ENRON S COLLAPSE THE OVERVIEW ENRON COR LARGEST FOR BANKRUPTCY

Post on: 12 Апрель, 2015 No Comment

By RICHARD A. OPPEL Jr. and ANDREW ROSS SORKIN

Published: December 3, 2001

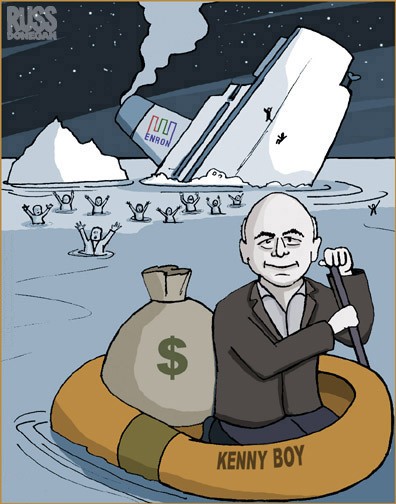

Enron, which became one of the world’s dominant energy companies by reshaping the way natural gas and electricity are bought and sold, filed the largest corporate bankruptcy in American history yesterday and blamed the company that had presented itself as its rescuer.

The Enron Corporation sued Dynegy, a crosstown Houston rival that had agreed to acquire Enron on Nov. 9, for backing out last week after citing what it called Enron’s rapid deterioration and misrepresentations. Enron immediately collapsed, making a bankruptcy filing all but certain.

Once the world’s largest energy trader, Enron is now seeking $1 billion or more in loans and a partnership with a major bank to allow it to stay in business.

Given Enron’s size, as the nation’s seventh-largest company in revenue last year, and its baffling complexity, creditors, which include major financial institutions around the world, are likely to face drawn-out proceedings to receive repayment.

The lawsuit demands at least $10 billion in damages from Dynegy and a court order blocking the company from seizing a natural gas pipeline that is one of Enron’s most prized assets. Dynegy says its actions were entirely legal. Under the terms of its agreement with Enron, it says, it plans to take control of the pipeline on Dec. 12 in return for its $1.5 billion investment in Enron.

Although Enron’s energy-trading operation was widely thought to be near collapse before Dynegy agreed to the acquisition, Enron’s lawsuit essentially accuses Dynegy of using the merger as a ploy to weaken Enron even further. By calling off the deal, Dynegy »sought to put an end to Enron as a competitive force» and therefore bolster its own business, the lawsuit said.

Dynegy’s chairman, Chuck Watson, said last night that Enrons lawsuit is »frivolous» and that his company »intends to pursue an action for the damages that Enron has caused Dynegy.»

»Enron’s charges against Dynegy are false, and the public should be wary of Enron’s efforts to deflect attention from the facts,» Mr. Watson added.

Enron’s bankruptcy filing, and its indication that creditors’ best hopes for recovery may come partly from litigation against its onetime merger partner, ends the company’s downfall. Its stock, worth $90 at its peak last year, is now nearly worthless, and other traders quit doing business with it last week for fear they would not be paid.

In filings with the Federal Bankruptcy Court in New York, Enron sought Chapter 11 protection from creditors while it reorganizes. The filings by Enron and its affiliates included its energy trading business and 12 of its other units, but not its pipelines. The company lists assets of $49.8 billion and debts of $31.2 billion, but these debts do not include many items not listed on its financial statements.

The largest previous bankruptcy filing, measured by assets, was Texaco’s 1987 filing, which listed $35.9 billion in assets. That filing came after Pennzoil won a large judgment from Texaco for breaking up Pennzoil’s merger with Getty.

In its struggle to remain a functioning business and avoid liquidation, Enron said it was in advanced talks to obtain new loans. People close to the talks said the loan agreements, probably for more than $1 billion, might be completed by the end of today.

Enron is also preparing for large-scale layoffs, primarily in Houston, where it employs 7,500.

Enron said it was also talking with leading financial institutions to restart its huge trading operations through a new joint venture. Under this strategy, the partnership would use the institutions’ financial strength to guarantee that Enron would pay its bills, thus giving other energy traders confidence to resume doing business with Enron.

People close to the talks said that Enron’s two leading banks, J. P. Morgan Chase and Citigroup, were among the institutions discussing the joint venture. »Enron would be the muscle; the banks would be the money,» an executive close to the talks said.

In an interview yesterday, Jeff McMahon, Enron’s chief financial officer, said that establishing a joint venture makes the best sense for creditors. While Enron has a large pipeline business and other tangible properties, its core energy-trading operation was by far its most valuable franchise and the biggest generator of profits.

»We’re having multiple discussions with multiple potential joint-venture partners, and each one of the options are different,» he said.

Enron said that it would provide the new operation with traders, technology and a back office. Trades would be done through EnronOnline, the Internet platform that was until recently the industry’s largest market maker. Any joint venture would be subject to the approval of a bankruptcy judge.

Enron’s lawsuit illustrates how acrimonious the merger effort became. The suit had to be filed quickly because Dynegy was preparing to take control of the Northern Natural Gas pipeline, Enron’s largest. Dynegy had given Enron $1.5 billion as part of its merger agreement to help stabilize Enron’s business, and it received an option to acquire the pipeline if the merger was terminated. Dynegy says it has exercised that option, but Enron says that the merger termination was illegal.