Day Trading Can You Trade the Heiken Ashi Day Trading

Post on: 16 Март, 2015 No Comment

Day Trading — Can You Trade the Heiken Ashi?

As a trend trader, one of the real challenges is to identify and stay in a trend. Trend retracements are frequent annoyances in trend trading that can lead to substantial losses. In short, identifying trends is extremely important. Of course, in a high volume markets like the ES e-mini identifying trends and retracements can be dicey business and no simple matter. To be sure, when the market is in a high volatility state, trend trading can be very difficult and challenging.

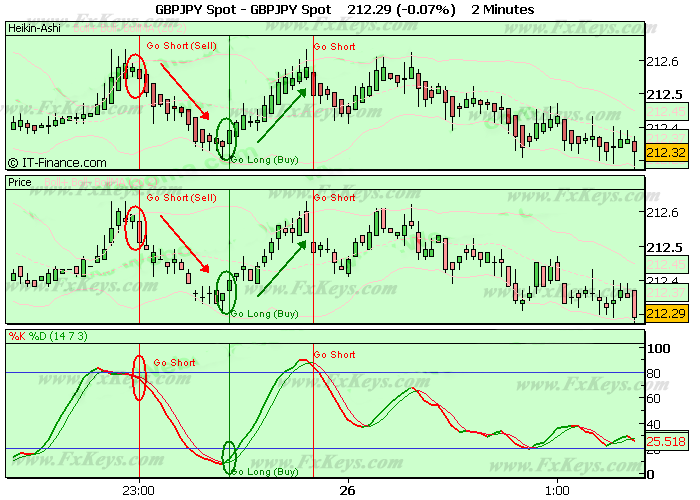

Enter the Heiken Ashi candlestick trading system. The Heiken Ashi system is a variant of the traditional candlestick formation system with some important improvements. In the system the candlesticks are calculated in a manner that improves trend identification and greatly improves the trader’s ability to identify trending markets.

So why doesn’t everybody use the Heiken Ashi system?

That is not a question that is easy to answer, but my general impression is that most traders are either unaware of the system or don’t care to add a new variable to their existing system. In any event, the system it is a great improvement for trend traders and has great potential to improve your trading results. The mathematical basis for the Heiken Ashi system can be found on a number of Internet pages, so I will not devote a great deal of time to detailing the mathematical underpinnings of the system. But there are several important rules to observe when using this new candlestick system.

1. A candle with a small body and long upper and lower shadows indicates a change in the trend. If you are brave soul, you may want to add or sell shares at this point. Personally, I’m inclined to wait for a confirmation bar in this situation.

2. Hollow candles lacking lower shadows (hollow candles indicate an uptrend, and solid candles indicate a downtrend) indicate a strong uptrend. Obviously, and a strong uptrend you’ll want to maintain your position.

3. The exact opposite of point number 2, filled candles with no higher shadows indicate a strong downward move and most traders will stay in their trade. One quick point though, I am hesitant to enter into an already well-established trend. This is referred to as piling onto a trade and you risk piling on late in that trend movement and sustaining a loss.

4. Filled candles indicate a downtrend.

5. Hollow candles indicate an uptrend.

The rules in trading the Heiken Ashi system are fairly straightforward and easy to understand. More importantly, they readily identify trends in the market with better than average accuracy. If you are a trend trader using candlestick charts, the system will be a substantial upgrade to your current methodology and I highly recommend implementing the system. The candlesticks are relatively easy to adjust to, and with some practice you can easily adapt your current candlestick charts to the Heiken Ashi system.

In summary, I switched to using Heiken Ashi candlestick several months ago and have seen a noticeable improvement in my trend trading. We have noted there are several simple rules to follow when using the system. It is important to assimilate and implement these rules into your trading to get the full value of the system.

Hope this information is useful for you. For more detailed information on providers, kindly refer to the Right Pane.