Difference Between Primary and Secondary Markets

Post on: 6 Май, 2015 No Comment

Posted on May 10, 2012 by admin Last updated on: August 19, 2014

Primary vs Secondary Markets

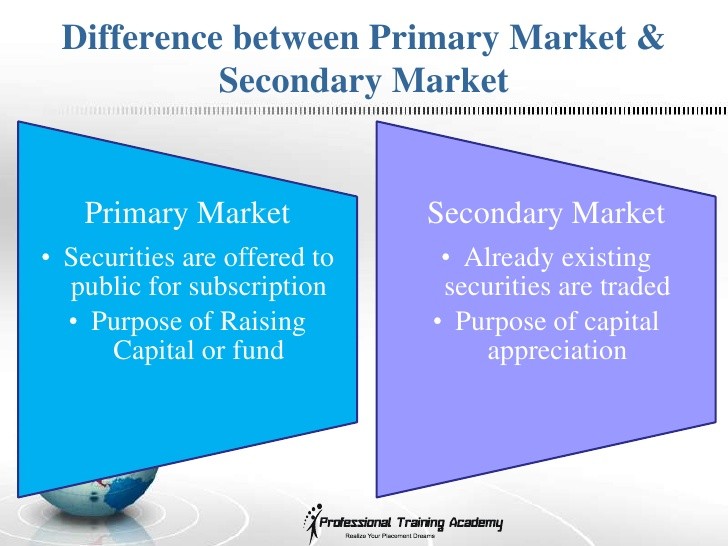

Primary and Secondary markets refer to markets, which assist corporations obtain capital funding. The difference between these two markets lies in the process that is used to collect funds. The circumstances under which each market is used to raise capital, alongside the procedures to be followed in raising funds are quite distinct. The following articles provide a clear understanding of each market, their functions, and how they are different from each other.

What is Primary Market?

The Primary market refers to the market where new securities are issued for the purpose of obtaining capital. Firms and public or government institutions can raise funds from the primary market through making a new issue of stock (to obtain equity financing) or bonds (to obtain debt financing). When a corporation is making a new issue, it is called an Initial Public Offering (IPO), and the process is referred to as the ‘underwriting’ of the share issue. In the primary market, the securities are issued by the company that wishes to obtain capital and is sold directly to the investor. In exchange for the funds that the share holder contributes, a certificate is issued to represent the interest held in the company.

What is Secondary Market?

The secondary market refers to the market where securities that have already been issued are traded. Instruments that are usually traded on the secondary market include stocks, bonds, options and futures. Certain mortgage loans can also be sold to investors on the secondary market. Once a security has been purchased for the first time by an investor on the primary market, the same security can be sold to another investor in the secondary market, which may be at a higher or lower price depending on the performance of the security during its period of trading. There are many secondary markets worldwide, and famous few include the New York Stock Exchange, The NASDAQ, the London Stock exchange, the Tokyo stock exchange and the Shanghai Stock Exchange.

Primary Market vs Secondary Market

The primary and secondary markets are both platforms in which corporations fund their capital requirements. While the functions in the primary stock exchange are limited to first issuance, a number of securities and financial assets can be traded and re traded over and over again. The main difference is that, in the primary market, the company is directly involved in the transaction, whereas in the secondary market, the company has no involvement since the transactions occur between investors.

What is the difference between Primary Market and Secondary Market ?

• Primary and Secondary markets refer to markets which assist corporations obtain capital funding. The difference between these two markets lies in the process that is used to collect funds.

• The Primary market refers to the market where new securities are issued by the company that wishes to obtain capital and is sold directly to the investor

• The secondary market refers to the market where securities that have already been issued are traded. Instruments that are usually traded on the secondary market include stocks, bonds, options and futures.

• The main difference is that, in the primary market, the company is directly involved in the transaction, whereas in the secondary market, the company has no involvement since the transactions occur between investors.