Examples Of AssetLiability Management_3

Post on: 4 Май, 2015 No Comment

As the first-ever definitive guide to Asset/Liability Management (ALM) across financial institutions, this book is essential in developing consistent frameworks for risk management. Leveraging the experience of 38 senior industry practitioners, it provides a unique and practical perspective on the practice of ALM covering:

- The management, techniques and practices of ALM in financial institutions

- The challenges facing depository institutions, the insurance industry, pension and mortgage providers

- The regulatory and accounting aspects of ALM options and decisions

An authoritiative resource, it is ideal for investment bankers, portfolio managers, traders, risk managers and equity analysts.

The target audience for this book includes a wide range of executives, investment bankers, equity analysts, debt capital market and sales professionals, portfolio managers, traders, actuaries, risk managers, analysts, and modelers. It is also intended to be suitable for MBA and PhD students in finance and the academic community in general: this field, like many others, can benefit tremendously from a more proactive collaboration between Wall Street and academia.

The main objective of the book is to help practitioners who ultimately affect ALM decisions to develop a broad perspective on philosophies, tools, and challenges that comprise the field of asset/liability management. By leveraging the experience and unique perspective of senior decision-makers from some of the worlds most sophisticated financial and educational organizations, this book attempts to create a forum where advances are communicated to a broad financial constituency and the critical importance of rigorous ALM for the viability of financial institutions is conveyed.

Note: Product cover images may vary from those shown

In over 25 chapters of one-of-a-kind insights from the leading minds in the area, giving you a unique perspective drawing on the experience of leading institutions. Here are a few examples of what you will find inside Asset/Liability Management for Financial Institutions.

Part 1

- Defines asset/liability management and illustrates the commonality of ALM tasks, approaches, challenges and solutions.

- ALM risks are presented in the context of the business of financial intermediation

- Links are established between ALM, risk management and corporate finance

Part 2

- Perspectives of players who significantly affect the way assets and liabilities are managed by financial institutions

- The current perception of ALM — and future directions — discussed by equity analysts and investors

- The role of traditional asset managers in the ALM of financial institutions

- The management of alternative investments, particularly hedge funds

Part 3

- Advanced techniques and practices that could benefit all financial institutions

- Financial modeling techniques applicable to ALM

- Applications of structures products to credit risk intermediation in the context of ALM

- Methodology for understanding counter-party risk following the increased use of hedging in derivatives markets

Part 4

Part 5

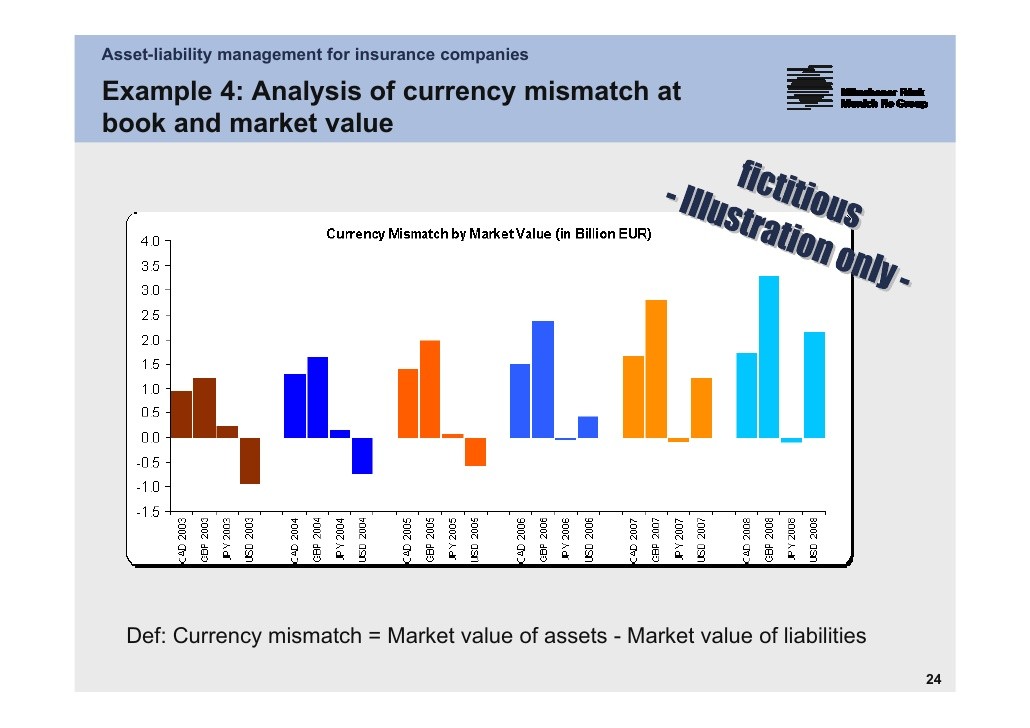

- ALM challenges specific to the insurance industry

- The impact of ALM of creditworthiness of insurance companies

- ALM in the context of life insurance

- ALM for property and casualty insurers

- The management of long and short options embedded in insurers’ balance sheets

Part 6

- ALM in the context of pension plans