ETFs Overview

Post on: 5 Апрель, 2015 No Comment

Find diversified, low-cost portfolio balancing ideas.

Reduce the risk of investing with Schwab’s research offering.

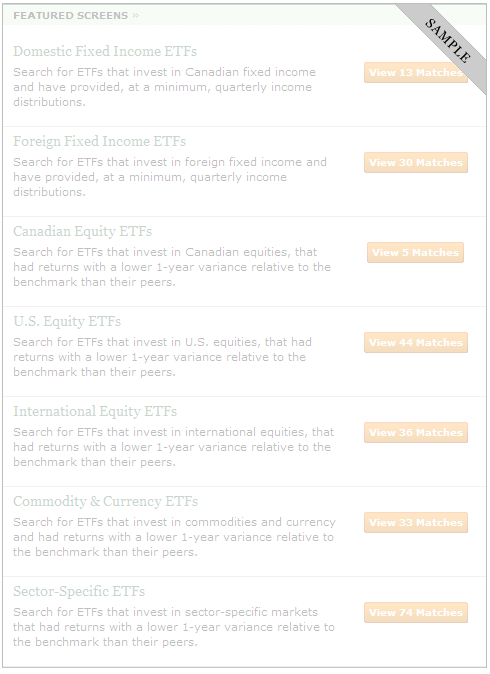

Use Schwab’s ETF Screener to search for ETFs that offer the exposure within various markets, industries, sectors, and asset indexes to fit your investing needs. Use our ETF Compare tool to compare ETFs diversification and risk to find investments that can help you balance your portfolio.

Get independent research ratings from leading experts like Morningstar Ratings and MarketEdge Second Opinion .

Narrow your ETF choices

ETF Resource Center

Quotes are delayed by at least 15 minutes. Before trading, please check a real-time quote for current information.

For standardized performance data, click on the individual fund link.

Performance data quoted represents past performance and does not indicate future results. Current performance may be lower or higher. See the Performance tab for updated monthly returns. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than original cost. The Overall Morningstar Rating is a weighted average of the funds’ three-, five-, and 10-year (if applicable) Morningstar rating.

Investors in ETFs should consider carefully information contained in the prospectus, including investment objectives, risks, charges and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing. Investors in Closed-End Funds please note that since these securities are not continuously offered, there may be no prospectus available.

Exchange Traded Funds and Closed-End Funds are subject to market risk. Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. Investments in foreign investments may incur greater risks than domestic investments. Past performance is no guarantee of future results.

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The top 10% of the funds in an investment category receive 5 stars, 22.5% receive 4 stars, 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star.

Schwab does not recommend the use of technical analysis as a sole means of investment research.

Sector investing may involve a greater degree of risk than an investment in other funds with broader diversification.

Leveraged ETFs seek to provide a multiple of the investment returns of a given index or benchmark on a daily basis. Inverse ETFs seek to provide the opposite of the investment returns, also daily, of a given index or benchmark, either in whole or by multiples. Due to the effects of compounding and possible correlation errors, leveraged and inverse ETFs may experience greater losses than one would ordinarily expect. Compounding can also cause a widening differential between the performances of an ETF and its underlying index or benchmark, so that returns over periods longer than one day can differ in amount and direction from the target return of the same period. Consequently, these ETFs may experience losses even in situations where the underlying index or benchmark has performed as hoped. Aggressive investment techniques such as futures, forward contracts, swap agreements, derivatives, options, can increase ETF volatility and decrease performance. Investors holding these ETFs should therefore monitor their positions as frequently as daily.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and S&P Capital IQ. GICS is a service mark of MSCI and S&P Capital IQ and has been licensed for use by Schwab.

The news sources used on Schwab.com come from independent third parties. Schwab is not affiliated with any of the news content providers. Schwab is not responsible for the content, and does not write or control which particular article appears on its website.