Executive pay How much is not too much

Post on: 4 Май, 2015 No Comment

Should directors disclose?

Daniël Malan | @Moneyweb  | 27 November 2008 15:21

Concerns about executive remuneration just wont go away. People are intrigued by what other people earn this could perhaps be regarded as slightly voyeuristic because most average earners do not voluntarily disclose what they earn and are quite often prevented from such disclosure through confidential employment contracts. It is therefore no wonder that we are fascinated and perhaps a bit jealous of what the big earners earn. At the same time, just like tax payers have the right to know what public servants earn, shareholders have the right to know and should have the right to be part of decisions about what directors and executives earn.

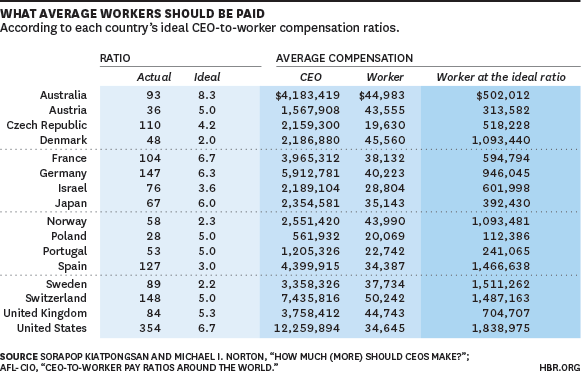

In South Africa this issue is particularly important because of high levels of unemployment and inequality, supported by the fact that the country has one of the highest Gini coefficients in the world. According to a recent Financial Mail survey the 600 directors of the top 40 companies on the JSE collectively earned R3bn over the last year, with the top two earners, Brad Mills (CEO of Lonmin) and Brian Bruce (CEO of Murray and Roberts) earning a whopping R126m and R99m respectively.

It is therefore not surprising that executive remuneration has received a lot of attention from the King III committee as part of its review of corporate governance standards for South Africa. According to CEO Lindie Engelbrecht the issues that the committee are considering include disclosure of performance targets, upfront approval of remuneration packages by shareholders and the need for disclosure of the top five earners per company, not only the remuneration of directors.

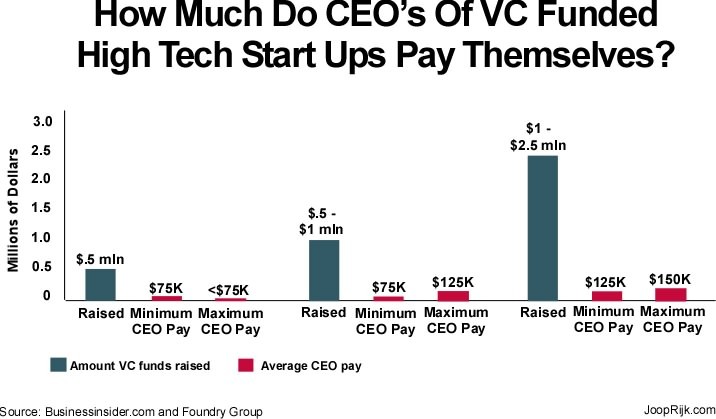

Share options is a particularly sensitive topic, since it goes to the heart of the agency problem in corporate governance if executives have share options they are tempted to steer the company in a direction that might result in short term gains (and therefore benefit their own pockets) but which might not be in the long term interest of the company or its stakeholders (including shareholders). The Public Investment Corporation (PIC) has taken a specific interest in this area. According to Deon Botha, Corporate Governance Specialist at the PIC, the PIC is not opposed to fair, even generous executive remuneration, provided that the remuneration is based on transparent and approved performance metrics that are aligned with the interests of long term investors. It is, however, of utmost importance that these metrics distinguish between the impact of macro-economic factors and individual performance. Executives should not be excessively rewarded just because of exogenous factors such as a commodities boom or the rallying of share prices in the construction industry. If you look at the gains which certain executives have made from share options over the past year, you have to ask whether they have deserved these enormous amounts of money. In other words, did they earn these amounts because of their exceptional management skills, or were they just in the right place at the right time? It is for this reason that the PIC is currently reconsidering its position on share options schemes.

Although disclosure is often seen as the most important strategy to prevent excessive remuneration, there are also some interesting arguments against disclosure: In a report prepared for the International Corporate Governance Network in 2002[i ], it was suggested that there is anecdotal evidence that highly paid executives are refusing to join the quoted company boards because this would reveal their earnings to the world. In addition, there is the danger that disclosure could have the opposite effect in terms of bringing down the numbers. According to Niall Fitzgerald, compensation disclosure can have the unintended consequence of increasing compensation levels no CEO wants to be at the median or in the lower quartile and a company may be required to meet those compensation demands if it wants to attract the best talent[ii ].

Disclosure certainly does more good than harm. But it has to be understood within context, with the most important criterion that of performance. In the same report to the ICGN mentioned above, the earlier point made by Deon Botha is supported: it would certainly help if institutional investors applauded high figures truly earned by the executive concerned. Therefore, basic disclosure guidelines that could be considered by companies should include the following: link remuneration to the performance of both the company and the individual, and disclose the numbers as a percentage of profits as well as a percentage of the average wage bill within the organization. Basic salary and share options should be reported separately, and share options should be reported on in terms of the number of years they were held before they were cashed in.

Hermes has recently published a set of concrete remuneration proposals[iii ] in the UK, primarily aimed at financial institutions in the wake of the credit crunch, but very useful in the broader context as well. In short, these proposals are:

Bonus structures should incorporate some risk metric and measure of the cost of capital involved in the deals which individuals are rewarded for;

There should be a change in the period over which performance is measured this period needs to match more closely the period over which it will become apparent whether a particular trade or deal was successful; and

Remuneration must go hand-in-hand with the culture that management is trying to inculcate in the organization, and therefore it is a topic that should be debated and handled by the whole board; the remuneration committee should still continue to play its role of making decisions on the remuneration of the CEO and top management, but where the pay of other staff is considered, the board as a whole needs to take ownership.

Hermes also argues that companies should be allowed to meet and discuss these measures with each other without falling foul of regulatory constraints in terms of anti-competitive behavior. If this is not allowed it is unlikely that any one company will take the lead on this issue.

The final question that usually remains unanswered is: How much? Both King II and the Combined Code in the UK state that levels of remuneration should be sufficient to attract, retain and motivate directors of the quality required to run the company successfully. The Combined Code tries to be more specific but really adds nothing by stating that a company should avoid paying more than is necessary for this purpose. Fair pay based on performance seems to be the only consistent guideline. Fair pay based on what others earn could have the opposite effect, as mentioned above and neatly summarised by an unidentified UK CEO: If salaries for the average FTSE chief executive were half as much, then relative to each other, they would still be more concerned about the relativity than they would be about whether its half.[iv ]

*Daniel Malan is the KPMG special adviser on ethics and governance and head of the unit for corporate governance in africa at the university of stellenbosch business school. The views and opinions of the author do not necessary reflect those of KPMG or the University of Stellenbosch Business School.

[i ] Executive Remuneration the caucus race? A Report to the International Corporate Governance Network, July 2002, available at www.icgn.org/organisation/documents/erc/remunerationreport.pdf

[ii ] Quoted in Using the OECD Principles of Corporate Governance: A Boardroom Perspective, OECD, 2008, p. 44, available on www.oecd.org.

[iii ] The Bad and the Ugly. Hermes Equity Ownership Services: Imperatives arising out of the crisis. November 2008.

[iv ] Source: Does Best Practice in Setting Executive Pay in the UK Encourage Good Behaviour?. by Ruth Bender and Lance Moir. Journal of Business Ethics (2006) 67:75 91.