ETF model portfolios Staying on the retirement track

Post on: 20 Май, 2015 No Comment

Nicolas Hansen | Agency Collection | Getty Images

Disclaimer: These model portfolios are selected by a panel of independent advisors and do not represent the recommendations of CNBC or any of its employees.

Let’s be honest: Baby boomers employed in the private sector have not been well-served by the current iteration of retirement plans.

Public employees have guaranteed pensions, managed by a team of investment professionals, with assured levels of return. By contrast, private employees have been handed a menu of investment options and with it the role of a portfolio manager.

How can that really be the case? Think about it. Asking a 401(k) plan participant to select from a list of mutual funds and determine when to buy, say, emerging-market bonds or small-cap growth stocks is asking that person to make decisions that have the most critical impact on investment returns.

Not surprisingly, investors have not fared well, as it’s difficult to to juggle the responsibilities of an investment manager when you have a day job.

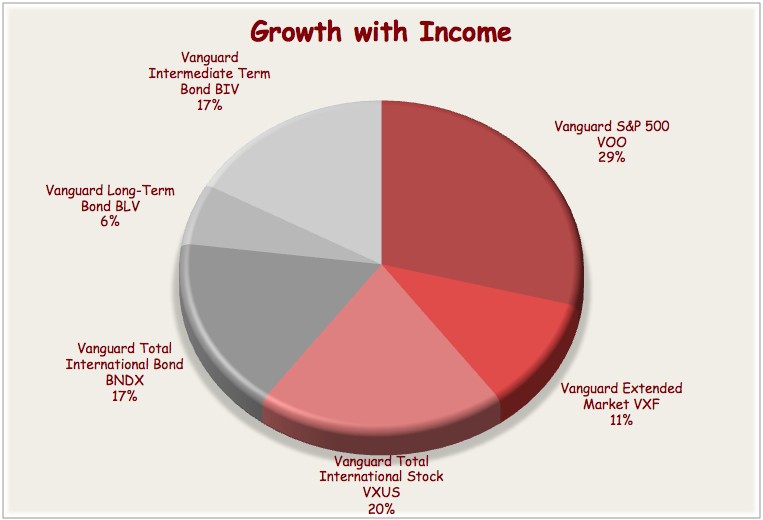

The challenge of the ETF Advisory Council was to propose a different way of approaching the retirement investing challenge. The target age 30-, 50- and 70-year-old models were designed to provide an allocation to lower-cost exchange-traded fund (ETF) portfolios that are diversified across global equities, global fixed-income and alternative or opportunistic ideas.

Clearly, retirement savers have different goals and risk considerations at each stage of their lives. Each target age portfolio was structured with these considerations in mind. The advisory council meets monthly to review the portfolios and make changes where warranted by changing market conditions. Managing the investment allocations on an ongoing basis is critical to keeping the portfolios in line with their long-term objectives.

The council has the following observations and has made the following portfolio changes for each model, which were initially populated in early April.

This strategy is designed to participate in a rising equity environment while avoiding the full impact of major market corrections and exhibiting substantially less volatility than an all-equity portfolio.

(Read more. Click here for the ETF model 70-year-old home page)

The challenge for the ETF Advisory Council was to generate a reasonable level of return from fixed income in a low-yield environment without leaving older investors subject to significant drawdowns.

Typically, longer-duration instruments provide greater yield but tend to be especially vulnerable when interest rates are rising. Lower credit quality instruments generally pay higher yields but are accompanied by greater default risks. An appealing compromise was a portfolio of senior bank loans (BKLN). While the yield is higher than the Barclays Capital Aggregate Bond benchmark and the duration is similar, the key appeal is the fact that this is a floating instrument.

What that means is that the loans offer protection from interest rate hikes, as they typically reset at higher interest rate levels (maintaining an interest rate spread) depending on the covenants of a given loan. Moreover, they tend to offer greater protection than high-yield debt, as they are senior instruments (in bankruptcy) and often secured with collateral. This ETF has significantly outperformed the bond benchmark.

Emerging market local currency (ELD) was added to the 70-year-old model at a 7.5 percent stake with two objectives. First, provide greater yields to a demographic group of investors that is striving to keep pace with inflation in a low interest rate environment. Second, add some upside potential without increasing exposure to stocks, which are typically more risky than bonds.

However, the recent perception that the Federal Reserve is looking to taper its bond-buying initiative has affected all fixed income, particularly emerging markets, with the idea that higher borrowing costs will most impact these nations.

A strong dollar has been a further headwind in the near-term, even though emerging-market local currencies are expected to appreciate versus the dollar over the long term given their increasingly robust balance sheets. The Advisory Council believes this position still makes sense long term (the 50-year-old and 30-year-old portfolios continue to hold smaller five percent and 2.5 percent stakes in ELD, respectively).

The 70-year-old portfolio had an aggressive 41 percent allocation to equities versus a 25 percent allocation for the underlying benchmark. The thinking was that 70-year-olds still require appreciation of the underlying portfolio, something that they were currently not receiving from their fixed income exposure.

However, during the monthly meeting of the Advisory Council, following solid months of April and May (to date) for equities, the decision was made to maintain the equity overweight, but to trim it from 41 percent equity to 31 percent. As a result, roughly 7.5 percent was reallocated from broad market U.S. (SPY) and international equities (VEU) to the BarCap Aggregate Bond Index (AGG)—the benchmark for fixed income, as well as short term corporate debt (CSJ), in equal percentage increases.

A sale of a 2.5 percent holding in the Gold Miners ETF (GDX)—a change made across all the model portfolios and discussed in more detail below—contributed to the increased bond ETF weightings.

ETF model 50-year-old

This strategy is designed to achieve long-term, equity-like returns while avoiding the full impact of major market corrections and exhibiting less volatility than an all-equity portfolio.

(Read more. Click here for the ETF model 50-year-old home page)

Among U.S. stocks, a prevailing theme for the markets over the past three years has been the search for yield. With a lingering level of uncertainty—given the lukewarm U.S. recovery—investors that are venturing back into equities have sought a level of protection from the perceived cushion that dividends provide.

Although consumer staples stocks, which tend to pay higher dividends, continue to get more expensive on a fundamental basis, investor demand for dividend-paying stocks has continued to be strong.

Consistent with this theme, U.S. equity income-focused ETFs (such as SCHD) have performed better than broad based U.S. equity indexes (such as the S&P 500), although this outperformance narrowed recently after Federal Reserve Chairman Ben Bernanke’s comments on Federal Reserve plans to taper its purchase of government debt. (The 70-year-old and 50-year-old portfolios have five percent exposure to SCHD, while the 30-year-old portfolio has a 7.5 percent stake.)

The general perception of the ETF Advisory Council was that the more defensive sectors (such as utilities, consumer staples and health care), which had performed strongly during the first half of 2013, were likely to lag the cyclical sectors (such as technology, industrials and materials) for during the latter half of the year. In terms of the 30- and 50-year-old portfolios, fundamental metrics for technology were more appealing than those for health care.

In addition, the DUKE/CFO Magazine’s Business Outlook Survey from June 2013 indicated optimism for greater corporate expenditures for the balance of 2013, a factor that tends to benefit technology firms. Moreover, a new product cycle from Apple in the fall might provide a catalyst for the sector, particularly given Apple’s significant market cap. Relative to health care, the Advisory Council also felt that dividend growth from technology (given a wealth of companies with strong balance sheets) would likely be greater than for health care even if a rotation to cyclical sectors fails to materialize.

For the 50-year-old portfolio and the 30-year-old portfolio (discussed in greater detail below), we sold a position of First Trust Health Care AlphaDEX (FXH) and bought a position of the Technology SPDR (XLK)—five percent in the case of the 30-year old and 2.5 percent in the case of the 50-year old portfolio.

ETF model 30-year-old

This strategy is designed to achieve long-term, equity-like returns while avoiding the full impact of major market corrections.

(Read more. Click here for the ETF model 30-year-old home page)

In terms of international stocks, this model sold a five percent stake in Emerging Markets (DEM) and purchased an equivalent position of Japanese Equity (DXJ) on June 27. China tends to be a key catalyst for emerging markets, but concerns about China emanate from the growing uncertainty about their shadow banking industry or system of trust loans.

These are insufficiently or uncertain collateralized loans made to small and midsize businesses in China that are unable to borrow from state-owned banks. These loans resemble the subprime lending that brought down the U.S. economy in 2008. Estimates suggest that trust loans could have a 15 percent impact on Chinese gross domestic product, while subprime loans and collateralized debt obligations affected only 9 percent of U.S. GDP during the recent financial crisis.

By contrast to the somewhat cloudy EM picture, Japanese Prime Minister Shinzo Abe is targeting a doubling of the monetary base in Japan over the next two years. This is even more aggressive than the Fed’s quantitative easing within the U.S. Abe is also targeting 2 percent inflation after over two decades of deflation in Japan. Devaluing the yen is very bullish for Japanese exporters as their goods appear progressively less expensive to overseas importers.

When the yen loses value, however, investments in Japanese equities lose value in U.S. dollar terms. As a result, a vehicle that hedges out the falling yen (as the DXJ does) is an attractive way to get Japanese equity exposure. Moreover, the DXJ ETF appeared to have found a temporary bottom at about $44 when it was purchased. This five percent switch was also made in the 50-year old portfolio, where DEM had been an original holding.

The model has not fared so well for any of the portfolios is gold mining companies. The Gold Miners ETF (GDX) was purchased within the Opportunity category of investments with the goal of short-term alpha generation.

The thinking of the ETF Advisory Council was that this industry was already down over 20 percent year-to-date (as of early April, when the models were constituted) and that the group was poised for a rebound.

However, as gold prices continued to plummet, margins for the miners were further squeezed and the industry collectively continued to fall steeply. As a result, the decision was made May 23 to cut the losses from the five percent GDX stakes in the 30-year-old portfolio and 50-year-old portfolio and move the money into a more conservative, short-term fixed-income allocation (CSJ).

A strong dollar, steep yield curve and continued corporate earnings growth all bode well for U.S. equities. When the S&P 500 rises by double digits in first half—which has happened 25 times since 1929—the stock market has been up 72 percent of the time in the second half. During the times the market has risen in the second half, the median gain has been 8.4 percent.

Nonetheless, the market has priced in a fair amount of good news given that the median price to earnings (P/E) ratio of 19.5 is greater than the trailing 50-year P/E average of 16.6. Markets have historically sustained a rise to a median P/E of 22 before a downturn ensues, however, so there may be room for further appreciation.

From a more sober perspective, recent U.S. industrial production appears consistent with real GDP growth of just 2 percent, which is only marginally higher than the 1.8 percent in the first quarter. As such, while economic growth continues, it is far from robust. In addition, 55 percent of S&P 500 companies’ pretax earnings are generated overseas, which is the highest level since 1995.

Overseas companies that derive a significant portion of their earnings from emerging markets have seen sales drop 3 percent versus sales for S&P 500 companies, which have risen 3 percent of the past five quarters. Accordingly, risks remain within the U.S.

Internationally, Chinese consumer and business confidence continue to decline with no new stimulus planned. This China lag may continue to weigh on emerging markets in the coming quarters. But aggressive Japanese quantitative easing is having the intended effect: Consumer spending is looking up, land prices are beginning to rise and consumer confidence is improving. Exposure to Japanese equities (with a currency hedge) continues to be an appealing theme.

—By Kim Arthur, CEO and portfolio manager at Main Management and an ETF Advisory Council member, and Hafeez Esmail, director of marketing at Main Management

CNBC brought in six of the best independent (not affiliated with any exchange-traded fund family) ETF experts to form an advisory council to build three retirement model ETF portfolios: one for a 70-year-old. one for a 50-year-old and one for a 30-year-old. CNBC asked for a broad portfolio, including U.S. stocks (small and big cap, either in a blended fund or separately) and bonds (Treasurys, corporates, munis and TIPs, as appropriate, either in a blended fund or separately), and international stocks and bonds, as well as a small amount of commodities.