Dividend Stocks Beat Down Market Inflation Investment U

Post on: 31 Март, 2015 No Comment

by Marc Lichtenfeld. Chief Income Strategist, The Oxford Club Wednesday, September 28, 2011 Income

by Marc Lichtenfeld. Investment U Senior Analyst

Wednesday, September 28, 2011: Issue #1610

The Federal Reserve Bank of San Francisco issued a report predicting stock prices could fall 13 percent in the next decade.

That would be some accomplishment. I’m not sure if the researchers who issued the report are aware that they’re predicting the fifth-worst 10-year performance by the market in the last 74 years. The four worst: the 10-year periods ending in the years 1937, 1938, 1939 and 1940 — all time frames that were impacted by the Great Depression.

Even the years of the Great Recession, 2008 and 2009, posted single-digit losses for 10-year returns.

Yes, things are difficult in the global economy. But there have only been seven times out of the past 74 years that the 10-year return of the market was negative. So the authors of the report are predicting something that historically only occurs nine percent of the time.

That’s a bold prediction.

A Conservative Investment to Keep Ahead of Inflation

I don’t think they’re right. But let’s assume their forecast is correct. You’re looking for a conservative place to grow your money and keep ahead of inflation. What should you do now?

The answer: Buy stocks.

Let’s assume you have $10,000 to invest. What are your other options? You can lock it away in a 10-year Treasury and collect 1.84-percent interest or in a 30-year bond at 2.93 percent.

That’s not very enticing.

However, after 10 years, you have little chance of maintaining the purchasing power of your original $10,000. Over the past 12 months, the consumer price index has increased 3.8 percent.

That’s a far cry from the $11,840 you’d have from a 10-year bond ($184 per year for 10 years plus your $10,000 principal).

Some corporate bonds will get you there. If you go down to AA-rated bonds.

However, we know that the government’s CPI statistics aren’t very accurate. Most of us would be thrilled if our healthcare, tuition and utilities’ costs only rose three percent per year. So we need a considerably higher return to offset inflation.

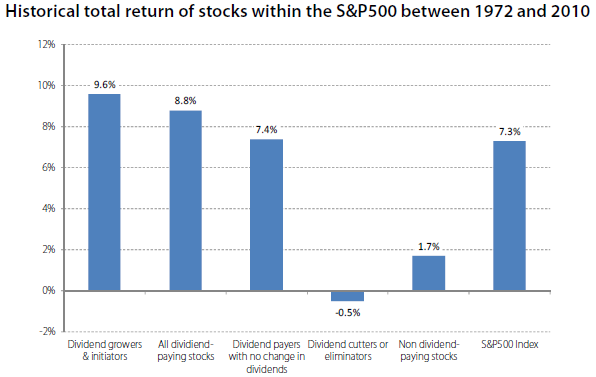

The Inflation-Beating Solution: Dividend Stocks

If you own dividend-paying stocks. particularly those that raise their dividends every year, you should be able to beat the inflation rate and protect your purchasing power.

And even if the Fed researchers are right and your stocks lose 13 percent over 10 years, you’ll still come out ahead.

Here’s what I mean.

Let’s use Perpetual Income Portfolio member Southern Company (NYSE: SO ) as an example. The stock currently pays a dividend of $1.89 per share and yields 4.5 percent. It has grown its dividend by an average of three percent per year over the past 10 years and has raised the dividend each year over the past decade.

This is the power of compounding dividends. Your dividends pay dividends. And as the dividend grows, it pays even more dividends, which pay more dividends. The key is to be able to give it time. It starts off slowly but then gains momentum as the years go by.

There’s a lot of bearishness in the market these days. Some pundits are telling you that this time it’s different. And it may very well be. But the numbers don’t lie. The market could generate a negative return over the next 10 years, something that historically happens less than 10 percent of the time. But if you’re invested in the right stocks, you can still beat inflation and outperform other asset classes.

Dividend stocks are the conservative way to make money in this unpredictable market.

Good investing,

Marc Lichtenfeld

[Editor’s Note: You’ve just read about just one of Marc’s favorite dividend stocks from The Perpetual Income Portfolio, one of Marc’s proprietary trading services. But starting in just a few weeks. you can gain access to other premier stock picks by joining IU Plus. You’ll gain access to Marc’s and other Oxford Club experts’ favorite plays in this tough economy. all for pennies a day. To learn more, Go Here Now .]