Exchangetraded funds cash in on commodities

Post on: 14 Май, 2015 No Comment

Soaring oil, corn, wheat and other commodity prices are squeezing consumers. But you don’t have to take it anymore. Thanks to exchange-traded funds, you can make money from rising commodity prices.

I’ll give you a few ideas in a minute, but first some background.

Commodities include energy products such as crude oil and natural gas, agricultural products such as corn and coffee, industrial metals such as copper and lead, precious metals such as gold and silver, and livestock such as cattle and hogs.

Until recently, buying futures options was the only way to invest in commodities. But because they are short-term vehicles that could expire worthless, futures were too risky for most individual investors.

But the advent of exchange-traded funds that track commodity indexes has made commodity investing doable for individual investors.

Exchange-traded funds, as you may know, are similar to index mutual funds. They track the performance of a specific market segment by following its index — for example, the S&P 500.

ETFs trade just like regular stocks, and you pay the same commissions that you would for trading stocks. Unlike conventional mutual funds, which discourage frequent trading, you can buy and sell the same ETF all day long, should you desire.

You can also sell them short. Short sellers profit when the stock or ETF that they’ve shorted drops in price but lose if it goes up instead.

Originally, ETFs tracked mostly stock indexes. But over the past two or three years, ETFs have been introduced that track indexes reflecting commodity futures prices. Or, in the case of gold and silver, the ETFs actually track the prices of the metals.

But the ETF shares do not trade at the same price as the commodity. For instance, an ETF tracking crude oil doesn’t trade at the same price as a barrel of oil. Instead, it trades at a specified fraction of the crude oil price.

For the most part, ETF share prices move the same percentage as the commodity. For instance, if crude oil prices double, so will the corresponding ETF’s share price.

Consider expense ratios

But ETFs, like mutual funds, have expenses that prevent them from fully tracking the performance of the tracked commodity. For instance, a 1 percent expense ratio would subtract 1 percent from an ETF’s annual return. In most instances, ETF expense ratios run below 1 percent.

Both MSN Money (www. moneycentral.msn.com ) and Morningstar offer ETF performance charts that you can use to compare the returns of various ETFs over selected time frames. I used Morningstar to do the research for this column. From Morningstar’s home page (www.morningstar.com ), select ETFs, then click on View Complete List in the Most Popular ETFs by Trading Volume section. Finally, click on the time frame of interest to sort the list with the best performers at the top.

Funds with good returns

I looked for commodity ETFs that had recorded strong performance over the past 12 months and were still going strong based on their last three-months’ returns. Here are some that caught my eye.

— PowerShares DB Agriculture (ticker symbol DBA) is a pure play on the price of the most widely traded agricultural commodities: soybeans, corn, sugar and wheat. The fund tracks an index reflecting futures prices for these four commodities, but is intended to reflect the performance of the agricultural products in general. This is a sector that has only recently taken off. The fund has gained 44 percent over the past three months, accounting for most of its 61 percent 12-month return.

— IShares S&P GSCI Commodity Indexed Trust (GSG ) tracks a broad index of 24 commodities weighted according to the proportion of the commodity flowing through the economy. Almost half of the index reflects crude oil, and the balance is split among other energy products such as natural gas as well as agricultural commodities, industrial and precious metals, and livestock. The fund has returned 44 percent over the past 12 months and 12 percent over the past three months.

— If you want a more diversified commodity play, the iPath Dow Jones-AIG Commodity Index Fund (DJP ) tracks an index comprised of 30 percent energy, 30 percent agricultural, 20 percent industrial metals, 10 percent livestock and 10 percent precious metals. The fund returned only 27 percent over the past 12 months but, reflecting the current hot agricultural commodity market, is up 17 percent over the past three months.

— If you want a pure play on oil, the United States Oil Fund (USO ) tracks the futures prices of West Texas Intermediate light, sweet crude oil. The fund recorded a 57 percent gain over the past 12 months. While the pace has slowed, oil prices are still moving up and the fund has gained 5 percent over the past three months.

— For a more diversified energy play, the PowerShares DB Energy Fund (DBE ) replicates an index tracking the prices of two different grades of crude oil, heating oil, gasoline and natural gas. The fund has returned 49 percent over the past year and 10 percent over the past three months.

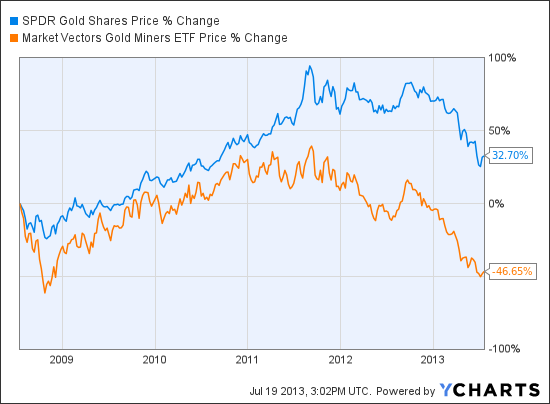

— If you are interested in gold, the streetTracks Gold Shares Fund (GLD ) tracks the price performance of gold bullion. The fund returned 38 percent over the past year and 15 percent over the past three months.

— If you want to mix some silver in with your gold, the iShares Silver Trust (SLV ) tracks the price of that precious metal, which until recently had gone nowhere. But now it’s on a tear. The fund has gained 27 percent in the past three months.

Commodity prices are notorious for going through boom and bust phases, and many experts think that they’ve already overshot on the upside. Others, pointing to the growing economies in China, India, Brazil and other emerging countries, say commodity prices can only head higher.

But all would agree that commodities are risky business. So don’t put the kids’ college money, or funds you’ll need for retirement, there.