Dividend Growth Portfolio

Post on: 16 Март, 2015 No Comment

As one of the legs of my passive income portfolio, I will be building a dividend growth portfolio. What is a dividend growth (DG) portfolio, you ask? A DG portfolio is a long-term investment strategy based around purchasing the shares of high quality companies who pay continually increasing dividends. My goal of this portfolio is to eventually increase this stream of dividend payments to an amount large enough amount to help fully cover my income needs in conjunction with my other passive income.

What was your last raise at work? Was it 2-3%? With a solid DG portfolio, I will expect to see dividend increases between 6-9% per year on average. These increases will far exceed the rate of inflation providing me with a perpetual and every-rising dividend stream. So how am I going to get to the point where these dividends actually matter? By regular contributions, dividend reinvestment, and the aforementioned dividend growth. Speaking of a stream of dividend income, check out my dividend calendar and see how and when Ive received dividends this year!

Currently, I house my DG portfolio in two traditional investment accounts, a Roth IRA and a taxable account, with TradeKing, an online discount broker. In 2014, I have added a third account to my dividend growth portfolio. I began to build a no-cost portfolio with Loyal3 and will be tracking my holdings separately from my other taxable investment account in the table below. One benefit of this portfolio is my ability to arbitrage my credit card rewards and receive essentially a discount on the shares purchased through Loyal3. After picking up the credit card rewards upon purchase, the ease in which you can selectively reinvest your dividends is pretty awesome too. Simply combine with new capital or make purchases once your account hits $10; Snowball City as I like to call it! UPDATE: Loyal3 will no longer be accepting credit cards as payments for new positions.

As I am in the accumulation phase, and the idea being that these investments will compound, I will be updating my investments regularly through trade posts and monthly income updates ; please find my most recent investment information below.

My Dividend Growth Portfolios

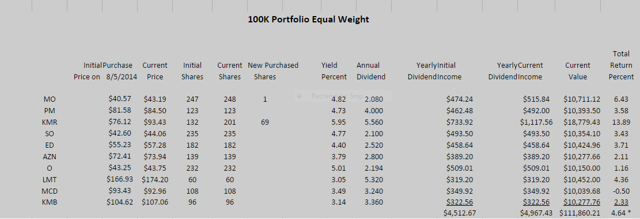

After maintaining my dividend growth portfolio in a table using a simple plugin, I decided to upgrade the experience and use Google Docs instead. You can read more details about what exactly I am showing below here. but overall I show my holdings and forward 12-month dividends in two separate tabs on the spreadsheet below. Enjoy!

One of the best ways to view a dividend growth portfolio is by the increase in forward 12-month dividends, as well as the progress in dividends received over time. The below chart reflects both since the beginning of 2013. I plan on updating this each time I complete a monthly passive income update. You can read more about forward 12-month dividends and how to calculate them in my post about Goal Setting Forward 12-Month Dividends .

If you have any questions about any of my holdings, or the overall concept of a dividend growth portfolio, feel free to ask!