Equity CEF Valuations in a Market Plunge

Post on: 16 Март, 2015 No Comment

A range-bound market over the past few months has quickly degenerated into something a lot more serious for the global markets. The question for investors in equity-based high-yielding closed-end funds (CEFs) is how much worse does this gets and which funds should they start looking to either add to or accumulate and which funds should they avoid.

Though I don’t believe we will see the washout of 20% to 30% discount levels we saw back in October 2008, clearly discount levels tend to increase during these market periods, however short term they may be. For some equity CEFs that have already dropped to historically wide discounts, much of the fallout may have already been absorbed while for others, there may be a way to go. So let’s look at these funds and see which ones investors might want to consider and which ones to stay away from.

I used a relative valuation model which filters these funds based on several criteria. The first criteria I look for is which income strategy is better suited in the current market environment; the option-income strategy, the leveraged strategy or the dividend harvest strategy. If you are unfamiliar with how these strategies work, you can review them in one of my previous articles here .

Though no strategy is going to offset a market plunge, you want to stick with non-leveraged, defensive funds which at least should hold up better. Only the option-income funds fall into that category. However, you have to be selective since many option-income funds have fairly low option coverages (25%-40%) on their portfolios which can make them less defensive than others. The leveraged and dividend harvest CEFs are generally much riskier in a down market.

From filtering through the most appropriate strategy in the current market environment, I then look for funds whose net asset values (NAVs) are outperforming their benchmark indices. In the tables below, I used a starting date from the market high on April 29, 2011, to show which funds’ NAVs are holding up the best since this should give an indication of which funds will continue to hold up if we go into a bear market. And then finally I look at which funds are at historically wide discount levels since these are the ones which are most undervalued and have the most upside if the funds revert back to their historic discount/premium average once the dust settles.

The following tables show the majority of equity-based high-yielding CEFs available to investors broken into these three income strategies: The option-income, the leveraged and the dividend harvest. The first set of tables lists out in order (red column) the NAV depreciation from the market high of April 29, 2011, through Friday, August 5th. All dividends between these two dates are added back to give each fund’s total negative performance during this correction phase. I have also listed each CEF’s market price performance with dividends included as well. The other columns are self-explanatory. For comparative purposes, the three major domestic market indices are shown below with the S&P 500 included in the tables.

Performances from market high, April 29th through August 5th (includes all dividends added back but not assumed to be re-invested):

DJIA -10.1%

S&P 500 -11.6%

Nasdaq -11.9%

Click to enlarge charts

What you’ll notice is that the NAVs of the option-income funds have generally held up better than the S&P 500 while the NAVs for the leveraged and dividend harvest funds have mostly underperformed. The leveraged funds which were able to outperform the S&P 500 were generally utility stock focused funds. Keep in mind that these tables only represent a roughly three-month period so the more the markets sell-off, the more pronounced these differences in performance will be going forward. For example, in the 2008 bear market, option-income funds NAVs outperformed the leveraged fund NAVs by about 20% on average. Note: Many of these funds have global equity portfolios so direct comparison to U.S. major indexes may not be correlated.

The option-income funds which have held up the best are Nuveen’s JSN, JLA and JPZ. I alerted investors to these funds back in June and said that if we went into a more difficult market phase, that these funds’ NAV’s would hold up the best, and that is exactly what has happened. The hardest hit funds since the market high on April 29th have been the Dividend Harvest funds both in NAV and market price performance and I have repeatedly warned investors to stay away from these funds for just this reason.

The second set of tables shows which funds are at historically wide discount levels and thus, may be considered more undervalued. The red column lists, in order, the difference between a fund’s three-year average discount/premium and its current discount/premium. The more positive this number, the more undervalued the fund would be.

This is where it gets interesting because many of the option-income funds have positive valuation differences which would be considered undervalued and many of the leveraged funds are negative, i.e. their current discount/premium is higher than their historic three-year average. I can only guess that investors are still inclined to want to hold onto the leveraged funds because that is what has worked so well over the bull market run of the last two years and also because that is where we have even seen dividend increases.

Click to enlarge charts

Over the past two years, the option-income funds have been the ones forced to cut dividends and this may still be accounting for the valuation discrepancy with the leveraged funds. However, the risk now shifts back to the leveraged funds and I reiterate that investors should focus on the option-income funds, many of which moved from deep discounts to premium pricing levels after the 2009 bear market lows in March.

Looking at the table above, ETJ has the highest undervaluation rating, meaning the current NAV discount is much wider than its three-year average. This may be due to Eaton Vance cutting the dividends on all of its option-income funds last December. But in ETJ’s case, its NAV performance has also been subpar for quite some time. ETJ is a risk managed fund that not only sells index call options on 83% of its large-cap domestic stock portfolio, but the fund also buys 100% put option protection as well, making ETJ exceptionally defensive. But even if the fund’s NAV is well protected in a market sell-off, ETJ has not shown that it can grow its NAV effectively on a longer term basis no matter what the market environment has been, so I hesitate to endorse this fund.

The next highest undervaluation ratings among the option-income funds are EOS and ETB and these are my two top selections. Not only have both funds’ NAVs outperformed their benchmark averages since April 29, they have outperformed year-to-date and even going back to inception. Both are at historically wide discounts compared to their three-year averages. At some point, someone besides myself is going to realize this!

At the other end of the option-income fund valuation discrepancy is NFJ. However this anomaly needs to be explained and does not mean that NFJ is overvalued. NFJ traded at a wide discount for most of the prior three years until it upped its quarterly dividend by 200% in December of last year. This dividend increase from $0.15 to $0.45 has helped significantly reduce NFJ’s wide discount from years past so the current narrower discount should not be interpreted as a reason for the fund to revert to its wider three-year average discount. I continue to recommend NFJ.

Looking at the leveraged funds, a couple of the utility based funds, GUT and ERH. are at the highest undervaluation levels. However, ERH at a discount is a lot more compelling than GUT at a 26.5% premium. GUT also cut its dividend starting this year which more likely explains its reduced premium from a three-year average of 41.8%. At the other end, PIMCO’s PGP would be considered the most over-valued based on its three-year average 44.9% premium and its current 62.8% premium. Though PGP is mostly a fixed-income fund, its high leverage and use of long S&P 500 mini futures make it the most vulnerable to a sharper sell off in a continued difficult market, in my opinion.

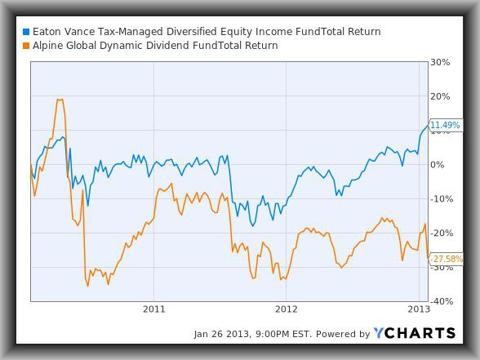

And finally, the dividend harvest funds are at what would appear to be very high undervaluation levels, however, I would urge investors to continue to stay away from these funds. These funds have had the worst NAV performance since the market high and have had the worst NAV performance going back to inception.

Disclosure: I am long ETB, ETW, EOS, NFJ, JSN, ETV, EXG.

Additional disclosure: Short DIA, SPY, IVV and QQQ