Employee Stock Options_1

Post on: 15 Апрель, 2015 No Comment

Valuation of ESOs is a complex issue but can be simplified for practical understanding so that holders of ESOs can make informed choices about management of equity compensation.

Valuation

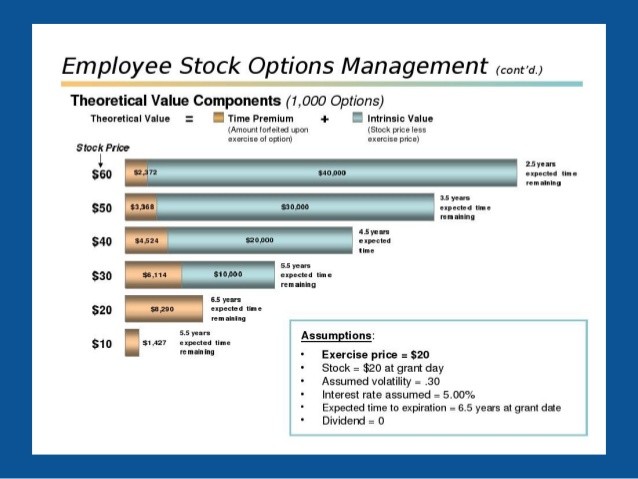

Any option will have more or less value on it depending on the following main determinants of value: volatility, time remaining, risk free rate of interest, strike price and stock price. When an option grantee is awarded an ESO giving the right (when vested) to buy 1,000 shares of the company stock at a strike price of $50, for example, typically the grant date price of the stock is the same as the strike price. Looking at the table below, we have produced some valuations based on the well known and widely used Black-Scholes model for options pricing. We have plugged in the key variables cited above while holding some other variables (i.e. price change, interest rates) fixed to isolate the impact of changes in ESO value from time-value decay and changes in volatility alone.

First of all, when you get an ESO grant, as seen in the table below, even though these options are not yet in the money, they are not worthless. They do have significant value known as time or extrinsic value. While time to expiration specifications in actual cases can be discounted on the grounds that employees may not remain with the company the full 10 years (assumed below is 10 years for simplification), or because a grantee may conduct a premature exercise, some fair value assumptions are presented below using a Black-Scholes model. (To learn more, read What Is Option Moneyness? and How To Avoid Closing Options Below Instrinsic Value.)

Assuming you hold your ESOs until expiration, the following table provides an accurate account of values for an ESO with a $50 exercise price with 10 years to expiration and if at the money (stock price equals strike price). For example, with an assumed volatility of 30% (another assumption that is commonly used, but which may understate value if the actual volatility across time turns out to be higher), we see that upon grant the options are worth $23,080 ($23.08 x 1,000 = $23,080). As time passes, however, lets say from 10 years to just three years to expiration, the ESOs lose value (again assuming price of stock remains the same), falling from $23,080 to $12,100. This is loss of time value.

Theoretical Value of ESO Across Time 30% Assumed Volatility