Example of a Collar trade Options for Rookies

Post on: 12 Апрель, 2015 No Comment

Important: This is an example and

not a recommendation.

Let’s say you like the idea of buying 100 shares of Google (GOOG) because its price has dipped near 500. You believe that the stock has been oversold and you appreciate the growth prospects of the company, but fear that the current bear market may inflict further punishment on the share price. As I look at my screen (July 14, afternoon), GOOG is trading near $511. For the purposes of this example, let’s assume that you are willing to pay that price.

By the way, if this stock price is too high and you don’t have $50,000 to invest in one position, don’t be concerned. This example is for illustrative purposes only. My idea is to show you how to construct a collar, using a real example. When investing your money, pick stocks that you want to be part of your portfolio.

A collar consists of three parts (legs): Buy 100 shares of stock, buy one put, and sell one call. The put is the insurance policy, giving you the right to sell stock at the strike price, no matter how low the stock may tumble. The call limits your profit potential to the upside, but is sold to generate cash that can be used to pay for the put.

You establish the ‘deductible’ for your insurance policy by selecting an appropriate selling price for your shares, and thats the strike price of the put option. Let’s assume that $480 is acceptable and if the worst case scenario occurs, you are willing to sell stock at $480, guaranteeing that your loss will not exceed $31 per share. Of course, you may choose a different deductible by selecting a different strike price. The less you are willing to lose, the higher the strike price of the put. And as the strike rises, so does the price (premium) you pay for the put. All insurance policies work that way: reduced deductible requires payment of a higher premium.

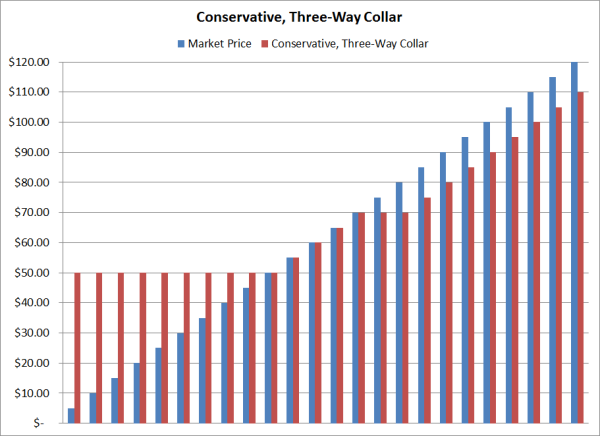

Let’s assume you buy 100 shares of GOOG at a total cost of $51,100. Not wanting to hold this stock unprotected, you immediately (you made the decision of which options to trade before you entered your order to buy stock) complete the collar by buying 1 GOOG Aug 480 put and selling 1 GOOG Aug 540 call. You pay $15.70 for the put and collect $18.10 for the call.  For the two option trades, you have a cash credit of $240, reducing your investment to $50,860.

What do you own?

You now have a collar that expires after the market closes on the 3 rd Friday of August. In this specific example, you own 100 shares of GOOG and have the right to sell those shares at $480. You are not obligated to sell; it’s your decision. That means the investment can never be worth less than $48,000 – or a loss of $2,860 (Don’t forget to add in commissions and the interest you are not earning because cash was used to buy stock.) You also accepted an obligation – and that’s to sell your shares at $540. If the stock is above 540 when expiration arrives, the call owner will exercise his/her rights to buy your shares – and you are obligated to sell. (You can cancel that obligation by repurchasing the Aug 540 call option but only if you do before you receive a notification that the option was exercised.)

If you are correct in believing this stock can rally, your maximum profit occurs if the stock is above the 540 strike price when expiration arrives. In that case, you sell your shares at $540mand earn a profit of $3,140.

It’s true that the profits are limited, but you make the trade and have an opportunity to earn a profit. But unlike traditional stock market investments, at the same time your portfolio is insured against a large loss. Trading that profit limit for protection a good deal, IMHO.

NOTE to more experienced traders: The collar is synthetically equivalent to selling a put spread. Thus, if you buy the Aug 480 put and sell the Aug 540 put, you own a position with the same risk and reward as the collar described above. The margin requirement for this position is $6,000 (minus the cash you collect when selling the spread).