ERISA Lawsuits Employee Stock Option Lawsuits

Post on: 15 Апрель, 2015 No Comment

FREE CASE EVALUATION

Send your Employee Stock Option claim to a Lawyer who will review your claim at NO COST or obligation.

ERISA Laws

The Employee Retirement Income Security Act (ERISA) is a federal law that sets minimum standards for pension and health plans offered by private businesses to their employees. ERISA was designed to protect employees who participate in such plans.

ERISA covers health plans, retirement plans and employee stock options plans, in which employees are given the opportunity to purchase shares of a company’s stock at a certain price, often lower than the actual or anticipated market price of the shares.

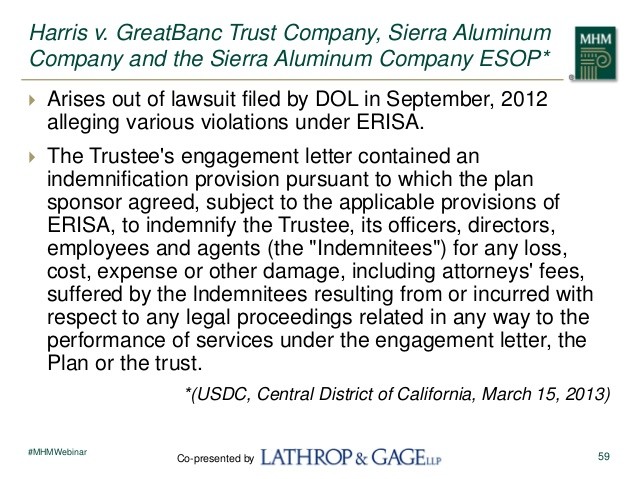

Under ERISA laws, the people responsible for overseeing employee benefits plans (often referred to as fiduciaries) must follow specific guidelines. These include acting in the best interests of the plan participants; providing participants with plan information, including information about plan features and funding; and providing a grievance and appeals process for participants. Breaches of fiduciary duty can result in a lawsuit being filed against plan fiduciaries.

Plan fiduciaries include plan trustees, plan administrators and people who sit on the plan’s investment committee. Fiduciaries are required to act prudently, diversify investments and avoid conflicts of interest when managing a plan’s assets.

ERISA Violations

Employee stock option litigation often involves a breach or misrepresentation of Stock Option Agreements; some scenarios include:

- A group of employees’ invested employee stock options are wrongfully canceled (i.e. their Stock Option Agreements are breached) when their subsidiary or division is sold by the parent corporation that granted them their options even though the employees continue to work for the same company and in the same jobs after the acquisition;

ERISA Lawsuit

An ERISA lawsuit was filed against YRC Worldwide Inc. . also known as Yellow Freight, alleging employees lost value in their plans because of imprudent investments by plan administrators.

Employee stock option lawyers have experience handling all types of employee stock option cases, and exclusively represent employees and focus their practice on employee stock option disputes, employee stock option cases, employee stock option litigation, employee stock option class actions, deceptive trade practices, and breach of Stock Option Agreements in connection with employee stock options.

Employee Stock Options Legal Help

If you have suffered stock losses from the cancellation or devaluation of employee stock options, please click the link below to submit your complaint to a lawyer who will review your claim for free.