ELSS Mutual Funds Best Option To Generate Wealth Along With Saving Maximum Tax under section 80C

Post on: 12 Апрель, 2015 No Comment

ELSS

Wealth cannot be Earned it Can Only be Created .

Just before Last quarter of financial year, most of the organizations ask for investment proofs from their employees and they in turn submit the proof with last minute haste investment which does not involve planning, strategy, and control on their investment to save tax. Here is a tool (ELSS) which is recommended for one time (lump-sum) investment for such hurry situations. Below are important questions on ELSS scheme being asked most frequently in tax planning-

What is ELSS

ELSS is a short form of Equity Linked Saving Scheme.

These are special types of mutual funds primarily cater to the tax saving need of investors.

In ELSS funds, minimum 65% of your invested amount is actually invested in Equity Market.

In simple language ELSS is the easiest way to invest 65% of your money indirectly into equity market which is managed by fund manager of any Asset Management Company/Bank (E.g. ICICI AMC, HDFC AMC etc) and rests of the amount is invested in safe/debt instruments.

What is Lock-in Period for ELSS Mutual Funds

Lock-in or Minimum holding period for ELSS is 3 years. Meaning- you can not withdraw amount before 3 years of period from date of buying, to be able to claim your investment under 80 C deduction.

What is Minimum and Maximum Limit of ELSS Investments

You can start your investment under ELSS scheme from as minimum as Rs 500 up to your maximum limit. However you can claim the deduction on your investment through ELSS Mutual Funds only up to Rs 1,50,000 under section 80 C.

Do ELSS Serve Only Tax Deductions

There is no restriction, anyone can opt for ELSS saving scheme. But someone who either does not fit in tax bracket or has opted for other tax saving plans, and can take higher risk has better options where he can get exposure to equity from 80% to 100% allocation. Such schemes are simply known as Mutual fund schemes.

How much return do ELSS serve

Generally, people buy ELSS funds, keep track of their portfolio and wait for 3 years and become upset with not so good returns. So why they need to invest in ELSS. Here are important factors effecting the returns -

a) Volatility of Market - Not every year there is boom in market and your fund may not perform as expected, and there is no guarantee too, since they are equity linked.

b) Term of Payment- Prudently and preferably one has to invest systematically (monthly/quarterly) rather than lump-sum (in single payment), as in volatile market condition your purchases of funds can cover the over-all loss at the end of an year and can accumulate moderate average return.

Note. Investing your money monthly/quarterly in any mutual fund scheme is known as SIP (Systematic Investment Plan)

c) Term Of Investment — This is important factor. Considering the continuing liability of tax for subsequent years after maturity of your ELSS scheme, you should continue your systematic investment which can yield good corpus after 10-20 years. Please note that if you are buying ELSS funds under SIP (Systematic Investment Plan) then you should opt for growth option. By this you will keep on saving tax every financial year. Most of the ELSS schemes have provided nearly between 15-20% of yearly return (averaged) in last 10 years.

Is Return on ELSS is Taxable

Since ELSS is 3 years locked-in fund scheme, so anything earned after this tenure will be known as long term capital gain so is not taxable.

How to pick best ELSS Scheme

The best way to find out the best ELSS scheme is to compare last years performance on www.valueresearchonline.com or www.moneycontrol.com. You should also consider the corresponding ratings given by CRISIL on these websites while opting for any ELSS scheme.

How to Buy ELSS Mutual Funds

You can buy ELSS Mutual funds by simply filling up KYC form and submit it with your ID and address proof with your favorite AMC/Bank. Instead of approaching a bank e.g. ICICI you should contact its AMC subsidiary viz. ICICI Prudential AMC (www.icicipruamc.com) which can save you good amount of commission and your maximum money will be used for your investment.

Who Should Invest in ELSS

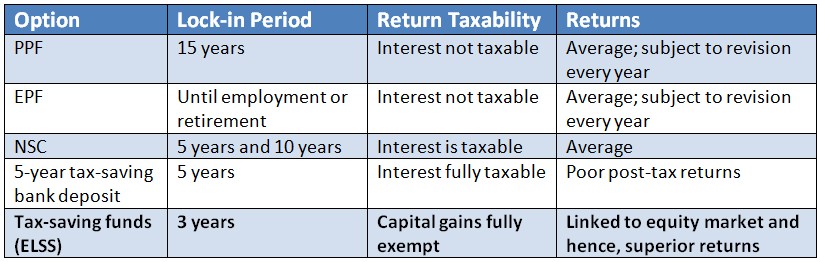

Persons with high risk appetite (young and dynamic investors) must use ELSS for long term saving, instead of any debt instruments as except PPF, every instrument has tax liability on interest. ELSS can be a good option to plan your long term goals (from 10 to 30 years)- retirement, higher studies of your children, buying a home, marriage of your children etc. You can invest through ELSS from 20-50% of your savings which you reserve for 80C deductions.

Should you have any query/suggestion please drop your message in comment box.