Exchange rate regimes fixed and floating currency policy

Post on: 24 Апрель, 2015 No Comment

Countries have multiple choices when it comes to exchange rate policy. At one end are the floating exchange rate regimes where the price of the local currency is determined only by market forces. If travelers, importers, exporters, and international investors demand more (or less) of a certain currency, its price goes up (down).

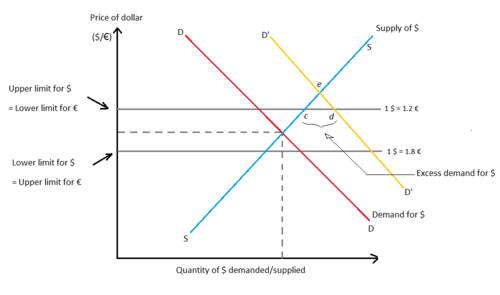

Fear of floating

There are very few countries that have a purely floating exchange rate. Only the very large economies such as the U.S. the eurozone, and Japan have policies that come close to that type of a currency policy. However, even these countries occasionally interfere in currency markets. Fixed exchange rates are more widespread but most countries have the so-called managed exchange rate regimes, also known as dirty float. Under that policy, currency values are allowed to adjust to market conditions. However, if exchange rate changes become too large, the government or the central bank of the country intervenes to keep currency values within certain bounds.

Why so few countries have a floating exchange rate? The reason is that large changes in currency values create uncertainty and instability. If the local currency appreciates fast and by much, domestically produced goods and services become expensive on international markets and exports decline. If the currency depreciates fast and by much, the prices of imported goods would increase sharply and will cause high inflation.

Even if currency values don’t change much, the mere possibility that they might change drastically in the future creates problems. Would you buy investment assets in a country with an unstable currency? Probably not. Hence, we have the “fear of floating” phenomenon, a term coined by Guillermo Calvo and Carmen Reinhart, two well-known international economists.

Other exchange rate regimes

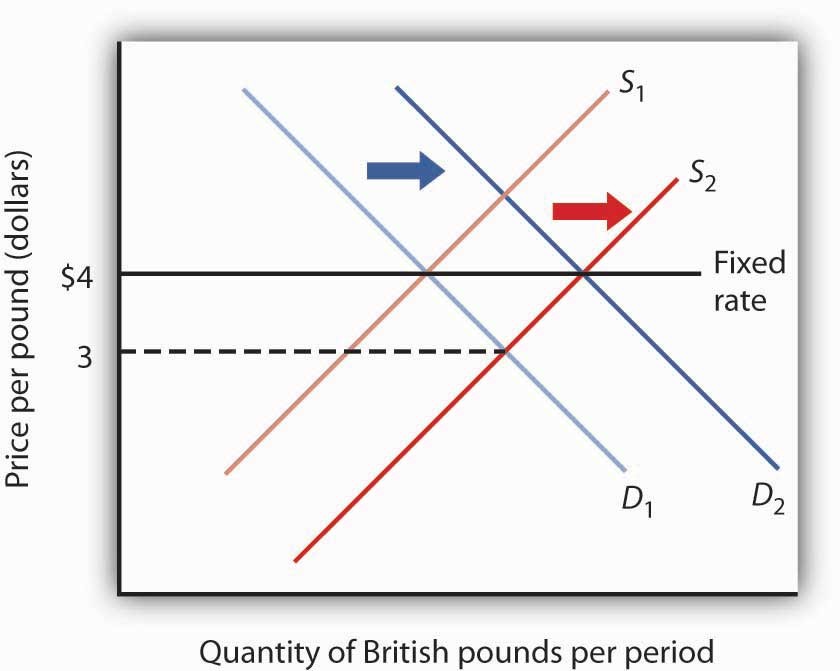

The fixed, flexible, and managed float regimes are part of the range of options available to countries. Other alternatives include dollarization when the local money is replaced with the dollar or the euro, currency boards when the government fixes the exchange rate and keeps very large foreign exchange reserves, and currency unions where several countries use the same currency. Another regime that is no longer in existence but was prevalent in the past is the gold standard. All of those are explained in separate articles.