F&C moves into private equity

Post on: 6 Май, 2015 No Comment

Platform Focus: James Hay

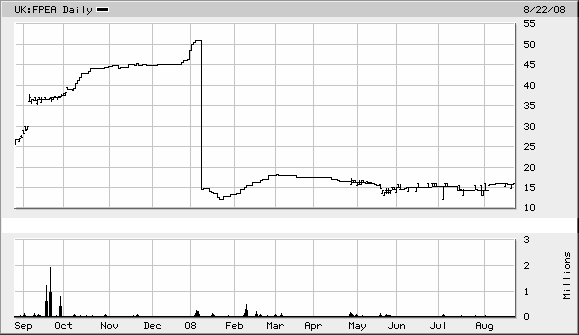

The deal, carried out for an undisclosed sum, will see a team of three managers led by Hamish Mair relocate to F&C’s Edinburgh office.

The board of Martin Currie’s capital return trust, currently managed by Mair’s team, has transferred the investment mandate to F&C.

The board of the Discovery trust, managed by F&C, has issued proposals for a vol-untary liquidation and transfer of assets to the capital re- turn trust.

Discovery’s proposals are expected to become effective in August, when the enlarged trust will be renamed the F&C private equity trust, with assets in excess of 90m.

Friends Provident has committed to a 20m investment in the new trust.

The F&C private equity trust will be spread across 30 private equity funds with over 200 underlying investments in Europe, North America and the UK.

F&C also plans to overhaul two-thirds of its UK growth and income fund after it was taken over by Ted Scott.

Scott has been reducing positions in defensive stocks such as Alliance Unichem and Severn Trent, believing the market is entering a bullish phase. He thinks the recent sell-off in small- and mid-caps has thrown up strong buying opportunities.

Plan Invest joint managing director Michael Owen says: A few people have been buying private equity firms. F&C has a wide-ranging operation and probably feels it needs to offer all things to all men.

But some of its performance needs to be improved and, on the equity side, it makes good sense to overhaul its UK fund.

Mark Hargraves is being replaced by Jeremy Lodwick as manager of Framlington’s international growth fund and reducing holdings by a third. Hargraves will continue to advise on the European part of the portfolio. Lodwick joined Framlington as CIO from Morgan Stanley in late 2004. The fund will also change its name to the managed growth fund. In addition, Framlington’s high-income fund, managed by George Luckraft, will change its name to the Framlington managed income fund. The Framlingtion European bond fund, managed by Chris Armstrong, will also change its name to the Framlington pan-European bond fund.

Kwik-Fit Financial Services is signing a single-tie deal with Legal & General to provide life insurance services. L&G will be the sole provider of critical illness, mortgage protection and term insurance products for the firm which is a subsidiary of automotive firm Kwik-Fit. Its current core products are car insurance, pet and household insurance and breakdown recovery services.

The FSA is publishing a booklet of case studies for young people called Helping Young Adults Become Financially Capable. It aims to help young people become more confident with money and will cover three sectors — further education, higher education and not in education, employment or training. The guide is available from the FSA’s website.

IFA network Mint Financial Services is expanding into Northern Ireland by hiring Leslie Johnston to head its business development services. Johnston has joined the 170 RI-strong network. Its head offices are in Chesterfield.

Skandia Investment Management has added Frank Blighe to its marketing team where he will be responsible for the marketing and promotion of the asset-management product range to the inter-mediary market. He will start this week, joining from Threadneedle, where he was head of UK marketing. He will report to head of marketing David Orr.

The Pensions Commission hosted a seminar this week to discuss options for the reform of the UK pensions system ahead of the publication of the Turner report. The three major political parties were in attendance and those representing the life and pension industry included the ABI.

Lifesearch has struck out at supermarkets, saying they cannot serve protection customers properly unless they make it clear what they are not offering as well as what they are. In its protection report Lifesearch says non-advisers merely take steps to ensure their brand-trusting customers ask no questions and make their own. Both Sainsbury’s Bank and Tesco Personal Finance have responded saying they meet the requirements of the FSA.

Holly MacKay has been appointed UK director of Allfunds Bank, the third-party fund distribution platform run by Abbey, as it opens its first UK office. Mackay was previously head of wrap propositions at Abbey, before administration of the wrap was taken over by James Hay.