Delta neutral trading is the key to my success as an options trader

Post on: 20 Апрель, 2015 No Comment

Delta neutral trading is the key to my success as an options trader

Demystifying Delta

Delta neutral trading is the key to my success as an options trader. Learning how to trade delta neutral provides traders with the ability to make a profit regardless of market direction while maximizing

trading profits and minimizing potential risk. Options traders who know how to wield the power of delta neutral trading increase their chances of success by leveling the playing field. This chapter is devoted to providing a solid understanding of this concept as well as the mechanics of this innovative trading approach.

In general, it is extremely hard to make any money competing with floor traders. Keep in mind that delta neutral trading has been used on stock exchange floors for many years. In fact, some of the most successful trading firms ever built use this type of trading. Back when I ran a floor trading operation, I decided to apply my Harvard Business School skills to aggressively study floor trader methods. I was surprised to realize that floor traders think in 10-second intervals. I soon recognized that we could take this trading method off the floor and change the time frame to make it successful for off-floor traders. Floor traders pay large sums of money for the privilege of moving faster and paying less per trade than off-floor traders. However, changing the time frame enabled me to compete with those with less knowledge. After all, 99 percent of the traders out there have very little concept of limiting risk, including money managers in charge of billions of dollars. They just happen to have control of a great deal of money so they can keep playing the game for a long time. For example, a friend once lost $10 million he was managing. Ten minutes later I asked him, How do you feel about losing all that money? He casually replied, Well, its not my money. Thats a pretty sad story; but its the truth. This kind of mentality is a major reason why its important to manage your accounts using a limited risk trading approach.

Delta neutral trading strategies combine stocks (or futures) with options, or options with options in such a way that the sum of all the deltas in the trade equals zero. Thus, to understand delta neutral trading, we need to look at delta, which is, in mathematical terms, the rate of change of the price of the option with respect to a change in price of the underlying stock.

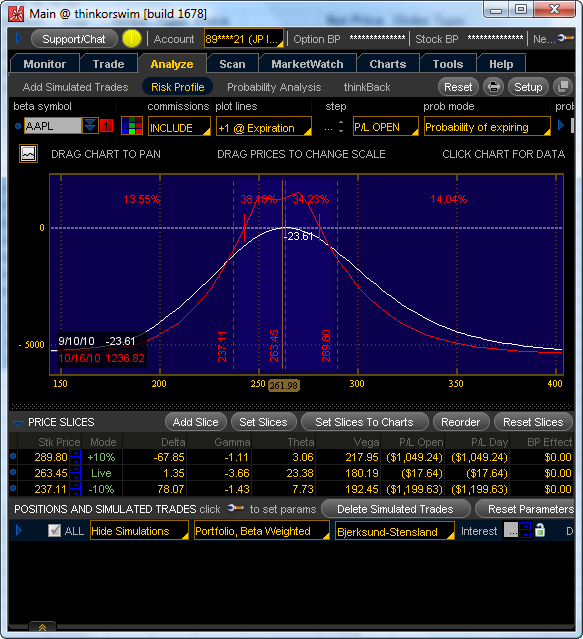

An overall position delta of zero, when managed properly, can enable a trade to make money within a certain range of prices regardless of market direction. Before placing a trade, the upside and downside breakevens should be calculated to gauge the trades profit range. A trader should also calculate the maximum potential profit and loss to assess the viability of the trade. As the price of the underlying instrument changes, the overall position delta of the trade moves away from zero. In some cases, additional profits can be made by adjusting the trade back to zero (or delta neutral) through buying or selling more options, stock shares, or futures contracts.

If you are trading with your own hard-earned cash, limiting your risk is an essential element of your trading approach. Thats exactly what delta neutral trading strategies do. They use the same guidelines as floor trading but apply them in time frames that give off-floor traders a competitive edge in the markets.

Luckily, these strategies dont exactly use rocket science mathematics. The calculations are relatively simple. Youre simply trying to create a trade that has an overall delta position as close to zero as possible. I can look at a newspaper and make delta neutral trades all day long. I dont have to wait for the S&Ps to hit a certain number, or confuse myself by studying too much fundamental analysis. However, I do have to look for the right combination of factors to create an optimal trade.

An optimal trade uses your available investment capital efficiently to produce substantial returns in a relatively short period of time. Optimal trades may combine futures with options, stocks with options, or options with options to create a strategy matrix. This matrix combines trading strategies to capitalize on a market going up, down, or sideways.

To locate profitable trades, you need to understand how and when to apply the right options strategy. This doesnt mean that you have to read the most technically advanced books on options trading. You dont need to be a genius to be a successful trader; you simply need to learn how to make consistent profits. One of the best ways to accomplish this task is to pick one market and/or one trading technique and trade it over and over again until you get really good at it. If you can find just one strategy that works, you can make money over and over again until its so boring you just have to move on to another one. After a few years of building up your trading experience, you will be in a position where you are constantly redefining your strategy matrix and markets.

Finding moneymaking delta neutral opportunities is not like seeking the holy grail. Opportunities exist each and every day. Its simply a matter of knowing what to look for. Specifically, you need to find a market that has two basic characteristicsvolatility and high liquidityand use the appropriate time frame for the trade.

THE DELTA

To become a delta neutral trader, it is essential to have a working understanding of the Greek term delta and how it applies to options trading. Al

most all of my favorite option strategies use the calculation of the delta to help devise managed risk trades. The delta can be defined as the change in the option premium relative to the price movement in the underlying instrument. This is, in essence, the first derivative of the price function, for those of you who have studied calculus. Deltas range from minus 1 through zero to plus 1 for every share of stock represented. Thus, because an option contract is based on 100 shares of stock, deltas are said to be 100 for the underlying stock, and will range from -100 to +100 for the associated options.

A rough measurement of an options delta can be calculated by dividing the change in the premium by the change in the price of the underlying asset. For example, if the change in the premium is 30 and the change in the futures price is 100, you would have a delta of .30 (although to keep it simple, traders tend to ignore the decimal point and refer to it as + or — 30 deltas). Now, if your futures contract advances $10, a call option with a delta of 30 would increase only $3. Similarly, a call option with a delta of 10 would increase in value approximately $1.

One contract of futures or 100 shares of stock has a fixed delta of 100. Hence, buying 100 shares of stock equals +100 and selling 100 shares of stock equals -100 deltas. In contrast, all options have adjustable deltas. Bullish option strategies have positive deltas; bearish option strategies have negative deltas. Bullish strategies include long futures or stocks, long calls, or short puts. These positions all have positive deltas. Bearish strategies include short futures or stocks, short calls, or long puts; these have negative deltas. Table 6.1 summarizes the plus or minus delta possibilities.

As a rule of thumb, the deeper in-the-money your option is, the higher the delta. Remember, you are comparing the change of the futures or stock price to the premium of the option. In-the-money options have higher deltas. A deep ITM option might have a delta of 80 or greater. ATM optionsthese are the ones you will be probably working with the most in the beginninghave deltas of approximately 50. OTM options deltas might be as small as 20 or less. Again, depending how deep in-the-money or out-of-the-money your options are, these values will change. Think of it another way: Delta is equal to the probability of an option being in-the-money at expiration. An option with a delta of 10 has only a 10 percent probability of being ITM at expiration. That option is probably also deep OTM.

When an option is very deep in-the-money, it will start acting very much like a futures contract or a stock as the delta gets closer to plus or minus 100. The time value shrinks out of the option and it moves almost in tandem with the futures contract or stock. Many of you might have bought options and seen huge moves in the underlying assets price but hardly any movement in your option. When you see the huge move, you probably think, Yeah, this is going to be really good. However, if you bought the option with a delta of approximately 20, even though the futures or stock had a big move, your option is moving at only 20 percent of the rate of the futures in the beginning. This is one of the many reasons that knowing an options delta can help you to identify profitable opportunities. In addition, there are a number of excellent computer programs geared to assist traders to determine option deltas, including the Platinum site at Optionetics.com.

Obviously, you want to cover the cost of your premium. However, if you are really bullish on something, then there are times you need to step up to the plate and go for it. Even if you are just moderately friendly to the market, you still want to use deltas to determine your best trading opportunity. Now, perhaps you would have said, I am going to go for something a little further out-of-the-money so that I can purchase more options. Unless the market makes a big move, chances are that these OTM options will expire worthless. No matter what circumstances you encounter, determining the deltas and how they are going to act in different scenarios will foster profitable decision making.

When I first got into trading, I would pick market direction and then buy options based on this expected direction. Many times, they wouldnt go anywhere. I couldnt understand how the markets were taking off but my options were ticking up so slowly they eventually expired worthless. At that time, I had no knowledge of deltas. To avoid this scenario, remember that knowing an options delta is essential to successful delta neutral trading. In general, an options delta:

Estimates the change in the options price relative to the underlying

security. For example, an option with a delta of 50 will cost less than an option with a delta of 80.

Determines the number of options needed to equal one futures con

tract or 100 shares of stock to ultimately create a delta neutral trade with an overall position delta of zero. For example, two ATM call options have a total of +100 deltas; you can get to zero by selling 100 shares of stock or one futures contract (-100 deltas).

Determines the probability that an option will expire in-the-money. An

option with 50 deltas has a 50 percent chance of expiring in-themoney.

Assists you in risk analysis. For example, when buying an option you

know your only risk is the premium paid for the option.

To review the delta neutral basics: The delta is the term used by traders to measure the price change of an option relative to a change in price of the underlying security. In other words, the underlying security will make its move either to the upside or to the downside. A tick is the

minimum price movement of a particular market. With each tick change, a relative change in the option delta occurs. Therefore, if the delta is tied to the change in price of the underlying security, then the underlying security is said to have a value of 1 delta. However, I prefer to use a value of 100 deltas instead because with an option based on 100 shares of stock its easier to work with.

Lets create an example using IBM options, with IBM currently trading at $87.50.

Long 100 shares of IBM = +100 deltas. Short 100 shares of IBM = -100 deltas.

Simple math shows us that going long 200 shares equals +200 deltas, going long 300 shares equals +300 deltas, going short 10 futures contracts equals -1,000 deltas, and so on. On the other hand, the typical option has a delta of less than 100 unless the option is so deep in-the-money that it acts exactly like a futures contract. I rarely deal with options that are deep inthe-money as they generally cost too much and are illiquid.

All options have a delta relative to the 100 deltas of the underlying security. Since 100 shares of stock are equal to 100 deltas, all options must have delta values of less than 100. An Option Delta Values chart can be found in Appendix B outlining the approximate delta values of ATM, ITM, and OTM options.