Economic Forecast Using GDP Indicator

Post on: 16 Март, 2015 No Comment

by Farnsfield Research on March 13, 2014

Gross domestic product (GDP) is referred to as the Godfather of the indicator world by Investopedia. It follows that if you are a trader of any type—forex, stock, bond, ETF, futures, options, you name it— you should probably know what GDP is and why this almighty indicator is important.

In this article, I hope to provide a relatively short (but thorough) explanation of the GDP indicator and what traders should know about the economic indicator.

GDP Definition

Gross domestic product is seen as a gauge of a country’s economic health. The figure itself is a dollar amount that measures the value of a country’s goods and services over a given time period. GDP for the United States is released quarterly.

GDP is generally expressed as a relative figure. For example, one might say “GDP for the fourth quarter decreased 2% from the third.”

GDP Releases

Gross domestic product figures are released by the Bureau of Economic Analysis at 8:30 a.m. ET on the last day of the quarter (the data is for the previous quarter). The final report comes out three months after the end of the quarter.

But this final report is preceded by two earlier revisions: the advance report comes out one month after the quarter’s conclusion, and the second Report (preliminary report), is released two months after the quarter’s end. There are also follow-up revisions to ensure accuracy of the information.

The entire release is available for public consumption. The Bureau of Economic Analysis also makes highlights, summaries (U.S. economy at a glance ) and analysis of the data available. GDP data is also broken down state-by-state. People can even sign up for e-mail notifications about the release.

How Is GDP Calculated?

Of course, the formula for calculating GDP is complex, but its intricacies need not concern you. For most purposes, it is enough to know the basics.

To go straight to the source, the Bureau of Economic Analysis explains GDP is “calculated as the sum of what consumers, businesses, and government spend on final goods and services, plus investment and net foreign trade.”

The Bureau continues, “In theory, incomes earned should equal what is spent, but due to different data sources, income earned, usually referred to as gross domestic income (GDI), does not always equal what is spent (GDP). The difference is referred to as the ‘statistical discrepancy.’

GDP: Economic Indicator

Ok, on to reading the massive report … As noted above, GDP indicator is a measure of economic growth, and therefore a country’s health. As such, it is also tied to things such as the nation’s currency, its bond market, and as a broad gauge of consumer sentiment. For this reason, unforeseen or greater-than-expected changes have the potential to rock the market.

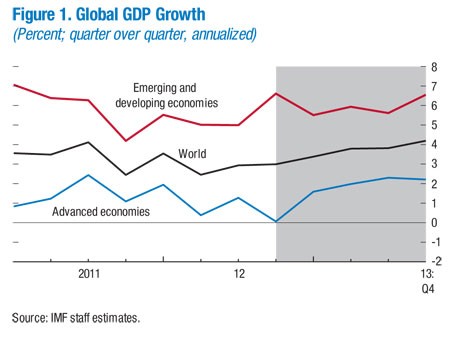

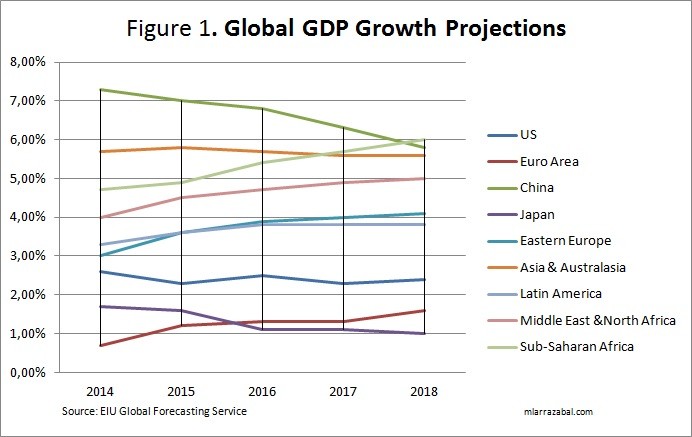

A general rule of thumb is that 2.5% to 3.5% is an ideal range of growth for real (inflation-adjusted) GDP. Growth within this range is indicative of a solid job market and corporate growth.

Figures higher than this range are not worrisome if a country is emerging from a recession. But if this is not the case, higher levels are often considered unsustainable, and a sign of inflation.

Negative GDP figures are negative, and two consecutive quarters of negative GDP can be considered a sign an economic recession is underway.

Interpreting GDP

Stock investors can look at the GDP’s corporate profits analysis for guidance as to which market sectors are exhibiting strength. In addition, GDP breaks this data down to corporate profits by industry, which makes it a great source for top-down investors. The report’s business inventory data is another section worth noting.

Because of the time lapse between quarter-end and the release of GDP, it is a lagging indicator. Nevertheless, it is important to be aware of its release dates (and their market-moving potential) as well as the report’s content.