Developing an Investment Policy Statement

Post on: 2 Июль, 2015 No Comment

Published on May 11th, 2009

Im in the process of consolidating all of my investments under one roof. This includes:

- My Roth IRA (currently with Sharebuilder )

- My profit-sharing pension through the family box factory (currently with Vanguard )

- My self-employed 401(k) (now at Fidelity )

- My non-retirement accounts (scattered hither and yon)

Between these accounts I have a large sum to invest. I dont know the exact total (the market fluctuates daily, and I dont really know the value of the Vanguard stuff), but its over $100,000. That may not be a lot to you. but its a lot to me. When I was struggling with money, retirement saving was one of the only things I got right. (And thats because it was automatic; I had no control over it.)

Because I have so much to invest, Ive begun to speak with financial advisors. Some advisors arent interested in taking on clients unless they have very large sums to invest (over $500,000, for example). But others are willing to help those who are building wealth. Ive spoken with advisors at my business bank, at my credit union, and at Fidelity. I intend to call others, too.

Note: Its not certain that I will work with a financial advisor. I may decide to do this on my own. But I want to explore my options, and I want to experience the process so that I know what its like.

The problem I keep facing is that Im not sure what my investment goals are. Advisors ask me, What do you want to do with your money? This is difficult to answer. Do I want to protect the money Ive already earned? Or do I want it to grow as much as possible? I need to determine my investment goals.

One of the best pieces of advice Ive found comes from The Quiet Millionaire by Brett Wilder. This book has been on the top of my to-read stack for months, but Ive only recently begun to plumb its depths. Wilder encourages readers to develop an investment policy statement:

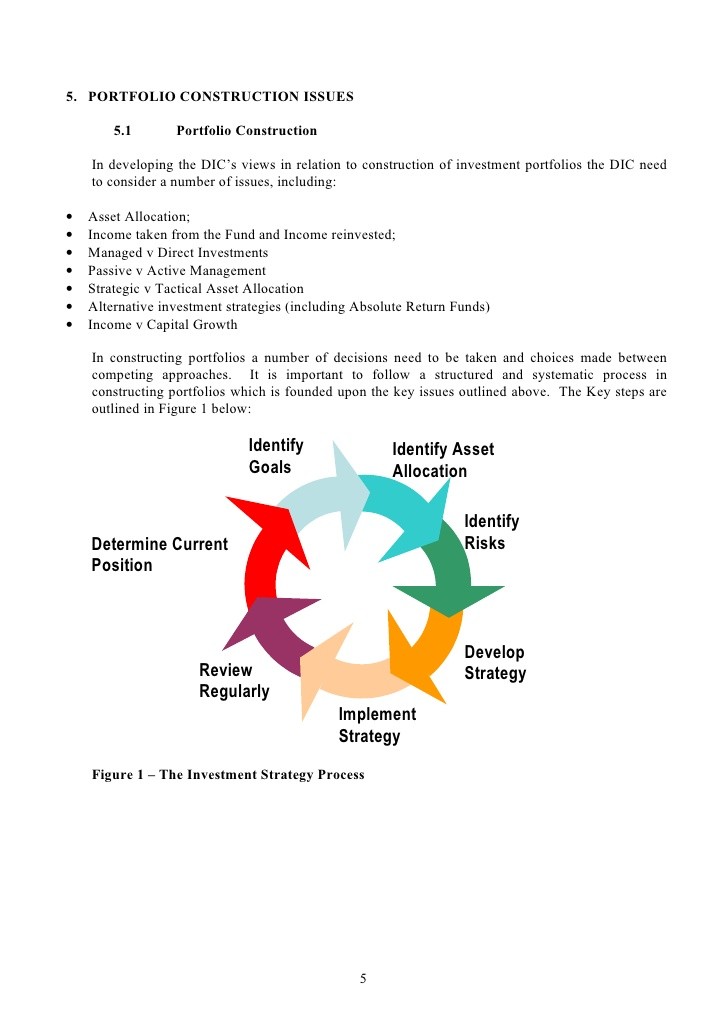

The investment policy statement should provide specific investment guidelines for you and your investment advisor to follow. The policy should specify how the portfolio is to be structured, the targeted rate of return, the time horizon for expected results, the risk tolerance level parameters, the amount and timing for anticipated contributions and withdrawals, and the emergency liquidity needs.

Having a written policy statement enables you to have a clear reminder about your personal expectations for the portfolio, and it will help you to monitor the performance accordingly. By being organized and prepared, you are less likely to fall into the emotional investor category and more likely to stay focused on monitoring the portfolios performance relative to meeting your specific planning goals and objectives.

Ive never made any sort of formal declaration of my investment objectives. Ive kept a sort of rough internal guide to the things I want to do (invest in index funds, retire early, etc.), but I havent written down my objectives or how I mean to reach them.

Do I want to build as much wealth as possible? Do I want to protect the wealth that I have? Am I interested in income? And what is my investment philosophy? Am I willing to accept greater risk in exchange for greater possible returns? How do I feel about administrative costs? Taxes? Diversification?

These questions are not easy to answer. We all want high investment returns with no risk. But those arent possible. So how do we compromise? How do we develop investment policies that match our values and our goals?

Im not sure, but Ill be sure to share with you as I find the answers.

For more info on investment policy statements, check out Morningstar: Creating your investment policy statement from Morningstar and Making an investment policy statement from tools for Money.

GRS is committed to helping our readers save and achieve their financial goals. Savings interest rates may be low, but that is all the more reason to shop for the best rate. Find the highest savings interest rates and CD rates from Synchrony Bank. Ally Bank. GE Capital Bank. and more.