Dividend Paying Stocks

Post on: 29 Апрель, 2015 No Comment

by John S. on July 28, 2010

I made a big mistake several years ago that cost me thousands of dollars. Blinded by double digit dividend yields. I invested several thousand dollars in some very risky stocks. After purchasing a Canadian Royalty Trust and a few other high yielding stocks, I thought I had a great portfolio that would offer a double digit return on my investment which would lead to a sizable monthly income stream .

After seeing almost my entire position wiped out in a few short months, I realized that my approach to investing in dividend paying stocks was all wrong. Since that time I have focused on learning how to build a solid income producing portfolio of stocks that can survive any recession or bear market.

Here are 5 things that I have learned about investing in dividend paying stocks over the past year.

1. Invest in the Best

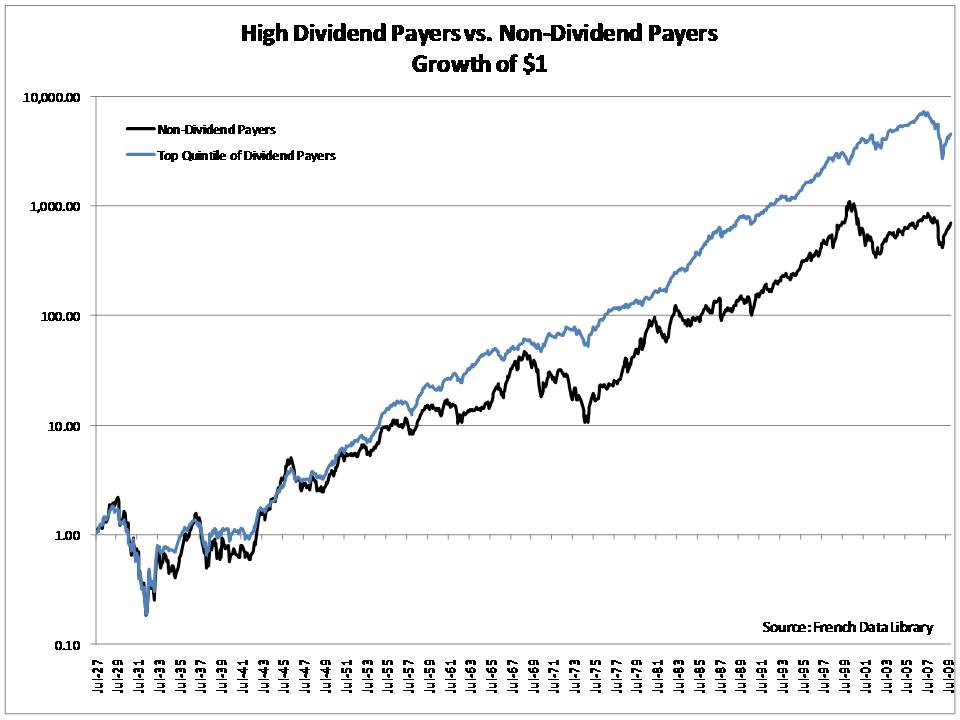

The days of chasing double digit dividend yields are over for me. I use to think that investing in a stock that paid a 15% yield was a much better income investment than one at 3%. It was obvious to me that 15% was much better than 3%.

Come to find out, there is actually a reason why a stock has a double digit yield. Other investors view it as a high risk. Go figure? I now focus on investing in only the best blue chip stocks available. I only select securities that have a dividend yield between 2% and 6% and look to resources like the S&P Dividend Aristocrats List as a place to filter out the top stocks.

By laying out a few simple ground rules, I have now reduced a lot of potential risk in my portfolio by considering only the best of the best stocks.

2. Dollar Cost Averaging

Dollar cost averaging has become a big part of my overall dividend paying stock investment strategy. No longer am I worried about purchasing a stock too high. Instead, I have been adding to my existing positions periodically to adjust my average purchase price.

Since I am selecting only the best dividend paying stocks available, I no longer stress about short term declines and actually welcome them to add to my existing positions. Anytime the overall market dips and takes these blue chip stocks with them, I simply go shopping on clearance .

3. Dividend Reinvestment

Another important strategy that I have added is setting up a dividend reinvestment plan (known as a DRIP) on each on of my positions. Since I now get quarterly dividend payments, a DRIP automatically reinvests the distribution directly back into more shares of the stock.

Most online discount brokers offer dividend reinvestment plans to their customers which helps to simplify and automate your investing. Since I am interested in building my positions, I let all my dividends roll back into more and more shares of the stock each time I am paid. Eventually as I grow my dividend positions I may adjust, but for now I reinvest each of my dividend payouts.

4. Define Your Exit Strategy

One of the hardest things for investors to do is to know when to take profits or cut their losses. I use to struggle with this myself, especially when it came to cutting my losses. Something deep down inside of me always told me to keep holding on to my stocks to avoid taking any kind of loss. Most of the time this strategy ends up costing you more money in the long run.

Since defining an exit strategy for my dividend paying stocks, I have been able to cut my losses much sooner on my bad investments. Regardless the type of trader you are (dividends, options, day trading, etc.), having an exit strategy is critical to your overall success.

Within the past year, my exit strategy has allowed me to sell my entire positions in GE (for a loss) and BP (for a large gain). Without this rule in place, I would probably still be holding each position for huge losses.

5. Find a Mentor

The financial media is full of hype and speculation. There is a ton of bad advice given by so-called experts every day on what the stock market will do next. As a dividend paying stock investor, it is important to remember that you are invested for the long term with a focus on income generation. With a solid dividend growth investment strategy, the media and hype become less and less a factor.

Instead of relying on the current flood of news and speculation in the market, find a mentor or someone you can follow that can help provide relevant information on the market.

I have been following two dividend investing sites for over the past year and have learned a ton of important information about dividend stocks. If you are looking for a place to start, I suggest checking out the following two sites -

Final Thoughts

Investing in dividend paying stocks is actually a very simple strategy to implement. Provided you dont start chasing high yields and risky stocks, a solid portfolio can provide years of income and wealth. Building a dividend paying stock portfolio takes time and patience to master, but is well worth it in the long run.

What types of rules do you use to invest in dividend paying stocks?