Examples Of Dow ETFs

Post on: 16 Март, 2015 No Comment

For many people, investing in individual stocks is not possible. For some people, there is the issue of time. Researching individual securities for potential investment can be time-consuming, as can be the time required to maintain a portfolio of hand-picked stocks. For other investors there is the issue of feeling overwhelmed and unqualified to assemble a stock portfolio. It is due to these factors the ETFs, or Exchange Traded Funds, have enjoyed a surge of popularity in the last few years.

ETFs track an index or sector, and offer low fees and commissions and the tradability of a stock. You can invest in an ETF that tracks the tech sector, the Standard & Poors 500, as well as many more options. One popular way to speculate on the Dow Jones industrial Average is through investing in a Dow ETF.

A Dow exchange traded fund aims to track the price movements of the DJIA as closely as possible. The fund usually tracks the Dow by buying all the 30 individual stocks that make up the Dow Jones Industrial Average.

The Dow Jones index ETF is ideal for long term investors or shorter term speculators who dont have the ability, the desire or funds in invest in individual stocks.

Buying and selling large quantities of stocks can result in hefty fees from your stock broker. so this often isnt worth it if you dont have a considerable account balance. The Dow ETFs allow you to purchase a large variety of companies in one transaction.

What are the alternatives to a Dow ETF?

One obvious alternative that springs to mind is a mutual fund aimed at tracking the Dow Jones Industrial Average. These funds often do a good job, but the management fees tend to be high than those charged by ETFs, and should be considered when deciding on a Dow mutual fund.

What about an inverse Dow ETF?

An inverse Dow ETF aims to do the exact opposite of the Dow Jones Industrial Average. For example if the Dow rose by 3% in a particular week, the inverse ETF would aim go Down by 3% and vice versa. If you want to bet on the Dow going down, you could by an inverse Dow ETF.

Inverse Dow ETFs are complex, and volatile financial instruments and are not suitable for every investor. You should always exercise caution when investing in an inverse ETF.

Popular Dow ETFs

Long Dow Jones Industrial Average ETFs

Double Long Dow Jones Industrial Average ETFs (2X Long Leveraged)

DDM ProShares Ultra Dow30 ETF

Short DJIA ETFs

Double Short DJIA ETFs (2X Short Leveraged)

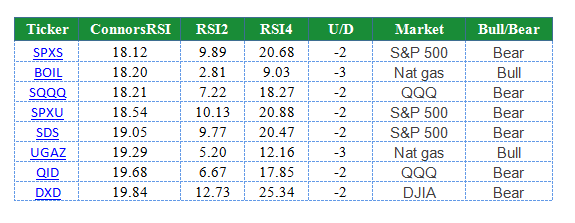

DXD ProShares UltraShort Dow30 ETF

What is a leveraged Dow ETF?

A leveraged fund is where the movements of the Dow are multipled. For example a 2x leveraged ETF would mean that if the Dow was up 3%, the fund would aim to be up 6% and vice versa. There are double and even triple leveraged Dow funds. Extreme caution is advised on any leveraged fund as the volatility and risk can often be very high.

Where can I buy a Dow ETF?

More information on stock brokers can be found here .