ETF Asset Allocation Portfolio

Post on: 19 Июнь, 2015 No Comment

ETFs

As with many investors, I like trading ETFs. This is probably the most flexible investment product you can find on the stock market. And I guess this is probably its biggest disadvantage too; you have so many options that it is hard to build your ETF asset allocation within your portfolio. It’s like being a kid in a toy store; you want it all but in the end, you won’t be able to play (handle) with all those toys. John Brennan, CEO of one of the biggest ETF manufacturer Vanguard, even said that the ETF market has become dangerous for the investor. This is why I wanted to discuss asset allocation with ETFs.

ETF Asset Allocation Micro Version

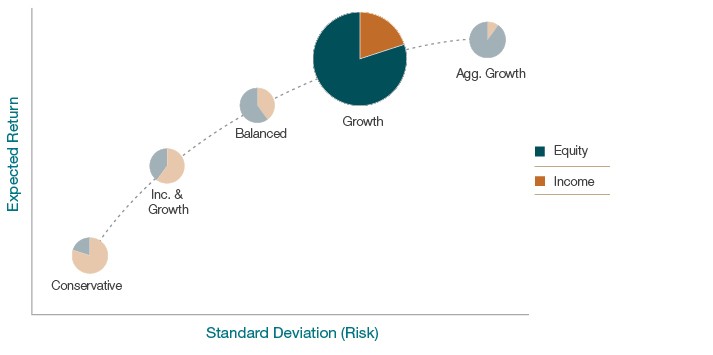

I think you can look at ETF asset allocation with 2 theories which I call the micro and macro approaches. The micro approach will encourage an investor to pick specific sector and buy ETFs according this strategy. The US market is well diversified and has great companies in many industries. You can easily build an ETF portfolio by choosing a few sectors that you believe they will outperform the overall market. For example, the financial and techno sectors have indications they may outperform the stock market in the upcoming years in my opinion. As well, you can decide to ignore other sectors in order to “optimize” your asset allocation.

I know that there are investors who think they can beat the market by selecting specific ETF sectors instead of going with indexes for example but I don’t agree with them. Most of the time, when an investor beats the market over 1 or 2 years, he will make an important mistake later on that eats-up past performance. Therefore, it’s hard to find someone who beats the market over a long period of time such as 10-15 even 20 years. This is why I would rather use an ETF asset allocation based on a macro model.

ETF Asset Allocation Macro Version

I like using a macro approach when establishing an ETF asset allocation. It makes my life as an investor much easier as I only care about the global asset allocation instead of adding time and energy on researching the “supposed” best sectors in the upcoming years. I think that following markets and indexes will produce a better return overall. However, then again, the numerous ETFs in each categories makes choosing the right asset allocation difficult. Here’s a quick list of my favorite markets to follow:

SPY, IVV, QQQQ, VTI, IWM

Canadian Market

EWC, XUI (on Canadian Market)

International Market

VWO, EFA, FXI (China), EWZ (Brazil), VEU

Real Estate (REIT)

VNQ, IYR, RWR, RWX, URE

TIP,LQD,AGG,BND,CSJ

We could easily add several other asset classes or specific ETFs to this small list but adding too many rhymes with complicated ;-).

Considering Commodities in your ETF Asset Allocation

In the ETF asset allocation with a macro approach, I suggest to look at natural resources as a whole. Some people will disagree and prefer to hit specific commodities. We all know that oil was very popular between 2003 and early 2008. Now, the “flavor of the moment” is the yellow metal. In 2011, I believe that we will have a growing interest in silver and uranium. Silver being undervalued compared to gold and uranium represents a great energy alternative to oil.

What About ETF Currency Asset Allocation?

As I mentioned before, we can never stop adding other categories to an ETF asset allocation. Another mainstream issue is the weakness of the US dollar. In order hedge your portfolio against it; some people will use a currency ETF in their asset allocation. Following the Canadian dollar seems like an interesting move at the present time. Considering their economic strength (compared to the US) along with the humongous amount of natural resources on their territory, the loonie might climb past parity with the US dollar for a few years.

More thoughts on ETF asset allocation in your portfolio

In the upcoming post, I will make a list of some ETFs that can be traded in your portfolio in order to balance your asset allocation according to your needs. If you have any questions or requests, please feel free to comment ![]()

***************************************************