Emerging Market Bonds Investment U

Post on: 16 Март, 2015 No Comment

By Investment U Research Team

The old rules of the fixed income world are being torn up…

Gone are the days when investors were told to shun emerging market debt. It was too risky, they were told. Developed markets were the only safe place for them to park their cash.

But thanks to the crisis in Europe – and to the debt burdens weighing on many other markets, including the U.S. UK and Japan – emerging market debt has never been so popular. Their bond funds saw a $26 billion inflow in 2011, the second-highest inflow of all mutual fund catagories.

Even cautious institutions are craving emerging market debt these days. According to JPMorgan, U.S. pension funds will likely pour about $100 billion into such investments over the next five years.

Surprisingly, emerging market bonds represent a conservative asset class over the long term, offering a stellar risk/reward ration and excellent diversification benefits. Many of the fundamental forces behind this upcoming trend are already taking center stage…

Emerging markets have definitely faced a number of trials and tribulations in the past.

As the mid-1990s drew near, Mexico shook up Latin markets as its currency and bonds both crashed in what became known as the Tequila Crisis. A few years later, Asia took its turn of turmoil. Currencies, bonds and stocks throughout the area tumbled one after another, beginning with Thailand.

The negative ripple effect spread to Russia next, which subsequently defaulted on its debt and devalued its currency. Then Brazil became infected the following year. It abandoned its fixed exchange-rate system and let its currency float (move freely in the foreign exchange market) against its global rivals.

To make matters worse, Argentina fell next, as it became the largest defaulter in bond market history. That renewed jitters among Latin investors, who soon stampeded right back out of Brazil again. The country’s benchmark sank to 42 cents on the dollar as outsiders and insiders alike worried about the supposedly market unfriendly President Lula’s new administration.

Fortunately, Lula went on to prove them all wrong. In his first two years alone, he reduced the deficit by more than a third, then held it at under 4% of GDP to earn investment grade status… to the extreme benefit of everybody who took the risk and bought into the country.

Before you judge their past bumbling too harshly, remember that many of these markets had only recently adopted free-market policies, some as late as the early 1990s. Given their newness to such a new ordinance, it really isn’t surprising that they made so many mistakes.

As they say, two steps forward and one step back. It’s a natural process and they performed just as any reasonable person should have expected during that time.

And since then, they’ve pulled together amazingly well.

Perhaps the most important reason emerging markets put in such a stellar performance is the free market economic framework they adopted.

In fact, access to the global capital markets wouldn’t be possible at all without this commitment to capitalism. And without access to the world’s investment funds, most countries wouldn’t have the wherewithal to compete in a globalized world.

The powerful forces of global investors can knock you down hard when you misbehave. But they’ll also be the first to pick you back up.

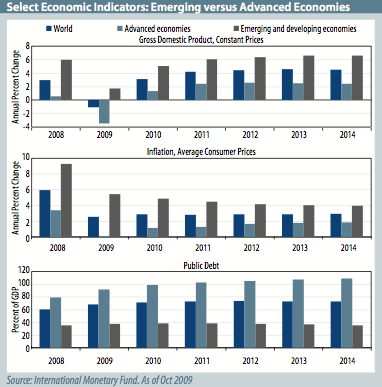

Many of the imbalances built up during the previously mentioned irrationally exuberant times have since unwound. Overall, government and corporate debt have been brought under control, while exchange rate policies are more sensible. A more responsible mentality has taken hold. Fiscal prudence and monetary discipline are the new government mantras. The cut-off of easy money has starved the irresponsible, wasteful and/or excessively speculative mentality that existed to varying degrees in both the public and private sectors.

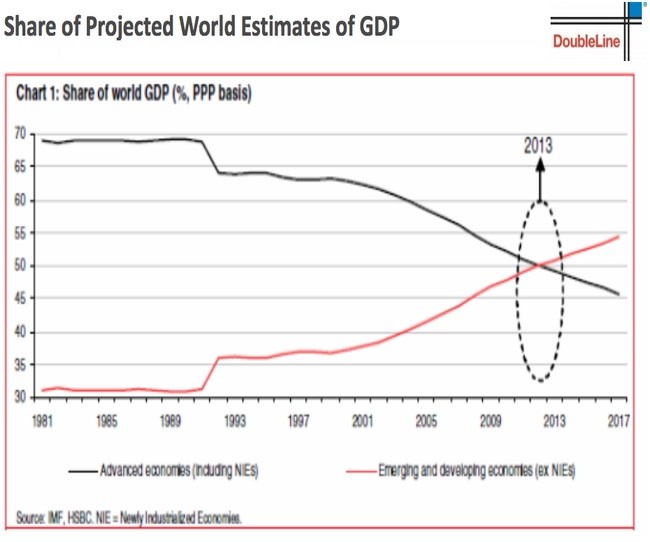

Many emerging nations now have strong economies, less leveraged banking systems, low budget deficits, current account surpluses and healthy foreign exchange reserves. Europe and the U.S. can only wish they had such a lengthy list to their credit.

In many cases, these emerging nations can count on rapid economic growth – 5% or more – to grow out of any debt burdens they may have and make payments on their bonds.

Many fixed income investors, such as bond fund giant Pimco, are no longer making their investment decisions based on whether a country is a developed or emerging economy. Instead, they’re basing decisions strictly on the economic fundamentals of each country.

RBS Capital Market Senior Strategist Nigel Rendell said it succinctly: “There is no longer a marked distinction between an emerging market and [a] developed world asset. It is all about public debt levels.”

Emerging Market Bond Types

While the opportunity emerging market bonds present is without a doubt an exciting one, investors should know a few basic facts before they go diving in…

Bonds may be issued either by a country – sovereign debt – or by an emerging market company. In addition, there are two types of bonds issued: dollar denominated debt and debt denominated in a country’s local currency.

In the past, most emerging market debt was of the former kind. And that group has performed extremely well. For example, the GMO Emerging Country Debt IV, a grouping of the most liquid emerging market sovereign debt, returned 16.88% in 2011.

In contrast, bonds issued by the Group of Seven nations returned a measly 0.3%.

Dollar denominated emerging market bonds have already shown tremendous gains, so perhaps the real opportunities now lie in emerging market bonds denominated in local currencies. During the 1980s and 1990s, that kind of investment experienced bad bouts of hyperinflation, currency collapse or default. But with emerging economies’ fundamentals changing so drastically, those days are gone.

Today, they’re attracting both retail and institutional investors looking for solid yields and diversification away from the U.S. dollar. According to the JPMorgan GBI-EM Broad index, the size of the local currency emerging market debt marketplace has grown to more than $1 trillion. In 2003, it amounted to less than $200 billion.

Meanwhile, the amount of dollar denominated emerging market debt represents a diminishing proportion of the market.

Yields on local currency emerging market bonds remain attractive. And they also gain – or lose – as the currencies in which they are denominated move up and down.

For investors who shy away from gold as a hedge against the inevitable decline of the dollar, these bonds offer a viable alternative. At the worst, an investor still receives income from the bonds. But they still need to choose carefully in order to avoid any potential political risk.

Emerging Market Bond Investments

Investors who want to take advantage of emerging market bonds have a few options:

Investors looking for local currency bond ETFs have a few options as well in Market Vectors Emerging Markets Local Currency Bond (NYSEArca: EMLC) and Wisdom Tree Emerging Markets Local Debt Fund (NYSEArca: ELD). And most mutual funds firms offer the same basic services.

But one way or the other, investors have to recognize the brave, new investing world in front of them.

Jerome Booth, head of research at Ashmore Investment Management in London, perhaps summed the current investment landscape best when he proclaimed: “All countries are risky. The difference is, it’s only in emerging markets that the risk has been priced in.”

Investors are well advised to take the less “risky” route and allocate a portion of their assets into emerging market bonds.

Good investing,

Investment U Research Dept.