ETFs look for a bigger slice of US 401(k) plans Professional Adviser IFAonline

Post on: 25 Май, 2015 No Comment

ETFs are slowly penetrating the US 401(k) market but there is a large part of it which is left untapped by the funds. Helen Fowler looks at the current use of ETFs in the retirement plans and what can be done by the industry to expand their slice of the market

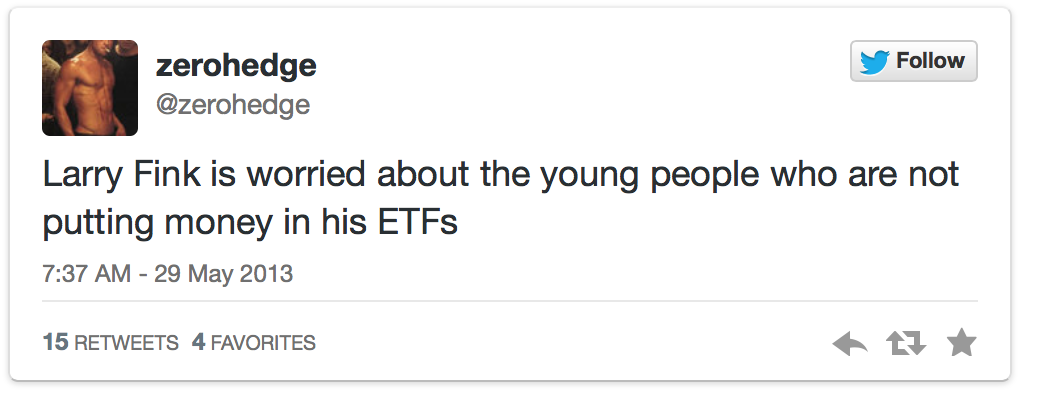

The 401(k) US retirement market represents a lucrative opportunity for providers to sell exchange-traded funds its assets total around $1trn. But, so far at least, ETFs have barely penetrated the vast market, despite their low costs, transparency and accessibility.

We really havent seen increased use of ETFs in 401(k) plans, said Amy Labanowski, US-based principal at investment consultancy Mercer. We dont generally see plan sponsors wanting to add ETFs to the core offering.

Despite the ETF industry boasting nearly $1.5trn in global assets, according to data from BlackRock, it accounts for a mere $2bn of the US pension pie. Whether that could change, with ETFs share of the 401(k) market likely to grow any time soon, remains open to debate.

The ETF industry is booming, growing at 20% to 30% yearly. And its growth comes at a time when the mutual fund industry is losing sales. According to BlackRock and Strategic Insight, mutual funds lost $4.5bn from clients over the 12 months to March. Over the same period, net sales of ETFs reached $38.4bn.

Wider trends might have been expected to influence US pension fund demand for ETFs. There is widespread discontent with the returns generated by active mutual funds. Over the five years to the middle of 2010, the S&P 500 index has outperformed 64% of actively managed large-cap US equity funds.

The discovery by US pension schemes that buying into a tracker fund could generate better returns might have been expected to trigger a flight to ETFs. However, this has not yet proved to be the case, for a variety of reasons.

There is limited evidence that the use of ETFs among 401(k) plans is growing. We are aware participants have been asking plan sponsors to include ETFs, said Labanowski at Mercer. Requests are not widespread but they are growing.

According to Labanowski, plan sponsors are not tending to respond to requests to include ETFs by adding them to a schemes default or core options. Instead, a popular route is to direct members towards a plans so-called brokerage window, if these exist. This facility, said Labanowski, allowed pension plan members to access a brokerage account.