Dollar Cost Averaging v Averaging

Post on: 16 Март, 2015 No Comment

Last week I wrote about the pros and cons of dollar cost averaging. It is not a perfect method of investing, but it has its benefits it is easy to set up and takes very little upkeep. While most people are familiar with dollar cost averaging, there is a similar investment strategy called dollar value averaging, or simply value averaging. Here is a comparison to the two investment methods:

Dollar Cost Averaging vs. Value Averaging

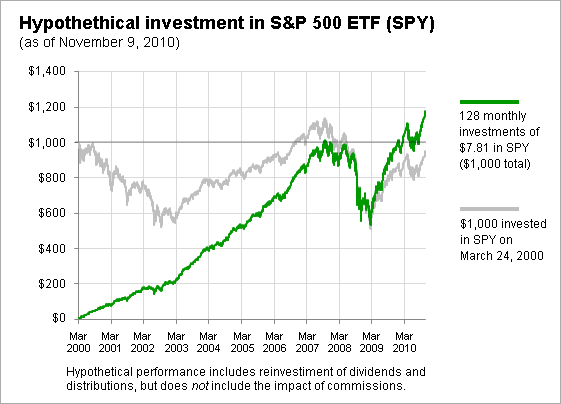

Dollar cost averaging (DCA). Dollar cost averaging is the method of investing the same amount of money at set intervals, regardless of share price. A good example would be bi-monthly contributions to a retirement plan such as a 401k or IRA. With dollar cost averaging, a steady contribution will buy more shares when prices are low, and fewer shares when prices are high. This takes the guess work out of systematic investing, and smoothes the average purchase price for your shares.

Value averaging (VA). A similar investing technique is value averaging, which involves changing your periodic investment contributions. With value averaging, you start with the end goal in mind and work toward a target number. Lets say you have a target portfolio value of $12,000 by year end, which means you need to grow your portfolio by $1,000 per month. You contribute $1,000 the first month, then make subsequent contributions based on the total portfolio amount. If in the second month the value of your shares drops to $900, you would contribute $1,100 to bring the total value of the portfolio to $2,000. If the value of the shares rose to $1,100, you would only need to contribute $900 to bring the value of the portfolio to $2,000.

How is value averaging different from dollar cost averaging? With DCA you always contribute the same amount of money, so you buy more shares when prices are low only because the shares cost less. With VA you buy more shares because the prices are lower and you contribute more money. Conversely, with VA you buy fewer shares when prices are higher because share prices are higher and you contribute less money. In effect, it gives you more bang for your buck.

Pros and cons of value averaging

The main benefit of value averaging is that it forces investors to contribute less money when prices are high, and contribute more money when prices are low, as opposed to dollar cost averaging, which uses the same contribution regardless of share price. Value averaging can actually have better results in the long run because you contribute more money when shares are lower. To employ correctly, value averaging also requires investors to know where they stand in regard to reaching your investment goal, which is another added benefit.

There are several disadvantages of value averaging. Value averaging takes more time than DCA, which basically runs on auto-pilot once you start it. Another disadvantage is when share prices fall so much that it takes very large investments to bring many portfolios back up to the goal. The current market would be a good example of this.

Neither dollar cost averaging or value averaging is perfect

Contributing to investments using dollar cost averaging or value averaging does not guarantee returns. But they both provide a system to follow, and promote disciplined investing. And disciplined contributions are a key to reaching your financial goals.

More information about value averaging. Dollar Value Averaging was developed by former Harvard professor, Michael E. Edleson. This investment technique was introduced in his book, Value Averaging: The Safe and Easy Strategy for Higher Investment Returns .