ETF Covered Call Options Strategy Explained

Post on: 16 Март, 2015 No Comment

by Justin Kuepper on April 10, 2013 | ETFs Mentioned: SPY

Exchange-traded funds (“ETFs”) have opened the door to previously hard-to-reach corners of the global marketplace, making it easier and more cost effective for anyone with an online brokerage account to develop institutional-level strategies. Those willing to invest the time in understanding options have the opportunity to greatly expand their arsenal of tactics to include common equity option strategies like covered calls [see 101 ETF Lessons Every Financial Advisor Should Learn ].

What Is a Covered Call?

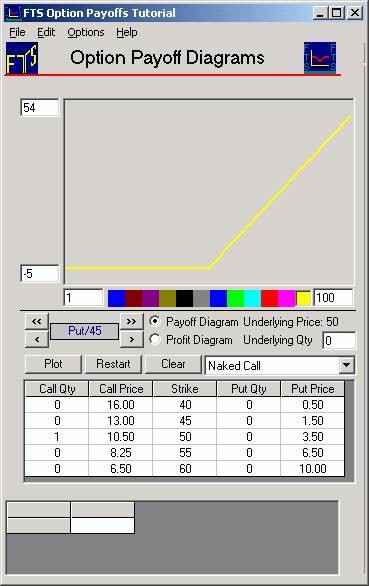

Covered calls are stock option agreements to provide shares that you own to a buyer at a pre-defined price and time in exchange for an upfront option premium payment. Since each options contract encompasses 100 shares, you must own more than 100 shares to use covered calls and must have even numbers of shares in order to cover your entire stock position. Meanwhile, the contract leaves you with an obligation to sell, and the buyer the right to buy [see ETF Call And Put Options Explained ].

For example, suppose that you own 100 shares of the S&P 500 ETF (SPY, A ), and those at-the-money call options on the ETF one month out are trading at $2.57 each. Writing a call option would enable you to receive $257 in premiums in exchange for agreeing to sell your 100 shares in one month at $157.00, if the buyer wants them. The breakeven point of the position is therefore the purchase price of the underlying minus the premium received [see also 10 Questions About ETFs You’ve Been Too Afraid To Ask ].

Who Is the Covered Call Strategy Right For?

Long-term investors often use covered call strategies as a way to generate extra income from a portfolio of stocks without taking on much risk. By writing covered calls, these investors receive upfront premium payments and do not risk selling their stock at prices they don’t agree to beforehand. The strategy effectively enables them to generate a virtual “dividend” on their stock, with the example above showing how a 1.6% “yield” could be realized in a month.

Other investors use covered calls as a way to prudently sell stock in a top-heavy market. For example, if an investor believes that the market may be overvalued and overdue for a fall, he or she may sell an in-the-money covered call option to lock in a selling price and receive a little more than would be possible selling outright into the open market. The contracts in this case serve more as a way to exit a stock position than generate long-term extra income.

What Are the Risks and Rewards?

Covered calls can be a lucrative way to generate extra income on a stock position, but investors should also be aware of the risks. As mentioned earlier, writing covered calls exposes investors to potential opportunity costs, if the underlying stock appreciates in value [see also How To Swing Trade ETFs ].

While investors can’t lose money on the options trade, the trade limits profit potential to the face value of the option (e.g. in the example above, the investor loses out on gains above $157.00 per share).

Let’s take a look at two potential scenarios using the SPY example above:

- If SPY rises to $165.00 per share in one month, you will be forced to sell your shares to the option buyer at $157.00 per share, giving up on $800.00 per share in lost upside, but keeping the $257.00 in premiums that you received to offset it.

- If SPY falls to $150.00 per share in one month, the buyer will not exercise his or her right to buy and you’ll keep your shares at a $700.00 loss. But, the loss will be offset by the $257.00 premiums that you received from the option contract.

Generate Monthly Income with ETF Covered Calls

The most popular use of covered calls is to generate monthly income on an existing long position. Since options can be written every month, investors have the potential to collect options premiums monthly and accumulate a virtual “dividend” over time. Of course, if the stock appreciates past the strike price, the investor will either be forced to sell the option at a loss or provide the underlying stock to the option buyer upon expiration [see 13 ETFs Every Options Trader Must Know ].

For example, assuming SPY stays roughly even, a three-month period may look like this: