Facebook IPO Wall Street Journal

Post on: 2 Июнь, 2015 No Comment

By Kaitlyn Kiernan

Bears looking to profit from a further fall in Facebook Inc. took the long view Monday, buying contracts that are liable to pay off if poor earnings this summer add to the companys run of bad news.

While June and July bets have been most active since Facebook options began trading last Tuesday—accounting for more than half of the total options outstanding—contracts expiring in August and September have been picking up steam.

Downside options that expire after the companys first public earnings report—expected at the end of July, though no date has been set—were the most actively traded Monday. The most popular positions included bets Facebook would fall below $25 a share over the next two to three months.

Facebook shares fell 82 cents, or 3%, to $26.90 in 4 p.m. Nasdaq Stock Market trading.

August $25 puts traded more than 11,400 times, while September $25 put options exchanged hands nearly 9,800 times. Put options convey the right to sell stock at a set price by a specific date. With an average price of $2.45 and $2.76 apiece, respectively, the options require Facebook shares to decline at least 16% by Aug. 18 and 17% by Sept. 22 to break even.

People are looking into more regular option plays now around earnings and moving away from the purely speculative short-term options, said Henry Schwartz, president at option-data firm Trade Alert. Whereas short-term bets accounted for as much as 27% of total volume on the first day of Facebook-option trading, on Monday it slipped to just 14%, he said.

The elevated activity in August and September contracts came as Facebook options notched a fifth consecutive day of heavy volume. In the first four days that Facebook options were available for trading, the company averaged more than 290,000 contracts traded a day, making it by far the most active Internet company.

Youve got remarkable volumes, because it seems like everyone you talk to has an opinion on where Facebook is going, and so you see a lot of different strategies being used, said William Lefkowitz, options strategist for vFinance Investments.

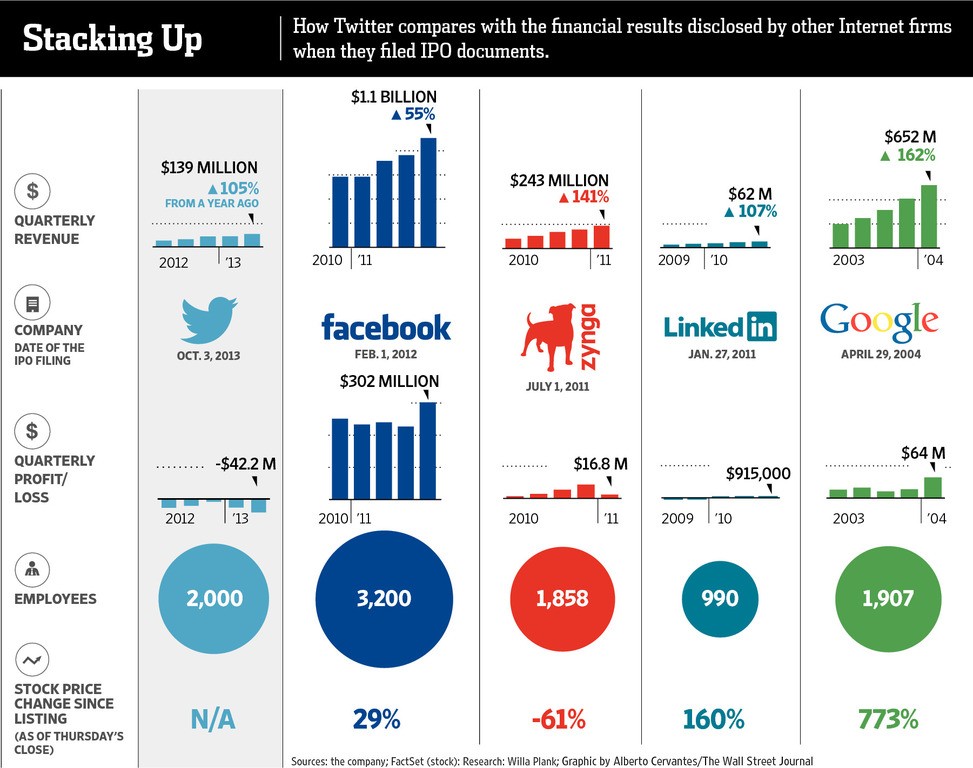

By comparison, Google Inc. options trade an average of 76,400 contracts a day, and professional-networking website LinkedIn Corp. averages 40,200. Social-games firm Zynga Inc. from which Facebook derived about 15% of its revenue in the first quarter, averages 37,600 options traded daily, according to Trade Alert data.

About 233,000 Facebook options had traded on Monday.

By Alexandra Scaggs

Analyst Ben Rose says he had three TV interviews in one week, compared with about three in a typical year.

Dominick Reuter for The Wall Street Journal

Ben Rose is used to doing about three television interviews a year. After he rated Facebook Inc.s stock a sell last month, the analyst had three in one week.

No one was really calling before, says the 51-year-old Mr. Rose, who started Battle Road Research Ltd. a four-employee firm based in Waltham, Mass. in 2001.

Facebooks initial public offering has caused lots of headaches for the investment banks who worked on the deal—and then watched the social-networking companys shares sink more than 25% since their debut May 18. In Monday afternoon trading, the stock was down another 1.6% to $27.33.

But for research analysts like Mr. Rose who follow Facebook and work at small firms, the companys headline-grabbing IPO has been a boon. With analysts at many large financial firms squelched by the mandatory quiet period because their companies were involved in the stock sale, Mr. Rose and his below-the-radar brethren are basking in newfound attention.

Under a Securities and Exchange Commission rule, managers and co-managers of an offering arent permitted to publish opinions on a stock for 40 calendar days after an IPO. For Facebook, that disqualifies analysts at 33 firms from commenting before June 27, according to Dealogic.

The first analyst to issue a rating on Facebook stock was Michael Pachter of Wedbush Securities, a unit of Wedbush Inc. Two weeks before the IPO, he released a report claiming Facebook was worth $44 a share—or $6 more than the eventual offering price of $38.

Mr. Pachter rated Facebook an outperform and has blamed the Menlo Park, Calif. companys underwriters for the stocks slide. His comments have led to an uptick in media-appearance requests, not just for him but for the rest of Wedbushs research division as well, he says.

A longtime analyst, Mr. Pachter is used to making high-profile calls, even if he isnt always correct. He issued a widely publicized sell rating on Netflix Inc. when the stock was below $40. The shares ended Friday at $62.95—and hit $295 in July 2011.

The more often our firm is on television, the better, Mr. Pachter says.

Brian Wieser of Pivotal Research Group slapped a sell rating on Facebook the day its shares began trading. Since then, the New York firm has gotten more calls from potential clients outside its core areas of telecommunications, media and technology.

On the margin, it definitely helps, even with existing clients, says Jeff Wlodarczak, Pivotals chief executive. The sell rating on Facebook, he adds, has raised the firms profile since Facebook became somewhat of a national obsession.

Of the 13 U.S. analysts who initiated coverage on Facebook, seven issued buy ratings, two went with neutral and four urged clients to sell. Since the stock began trading, it has fallen below nearly all of the price targets. Analyst Carlos Kirjner of Sanford C. Bernstein & Co. AllianceBernstein LPs research division, was the most bearish and on Monday assigned the stock a $25 price target and an underperform rating.

On Thursday, Pivotals Mr. Wieser upgraded Facebook to hold, saying the risks are now reflected in the stock price.

The publicity is worth more than just bragging rights. One way that research analysts get paid is the so-called vote system. A chunk of the commissions brokerages earn from trading business is divvied up and sent to the analysts who provide portfolio managers with research.

Portfolio managers decide by a vote which analysts and firms receive that money. The more votes an analyst receives, the more money is likely to flow from the brokerage, so recognition of an analyst helps. For an independent, boutique firm, the payments could make up the entire revenue stream.

And timely, provocative or prescient research calls can attract new clients to firms that rely on subscriptions to help finance their research.

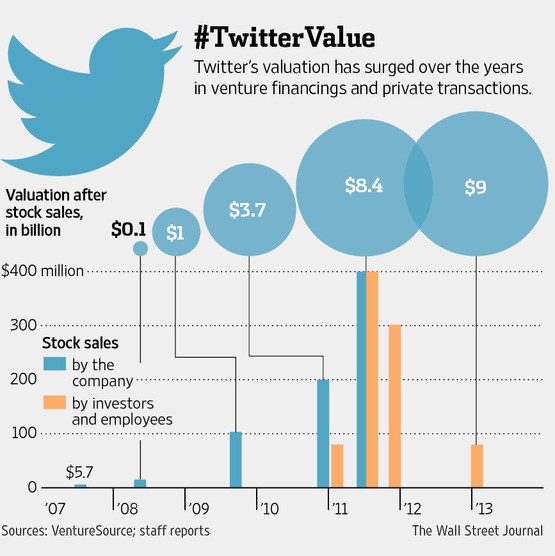

Under a recent change to the SEC rule, managers and co-managers of an offering could immediately offer research on companies with revenues of less than $1 billion before their stock sales. Facebook wouldnt have qualified for the exemption, having brought in more than $3.7 billion in 2011, according to the company prospectus.

With the underwriters due to start chiming in within three weeks, Mr. Pachter of Wedbush acknowledges his time in the spotlight may be drawing to a close. Still, its better to be first than to be out there saying something that looks like youre following everyone else, he says.

Corrections & Amplifications

Ben Rose is an analyst at Battle Road Research. A previous version of this article gave his name as Brian.

By David Benoit

Bernstein has delivered a new blow to Facebook this morning: A $25 price target.

Facebook shares, two weeks into their life as the most heavily-traded IPO of all time, face a material risk because investors will question the companys ability to meet 2013 forecasts, Bernstein says.

Therefore, it is difficult to argue for owning the stock today, the firm adds to its underweight rating.

The price target is the lowest target on the street, according to FactSet Research. There are 15 ratings, of which seven are the equivalent of buy, four are a hold and four are a sell, according to the data provider.

Bernstein says it bases its opinion on advertising forecasts and it has doubts that social advertising will prove to be disruptive enough to beat back rival Google. The firm says Facebooks ad-revenue growth has seen a rapid deceleration over the recent quarters but while that will ease off it will lag Googles growth rates.

Bernstein does say it is possible the social advertising will outperform Google, but that over the next 12 months too many questions wont be answered, so Bernstein is avoiding the stock for now.

Facebook shares down 1.5% to $27.30 premarket.

-Alexandra Scaggs contributed to this post.

By David Benoit

Groupon shares are hitting a new low today on huge volume as the lockup expires from its IPO.

The daily-deals site is down nearly 10%, touching $9.55, the lowest the stock has hit since its November IPO. The volume on the stock Friday is already twice as much as its 30-day average an hour into trading.

The volume and the drop are attributable to a sharply higher float today. More than 93% of the companys shares outstanding will become available to trade today, Susquehanna noted recently, but the good news is that the top executive group together owns a third of the shares outstanding and venture-capital firms hold another third. With the stock just half its $20 IPO price, we are not sure about VC appetite to be selling at current levels.

But the fear of insiders cashing out is spooking investors, it seems.

This, of course, is what Facebook says it was trying to avoid by pushing its insiders to sell more shares into the IPO. The idea, the social network claimed, was to ease the amount of shares that would flood the market at later dates, thereby easing the worries of investors and avoiding a stock plunge.

For Facebook, though, the plunge came earlier than Groupon. Facebook is currently down 6%, giving back all of Thursdays afternoon rally and back below $28 to $27.82. It already clinched the worst big U.S. IPO on record, through 2 weeks, according to Dealogic, and is not looking to start its second week much better.

Andrew Fitzgerald contributed to this post.

By David Benoit

Ross Mantle for The Wall Street Journal

James Gorman took to CNBC this afternoon to talk all things Morgan Stanley and Facebook.

The CEO defended his banks role in the controversial IPO and said the bank was not facing any liquidity concerns in the midst of a looming Moodys downgrade.

Here are some highlights of his thoughts on Facebook:

Investors looking for short term pop were naive: Gorman said that Facebook is hoping to establish a long-term investor base, and he hopes that such buyers havent panicked as Facebook is in a volatile period. And to those looking for that quick pop, Gorman said youre naive and you bought under the wrong pretense.

A potent elixir mixed up trouble: Buyers and sellers didnt know what they were gettingThat confusion in, frankly, a deal of almost unprecedented size against a macro backdropcreated apotent elixir, if you will, that really set this thing aflame.

On retail allocation: Retail investors were given 26%, Gorman said, in line with the Journals reporting. Gorman said this wasnt entirely out of the ordinary, citing offerings from GM and Kraft, which he said also had lots of retail demand.

On raising the offerings size: Gorman said the decision to increase the offering size, here by 25%, wasnt terribly unusual. He also said the deal had unprecedented retail demand at Morgan Stanley.

(Despite Gormans remarks about the share-increase size, in fact its terribly unusual to both raise the size of the deal and the price to a new range. In the 4,674 U.S.-listed IPOs to price since 1995, only 3.4% have dared to raise the expected range and the amount of shares, according to Dealogic. One was GM, which Gorman referenced several times.)

Dont give up hope yet: This is an American celebrationthe story isnt overwe have to be a little patientWe just all need to settle down a bit, get to the right price and get back to the fundamentalsLets have this conversation in 12 months.

Facebook shares jumped 5% Thursday in a strong rebound from the days lows, a move Gorman was eager to tout. Still the stock his bank led into the public markets has ended its first two weeks as the worst large IPO in history. Down 22% from its IPO price, no other IPO that raised at least $1 billion has done worse for that time period, according to Dealogic.

-Brett Philbin contributed to this post.

By Steven Russolillo

Reuters

Facebook shares reversed early losses and finished sharply higher in another rocky trading session for the social network.

Shares finished up 5% to $29.60, with trading volume picking up sharply in the final hour of trading. Earlier the stock tumbled as much as 4.8% and hit a fresh low of $26.83, before snapping back.

The stock received a mix reaction from analysts today. Topeka Capital Markets started shares with a buy rating and $40 price target, while S&P reiterated its sell rating and slashed its price target to $27 from $30.

Shares of Morgan Stanley, the lead underwriter behind Facebooks IPO, also reversed course and finished higher. The stock rose 2.1% to $13.36, after earlier dropping as much as 1.5%.

Facebooks turnaround occurred as major stock indexes pared earlier losses, but still finished in the red. The Dow closed down 26 points, or 0.2%, to 12393, its second straight decline.