Equity Option Strategies Covered Calls

Post on: 16 Март, 2015 No Comment

The Equity Strategy Workshop is a collection of discussion pieces followed by interactive worksheets. The workshop is designed to assist individuals in learning how options work and in understanding various options strategies. These discussions and materials are for educational purposes only and are not intended to provide investment advice.

Access to, or delivery of a copy of, the Options Disclosure Document must accompany this worksheet.

Who Should Consider Writing Covered Equity Calls?

- An investor who is neutral to moderately bullish on certain portfolio holdings.

- An investor willing to limit upside profit potential on a specific stock holding in exchange for limited downside protection.

- An investor who wishes to generate income in addition to any dividends from shares of underlying stock owned.

This strategy is one of the most basic and widely used that combines the flexibility of listed equity options with the benefits of stock ownership. It works well for cash, margin, and Keogh accounts or IRAs. Although this strategy may not be suitable for everyone, it can provide a stock-owning investor limited downside stock price protection in return for limited participation on the upside. In addition, the covered call generates income from the premium received from the call contract’s sale that can supplement any dividend income paid to eligible underlying stockholders.

Definition

Covered call writing is either the simultaneous purchase of stock and the sale of a call option, or the sale of a call option covered by underlying shares currently held by an investor. Generally, one call option is written for every 100 shares of stock owned. The writer receives cash for selling the call but will be obligated to sell the stock at the call’s strike price if assigned, thereby capping further upside stock price participation. In other words, an investor is paid for agreeing to sell his holdings at a certain level (the strike price). For this reason the covered call is considered a neutral to moderately bullish strategy. On the downside, limited stock price protection is provided by the premium received from the call’s sale.

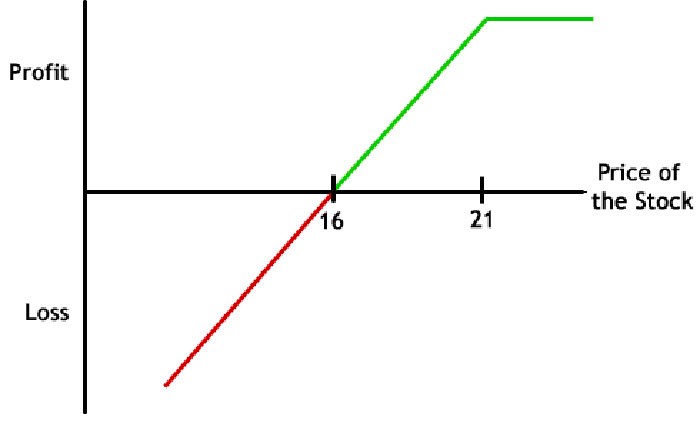

The upside profit potential if assigned is limited to the premium received from the call’s sale plus the difference between its strike price and the stock purchase price. If assignment is not received and the call expires out-of-the-money and with no value, the upside profit potential is any gain in share value plus the premium received. The downside loss potential is substantial and comes entirely from owning the underlying shares and is limited only by the stock declining to zero. The break-even point is an underlying stock price equal to the purchase price of the underlying shares less the premium received. As with any short option position an increase in volatility has a negative financial effect on the covered call while decreasing volatility has a positive effect. Time decay has a positive effect.