ETFs V Funds Quantifying The Differences_4

Post on: 2 Май, 2015 No Comment

December 4, 2014

Invest In Leisure & Entertainment For 2015 Commentary

As we head directly into the heart of holiday spending season it’s natural that many traders are looking for opportunities in the leisure and entertainment industries. Leisure and entertainment have started to gain momentum and have gained nearly 3% over the past three months, as measured by the Powershares Dynamic Leisure & Entertainment Portfolio ETF ( PEJ ). For those unfamiliar with this exchange-traded fund. it invests at least 90% of its assets in 30 common stocks from areas such as design, production or distribution of goods or services within the leisure and entertainment industries. (For more, see: Investing in Leisure Funds .)

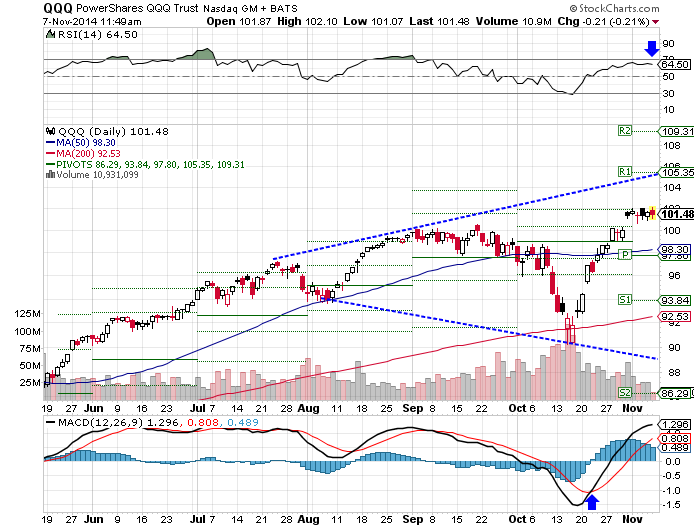

Given the niche nature of this fund it should be no surprise that it’s subject to greater risk and volatility than a broad-market fund. Taking a look at the chart below, you can see that the bulls have recently managed to send the price of the fund above several key long-term levels of resistance. The break above $34 creates an interesting risk/reward situation heading into the final days of 2014.

Based on the chart, it wouldnt be surprising to see bullish traders protect their position by placing a stop-loss order below the cluster of support levels near $34. The ascending trendlines and long-term moving averages will likely act as a floor in the event that the bears try to send the price lower. At this point, there are few ETFs better positioned for a stronger finish to 2014 than PEJ.

Powershares Dynamic Leisure & Entertainment Portfolio ETF ( PEJ )

The top holding, with a weight of 5.43%, in PEJ is Marriott International, Inc. ( MAR ) The hotel company boasts a market capitalization of approximately $22 billion and is trading in one of the strongest long-term uptrends found anywhere in the public market. Taking a look at the five-year weekly chart, you’ll see that the trend is so strong that there are no previous resistance levels to use as a guide for a potential target. Many bullish traders will try and enter a position as close to the 50-week average (blue line) as possible. Traders who were brave enough to enter a trade on the dip toward the average in early October have been rewarded handsomely. (For more, check out: Calculating Risk and Reward .) Marriott International, Inc. ( MAR )

When it comes to leisure, one go-to options is to sit back and to enjoy your favorite movie or television show. Two major players when it comes to entertainment are Time Warner Inc. ( TWX ) and Walt Disney Co. ( DIS ), both of which are top holdings of the PEJ fund. As you can see from the strong uptrends shown below, there are few sectors better positioned for growth than entertainment. Walt Disney Co. ( DIS )

The trends shown in the charts below will be extremely difficult to reverse, but as a precaution many traders will likely set their stop-loss orders below the 50-week moving averages (blue lines). (For more, see: Betting on the Entertainment Industry.) The Bottom Line Heading into the last month of the year is often the time that most people spend the most money in areas related to leisure and entertainment. As mentioned above, the Powershares Dynamic Leisure & Entertainment Portfolio ETF has already started to become a beneficiary of this trend, but it looks as though this will continue heading into 2015. Leisure companies such as Marriott International are trading within significant uptrends and don’t look to back off any time soon. (For related reading, see: Walt Disney: How Entertainment Became an Empire .) Refine Your Financial Vocabulary

Gain the Financial Knowledge You Need to Succeed. Investopedia’s FREE Term of the Day helps you gain a better understanding of all things financial with technical and easy-to-understand explanations. Click here to begin developing your financial language with this daily newsletter.

Casey Murphy previously worked as the Product manager of Investopedia’s markets, active trading and forex channels. Casey’s areas of specialization include active trading, technical analysis, ETFs, commodities, options and forex. Click here to follow Casey on Twitter.

Charts courtesy of stockcharts.com

At the time of writing, Casey Murphy did not own shares in any of the companies mentioned in this article.