Double Calendar How To Trade The Double Calendar For Monthly Income

Post on: 7 Апрель, 2015 No Comment

Here is a different way to trade the double calendar option trading spread that is worth taking a look at.

Normall, double calendar spreads are initially placed as a double calendar spread. At the start of the trade the one trading the spread will purchase one calendar spread slightly below where the underlying is trading at and then another calendar spread slightly above where the stock or index product is trading at. This can either be done in two separate trades or if your options broker allows it, as one trade.

Once the trade is on, as long as the underlying stays between the two profit tents you can claim your profit.

However, if the underlying moves too far one way or the other and rund through your upside or downside break even levels you will need to adjust the position using one of several different available adjustments.

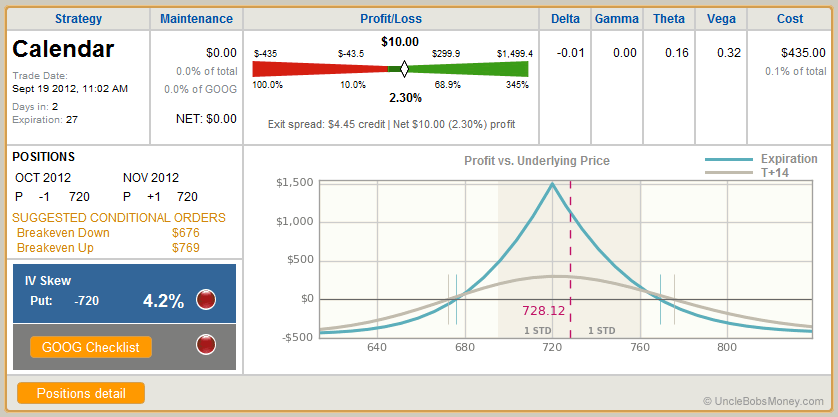

Another way to place this trade is to simply place just one calendar spread at the money and then wait to see what the underlying will do. In other words, instead of starting the trade off as a double calendar option position, you would start if off as just a single calendar.

Then, if the underlying moves past the break even levels on either the upside or the downside you would adjust the position by adding another single calendar spread slightly above or below where the underlying is trading at creating a double calendar spread. In other words, if the underlying ran up past original single calendar spread upside break even level, we would add another single calendar spread slightly above where the underlying is currently trading at, creating a double calendar. If the underlying moved down past the original single calendar spread downside break even level, we would add another single calendar spread slightly below where the underlying is trading at, creating a double calendar spread.

So rather than starting the position off as a complete double calendar spread, what we are doing with this approach is initiating the trade as a single calendar spread with the plan to turn it into a double calendar spread depending on where the market moves to.

And, if we hit our profit target BEFORE the underlying threatens either side of our original single calendar trade we simply take the single calendar off and close the trade booking our profits without ever needing to complete the double calendar trade set up.

Double Calendar Using Weeklys

Posted on November 9, 2011, 8:47 pm, by Double Calendar, under Double Calendar.

The double calendar strategy now has the ability to provide several new strategies or perhaps a better way to put it mutations of the original double calendar option trading strategy thanks to the creation of the new weekly options.

In the past the basic double calendar spread was made up of two traditional calendar spreads placed on an underlying either next to one another or several strikes apart.

Double Calendar Example

For example a traditional double calendar spread trade might look like the following example:

Purchase one July Put at the 100 strike.

Sell one May put at the 100 strike.

Purchase one July Call at the 110 strike.

Sell one May Call at the 110 strike.

With the type of double calendar spread set up above, an option income trader would be able to make this type of trade on a particular underlying about 12 times per year or once per month.

Double Calendar Weeklys

However, now with the new weekly options its possible to make this type of trade FOUR times per month or about 48 times per year. And with the way many of the weekly options are priced it is also possible to bring in around twice as much in premium potentially almost doubling the return.

Another benefit of using the weekly options for double calendar spreads vs. the traditional monthly options is that by mismatching options within the double calendar spread option traders have much more flexibility in adjusting these trades.

For example, in the even where one of the break even sides of a double calendar spread becomes threatened the option trader now has more options to choose from to make an adjustment being able to pick from the current weekly which is already being utilized in the trade to the next weeks weekly to the current monthly option that is available to an option that has an expiration several months away.

To learn more about the double calendar spread how to correctly set them up manage and adjust them as well as how to utilize the new weekly options in the double calendar spread as well as other option income strategies join our free option income trading newsletter by clicking here .