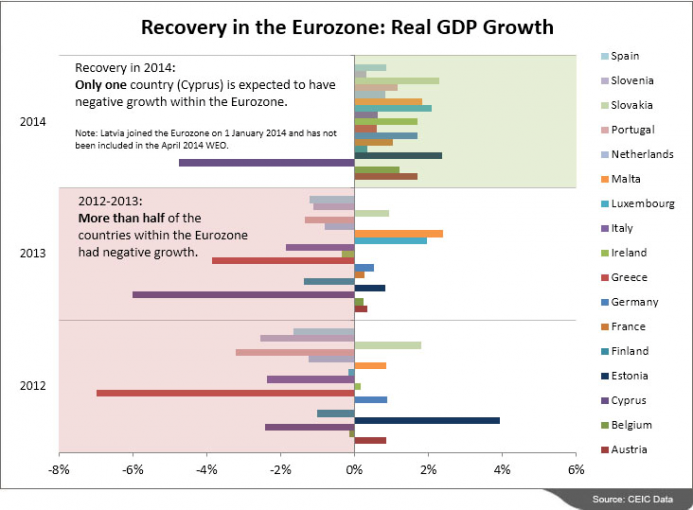

Emerging Markets Economic Growth Projections

Post on: 16 Март, 2015 No Comment

Figure 5 – Not all emergingmarkets are in the danger zone

Figure 6 – Falling to BIITS? Some emergingmarket currencies have had a painful run

Figure 7 – But poorer growth in 2013/14 should be seen in the medium term growth context

While advanced economies were struggling with the consequences of the financial crisis, emerging markets remained resilient as economic growth held broadly steady.

Now, as economic conditions are improving across advanced economies, the opposite seems to be the case in emerging markets. Sharp falls in exchange rates (figure 6), coupled with slowing growth and some domestic political troubles, may give the impression that the wheels are coming off the emerging market growth story, but what is behind the headlines?

The truth is that some emerging markets are suffering more than others – with the so called “Fragile 5” (highlighted in figure 5) capturing the most attention. A key vulnerability has been the deterioration of their external positions over the last few years – in simple terms, exports have struggled while foreign liabilities have piled up.

Strong domestic currencies (driven by “cheap money” from the Federal Reserve and other central banks), coupled with slow growth in advanced economies, damaged their ability to export (Figure 5). At the same time, foreign liabilities have mounted as international investors searched for yield. For example, since 2008, net foreign liabilities owed by Turkey’s corporate sector have almost tripled to approximately $170bn.

The announcement and start of tapering by the Federal Reserve has been a catalyst for a reversal in investor sentiment in emerging markets, especially the conviction that higher risks were justified by higher expected returns.

Emerging markets were lifted by a tide of liquidity provided by the Fed but, as this is wound down, the fear is that some of these economies will become “beached” as currencies fall, interest rates rise and growth slows.

To an extent, the data supports this concern as rises and falls in exchange rates have been broadly aligned to the actions of the Fed since the financial crisis, but there are other factors at play.

Economic “governance issues” across emerging markets are becoming harder to ignore. One notable example is the high level of political engagement in central banks in some emerging markets. A prime example is Turkey, where recent interest rate hikes have met with stiff political opposition. In the “Fragile 5”, as well as other emerging markets facing election cycles in 2014, it could be that “easy options” will be chosen over reforms that carry benefits over the longer term.

We still believe that most emerging markets have the economic fundamentals (in terms of labour force growth and potential for capital investment and productivity improvement) for solid economic growth in the longer term. But risks undoubtedly exist and it will be a bumpy ride for some emerging markets.

In the short term, despite substantial falls, it’s by no means certain that some currencies have bottomed out. Meanwhile, continued shortfalls in economic governance suggest that volatility and policy uncertainty are likely to be the dominant themes of the day. This is clearly reflected in our expectation of relative growth underperformance in 2014 in many emerging markets compared to the stronger potential that we think these economies possess in the medium term (see figure 7).