Diagonal Trading Strategies

Post on: 7 Апрель, 2015 No Comment

Our objective is to identify opportunities to generate 50% or more annual returns, using call options and option spreads as our investment structure rather than outright stock purchases, with each trade having a two to six month investment horizon. We generally look to have four or five positions open at a time.

Our strategy is comprised of three steps:

1. Company Selection

We typically identify undervalued, large cap companies with attractive growth potential as the basis for our trades. We focus on fundamental and valuation analysis, with technical and momentum factors as secondary considerations. We start with large caps primarily because they tend to have good liquidity. We then screen to identify companies with attractive fundamentals and growth potential that appear to be undervalued. And then we do further research and analysis to determine what is driving relatively low valuation, potential catalysts for value expansion, and potential risks.

2. Option Structure Determination

Once we have identified potential companies in which to invest, we evaluate potential options structures based on availability, liquidity, implied volatility, and price sensitivity (Greeks) of various strikes and expiration dates for the underlying companies we identify. We typically open a new position with a long-dated call, often with expiration 3-9 months out (although we often don’t hold the trade for that long).

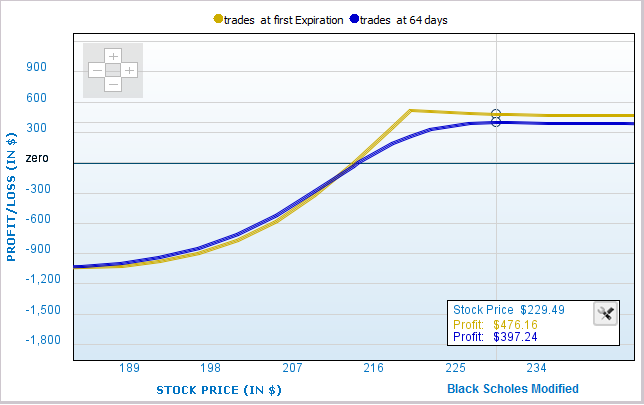

At times, depending on market conditions, when we buy the call, we also will simultaneously sell another call against the long call to create a call spread. Depending on the situation, these higher strike calls may have the same expiration date (vertical spread) or nearer-dated expiration (diagonal spread). We do this to reduce the initial investment in the position and reduce risk.

3. Ongoing Profit-taking and Adjustments

We typically will open a new position with either a call or a diagonal call spread, and over time tactically adjust the position into one of the following structures:

Diagonal Call Spread a spread in which a long call is paired with a short call that has a nearer expiration date, where the short strike is higher or lower than the long strike.

Calendar Spread a spread in which a long call is paired with a short call that has a nearer expiration date, where both the long and the short have the same strike.

Vertical Call Spread a spread in which a long call is paired with a short call that has a higher strike price and the same expiration date.

Diagonal, Broken-Wing Butterfly Call Spread

- The standard butterfly consists of one long call at a lower strike price, two short calls at a middle strike price, and one long call at a higher strike price all with the same expiration.

- Broken-wing butterflyA broken-wing butterfly has one of the long calls farther from the short middle strike calls than the other long call.

- Diagonal ButterflyA diagonal butterfly has calls with different expiration months

We deploy diagonal spreads tactically based on implied volatility and to take advantage of options math (the Greeks), which determine the sensitivity of an option price relative to factors such as time decay (theta), change in price of the underlying stock price (delta), and change in volatility of underlying stock price (vega).