ETFs Approaching Your 401(k) Plan

Post on: 2 Май, 2015 No Comment

ETFs Approaching Your 401(k) Plan

Posted on 16 March 2012 by admin

Retirement plans started long ago as a generous and guaranteed for life offer. However, those days are gone, as the US has moved from a defined benefit to defined contribution. This means that the plan participants can largely depend on themselves only. 401(k) plan is called “defined contribution” since your retirement income will depend on how much money you contribute to your plan and how you invest it. Today ETFs are close to changing people’s retirement options just like they have recently changed the investment landscape.

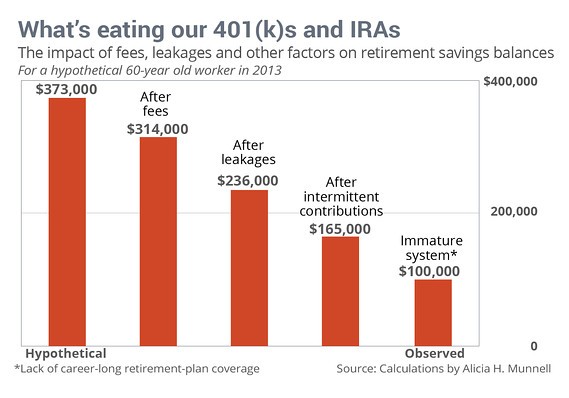

A lot of people don’t even know the fees in their 401k, because if they pay attention, they understand that all investment options, including mutual funds in their plans have built-in annual fees. However, not many employees know about the various expenses coming out of their plans. Meanwhile, the fees can add up to 1-1.5% every year.

Undoubtedly, some of this money is spent not without a purpose, to the extent it offers you good advice. Although keeping the paperwork organized is necessary, of course, it’s still unclear why retirement has to cost so much before people even retire. All of this will change soon with the industry being forced to open up.

This winter the American Department of Labor confirmed a rule demanding 401(k) providers to reveal the costs of different services. It means that the plan participants won’t be in the dark any longer, starting July 2012. Of course, the requirement to disclose won’t necessarily mean that fees will fall. Actually, employers are still able to hire whatever service providers they want, and continue overpaying, with the only difference that the workers will now know about everything. Moreover, 401(k) fees will also be known to all competitors and prospective employees as well, which is expected to put downward pressure on fees in a while.

Although at the moment ETFs are usually unavailable in 401(k) plans or only offered via expensive and complicated self-directed brokerage options, everything will change soon. The current situation is explained by the fact that retirement plan administrators create their industry around mutual funds with end-of-day pricing in order to be able to hide additional charges in the mutual fund expense ratios. That’s why their system simply doesn’t support real-time purchasing and selling, thus making ETFs not compute. But educated people can force a change: at the moment they can choose ETFs in 401(k) plans offered by TD Ameritrade and ING Direct, and the largest corporations (including Charles Schwab and Fidelity) are now choosing them as well.