investment risk after they retire. These funds are generally for employees who dont expect to withdraw all of their 401(k) account savings immediately upon retirement, but would rather make periodic withdrawals over the span of their retirement years. Other TDFs are concentrated in more conservative and less volatile investments at the target date, assuming that employees will want to cash out of the plan on the day they retire. If the employees dont understand the fund’s glide path assumptions when they invest, they may be surprised later if it turns out not to be a good fit for them.

- Review the funds fees and investment expenses. TDF costs can vary significantly, both in the amount and types of fees. Small differences in investment fees and costs can have a serious impact on reducing long term retirement savings. (2 ) Do you understand the fees and expenses, including any sales loads, for the TDF? If the TDF invests in other funds, did you consider the fees and expenses for both the TDF and the underlying funds? If the expense ratios of the individual component funds are substantially less than the overall TDF, you should ask what services and expenses make up the difference. Added expenses may be for asset allocation, rebalancing and access to special investments that can smooth returns in uncertain markets, and may be worth it, but it is important to ask.

- Inquire about whether a custom or non-proprietary target date fund would be a better fit for your plan. Some TDF vendors may offer a pre-packaged product which uses only the vendors proprietary funds as the TDF component investments. Alternatively, a custom TDF may offer advantages to your plan participants by giving you the ability to incorporate the plans existing core funds in the TDF. Non-proprietary TDFs could also offer advantages by including component funds that are managed by fund managers other than the TDF provider itself, thus diversifying participants exposure to one investment provider. There are some costs and administrative tasks involved in creating a custom or non-proprietary TDF, and they may not be right for every plan, but you should ask your investment provider whether it offers them.

- Develop effective employee communications. Have you planned for the employees to receive appropriate information about TDFs in general, as a retirement investment option, and about individual TDFs available in the plan? Just as it is important for the plan fiduciary to understand TDF basics when choosing a TDF investment option for the plan, employees who are responsible for investing their individual accounts need information too. Disclosures required by law also must be considered. The Department published a final rule that, starting for most plans in August 2012, requires that participants in 401(k)-type individual account retirement plans receive greater information about the fees and expenses associated with their plans, including specific fee and expense information about TDFs and other investment options available under their plans. The Department of Labor is also working on regulations to improve the disclosures that must be made to participants specifically about TDFs. For example, in addition to general information about TDFs, the proposed regulations call for disclosures to include an explanation that an investment in a TDF is not guaranteed and that participants can lose money in the fund, including at and after the target date. Check EBSAs website for updates on regulatory disclosure requirements.

- Take advantage of available sources of information to evaluate the TDF and recommendations you received regarding the TDF selection. While TDFs are relatively new investment options, there are an increasing number of commercially available sources for information and services to assist plan fiduciaries in their decision-making and review process.

- Document the process. Plan fiduciaries should document the selection and review process, including how they reached decisions about individual investment options.