Equity Trading

Post on: 13 Июнь, 2015 No Comment

3 Flares Twitter 2 Facebook 1 Google+ 0 Filament.io More Info ‘> 3 Flares

What is Equities Trading?

The term equity trading and stock trading are sometimes used synonymously; however, there are a few minor differences between the two. Let’s start with the basic definition; equity trading is essentially the purchase or sale of company stock through one of the major stock exchanges, just as stock trading is. An equity trade can be placed by the owner of the shares, through a brokerage account, or through an agent or broker; again, similar to stock trading.

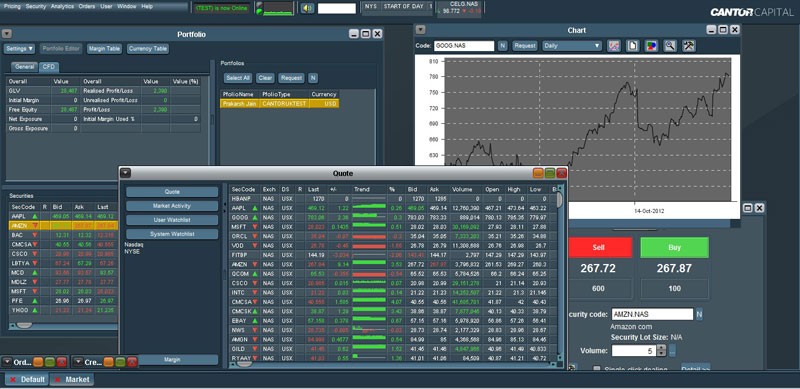

The key difference between equity trading and stock trading lies in their investment options and management firms. Equity trading firms specialize in offering in-depth market research, trading expertise, unique trading systems (even algorithmic), and have direct access to the trading floor for better executions. These equities trading firms predominately exist in the form of hedge funds and are setup to trade within a larger investment bank; such as, Morgan Stanley, Goldman, Sachs, JPMorgan, and Bank of America to name a few.

Hedge Funds

Hedge funds have more leeway in their investing activities and are generally far more active than traditional mutual funds that believe in the long term buy and hold approach; however, this tends to be a double edged sword. There have been many instances where hedge funds have significantly outperformed mutual funds and actually profited handsomely during down markets. Conversely, they take risks and these risks can wipe a large portion of your capital out if the hedge fund manager goes through a dry spell.

Hedge funds allow a fund manager with the flexibility to invest in any type of asset class that they choose, as long as it fits within their trading strategy or plan; this can include stock trading, equity trading, bond trading, equity option trading. or even foreign currency trading.

Private Equity Trading Firms

There has been a flood of private equity day trading firms which have come to market, also known as “prop” firms. These companies grow their capital by allowing successful traders to have access to the firm’s capital. In many cases, these equities trading firms will design their own formula for success and require each trader to use this formula. Others will allow their traders to have free reign to use any strategy that they choose as long as they consistently remain profitable. For the most part, private equity day trading firms utilize technical analysis and their ability to track money flow to take advantage of short term trading opportunities in the markets.

Conclusion

All in all, we can say that equity trading can be viewed as a niche within the general stock trading arena. It is geared for more aggressive individuals, money managers and investors, who have either developed solid trading strategies or want to invest in them. These strategies are usually very intricate in design and one should do their due diligence before they consider investing in them. There are usually very heavy minimum investment amounts and heavy profit sharing models which can take up to 40% of your profits. While it can be risky and seem expensive, the rewards can also be commensurate if you find the right money manager.